Automated Strategies Q1 Rebalance

Apr 1, 2024

Q1 2024 was a positive quarter for equity and mixed for bond markets. Here’s a quick update on what happened in our automated strategies, and what’s to come.

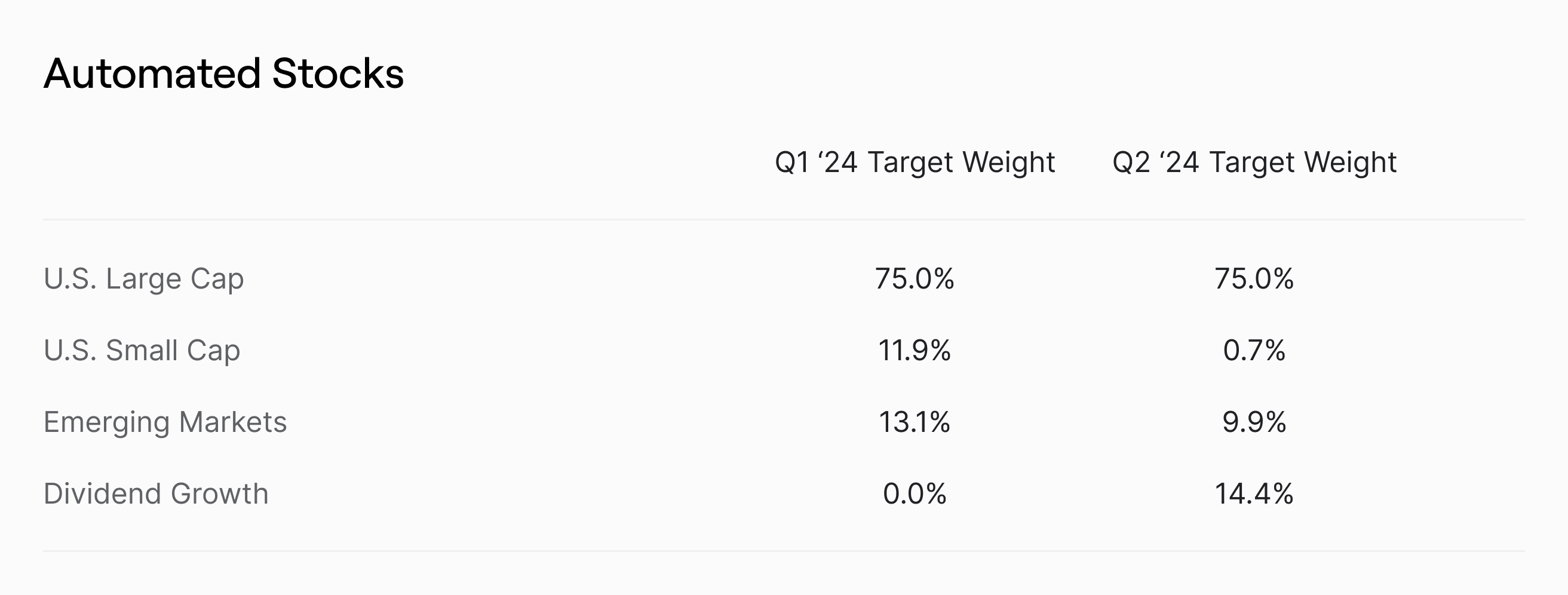

Automated Stocks

Automated Stocks was up 8.4%¹ in Q1 2024, with positive attribution across equity markets broadly.

Global equity markets gained broadly over the quarter as concerns about inflation and interest rates continued to recede, driving more economic optimism. U.S. Large Cap (VOO) equities had the strongest gains on increased likelihood of a “soft landing” and as recession fears continued to fade. U.S. Small Cap (IJR) equities gained but underperformed, being more sensitive to expectations that interest rate cuts may not come as soon as initially expected and giving back some gains from December. Emerging Market (VWO) equities also gained to a lesser extent as emerging market currencies weakened and investors remained risk-averse.

Looking ahead into Q1 2024, our automated model’s target weights will change slightly. The chart below summarizes the changes to the strategy:

As a reminder, clients who are more than ± 3% from the model’s target weights may be automatically rebalanced on April 1st for risk management purposes.

