Titan Trade Update: Sizing up Ethereum in Titan Crypto

Apr 4, 2022

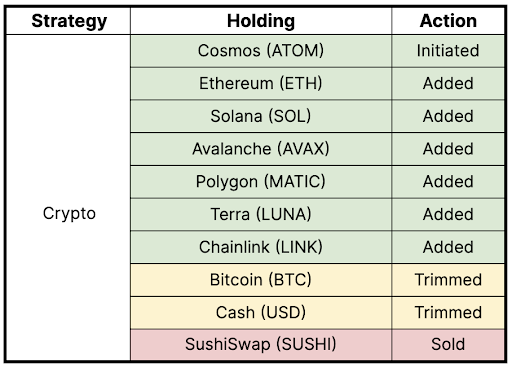

Ahead of the Ethereum Merge, we’ve gone overweight Ethereum while increasing our stake in several altcoins and initiating a position in Cosmos. To fund these moves, we reduced our bitcoin position, sold our small stake in SushiSwap and drew down our cash reserve.

This marks the first changes in Titan’s Crypto strategy since late January 2022. The crypto market is catalyst-rich right now, and we’re back on offense.

The table below summarizes these moves:

The Merge is here – almost

The biggest change to Titan Crypto in this latest rebalance is our decision to put more than half of the strategy’s capital into Ethereum (ETH).

We are approaching the “Ethereum Merge” going live, with the final test occurring in March. For context, Ethereum currently relies on a proof-of-work mechanism — a notoriously energy-intensive process — to validate transactions on its blockchain and secure the network.

The Merge will shift Ethereum’s network to a proof-of-stake consensus mechanism, which will decrease the amount of energy used by the network. Perhaps more importantly, at least in the eyes of an investor, this change will enable ETH holders to stake their tokens and earn passive income. No longer will ETH holders be reliant on price appreciation to drive gains — they will now earn their pro-rata share of transaction fees that will be paid to all stakers.

Ethereum has been our top pick since the inception of Titan Crypto, and we’re excited to metaphorically back up the truck ahead of The Merge.

Cosmos and catalysts

In addition to notably upsizing our Ethereum position, we’ve also increased our position in several Altcoins and initiated a new holding in Cosmos (ATOM).

Cosmos, dubbed the Internet of Blockchains, aims to create a network of crypto networks united by open-source tools for streamlining transactions between them, and we believe 2022 will be an action-packed year that will radically improve the utility of the Cosmos hub and ATOM tokens. The ecosystem is largely under the radar, and the price of ATOM has not kept pace with bitcoin, providing a great entry point in our eyes. Cosmos has an intense focus on interchain security, a theme we are hyper-bullish on this year, and they plan to launch NFTs this summer as well. We’ve sized this position relatively small to get started, but we’re bullish on ATOM in the near-to-mid-term.

We’ve also increased our positions in Solana and Avalanche, two protocols that have clear catalysts to drive real world use cases and, in our eyes, price appreciation. Solana’s NFT ecosystem has caught fire in recent months, and with NFT marketplace OpenSea set to integrate with Solana in April, tailwinds should be persistent into the summer.

Avalanche, meanwhile, recently introduced Avalanche Multiverse, a $290M incentive program focused on accelerating the adoption and growth of Subnets. Multiverse is focused on supporting new ecosystems, including blockchain-enabled gaming, DeFi, NFTs, and institutional use cases. I personally love spending time in the Avalanche network and find its interface particularly user-friendly, and the launch of Defi Kingdoms should continue to drive adoption of the network.

Polygon is currently in a Layer 2 arms race, and we slightly increased our position during this portfolio update. As a reminder, Polygon’s goal is to help Ethereum expand in size, security, efficiency, and usefulness.

The momentum has shifted

Terra’s LUNA tokens have been the best-performing holding in Titan Crypto over the last several months, and with this rebalance we’ve added to our position and maintain our bullish stance on the Terra ecosystem.

Terra CEO Do Kwon’s commitment to buy $10B worth of Bitcoin to act as a reserve currency for UST, Terra’s bellweather stablecoin, has been a key factor in reigniting momentum in broader crypto markets, in our view. Terra has been buying 2.5K-3K BTC — or about ~$120M worth each day — which is quite meaningful for a ~$800M market cap asset.

Kwon also bet back in mid-March that the price of LUNA tokens would be higher than its then-current price of $88 one year later. With LUNA crossing $110 in recent days, it seems he’s well on his way towards winning this bet.

On top of this, positive crypto headlines have become front-and-center once again after a difficult start to the year for digital asset markets. The U.S. has committed to support advances in digital assets with Biden’s executive order, Exxon is mining bitcoin, inflows are at their highest levels since December, venture capital continues to pour into crypto projects and many more.

Calling in our capital

With this rebalance, we’ve also drawn down nearly all of the strategic cash pile we had accumulated for clients in Titan Crypto.

Volatile financial markets and an uncertain macro backdrop had exerted increasing influence over crypto markets late last year and into the first quarter of 2021.

In our view, as broader financial markets become more comfortable with rising interest rates and overall volatility moderates, crypto markets should return their focus to fundamentals with external factors playing a smaller role in price moves.

To be clear, this is not a full “risk-on” trade, but rather a chance to opportunistically deploy our cash and increase several altcoin positions ahead of certain catalysts. We’ll continue to be tactical and share our findings along the way.

Thank you as always for the opportunity to manage your capital, and please let us know if you have any questions about these moves.