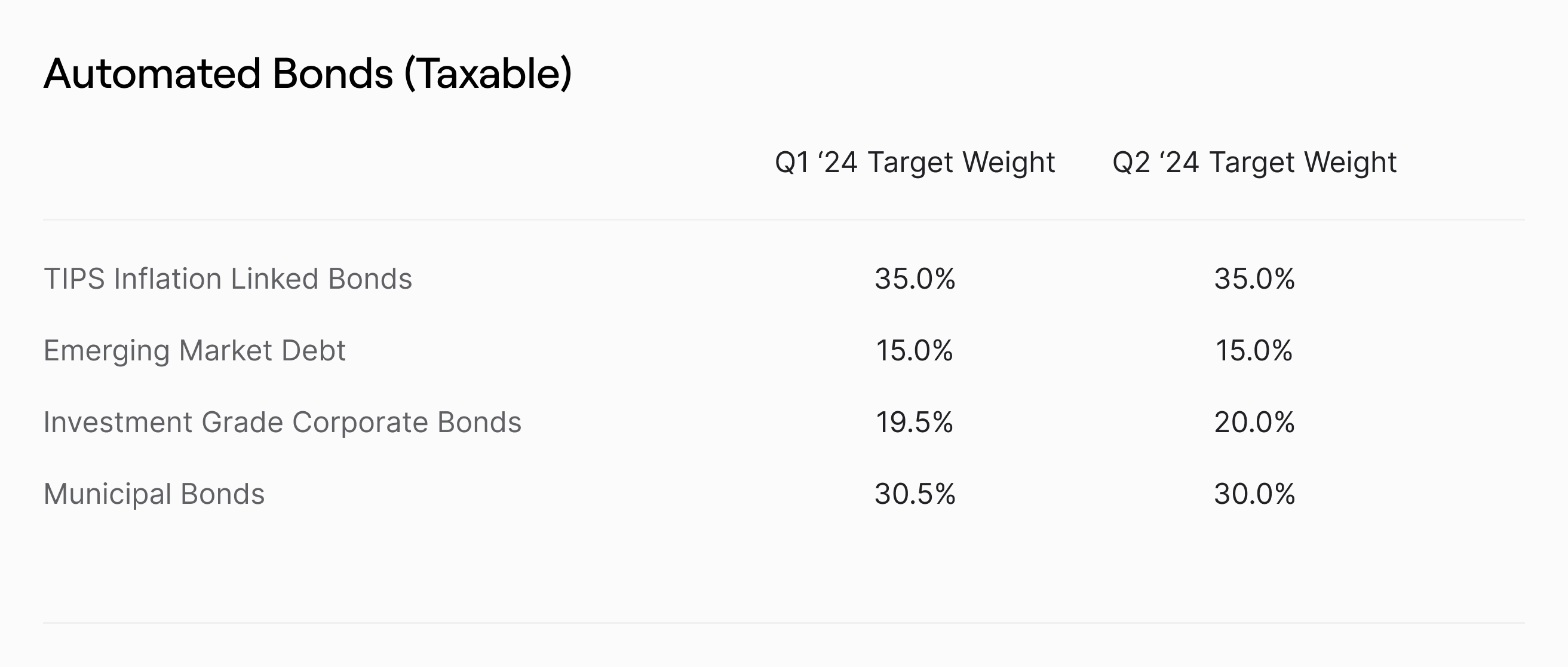

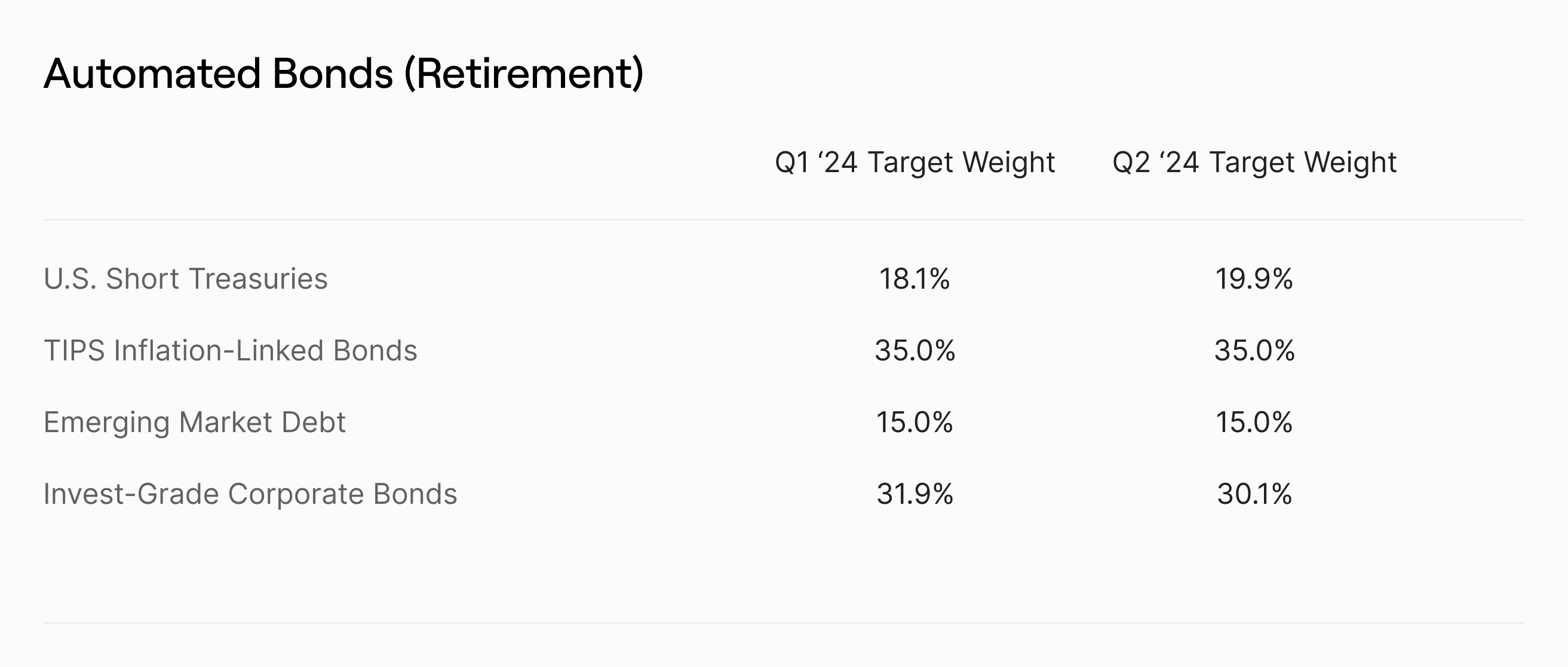

Automated Bonds

Automated Bonds was up in Q1, returning 0.4% (taxable)¹ and 0.8% (retirement)¹ with mixed attribution across bond markets.

US government bond yields continued to decline on expectations that the Federal Reserve would remain dovish and proceed with interest rate cuts in the later part of the year due to concerns about slowing economic growth. Inflation-Linked Bonds (VTIP) had strong gains as the inflation rate rose in February. Emerging Market Debt (EMB) also outperformed, with some countries such as India benefiting from improved domestic growth and lower interest rates. U.S. Short Treasuries (GBIL), a holding in Automated Bonds for retirement accounts, also contributed positively as short-term treasury rates remained elevated. Municipal Bonds (VTEB) underperformed as issuances rose, increasing supply and resulting in short-term pressure on the ETF price. Investment-Grade Corporate Bonds (VCIT) also underperformed as investors remained cautious about a potential economic slowdown impacting corporate profitability.

Looking ahead towards Q1 2024, our automated model’s target weights will change slightly. The chart below summarizes the changes to allocation for the upcoming quarter.

Refresher: Automated Strategies Model

Titan’s Automated Strategies select weights algorithmically based on constrained mean-variance optimization models. The goal is simple: our models aim to optimize the risk-adjusted return of each strategy. This type of model favors diversification, meaning that as asset classes appear less risky, less correlated, or higher returning, the model will assign more weight to them (within reasonable constraints).

Estimates that the models use can change slightly quarter-over-quarter, which leads to changes in weights. Clients who are more than +/-3% from our model’s target weights may be automatically rebalanced at the start of the quarter for risk management purposes.

For more information, feel free to reach out to our team and we’re more than happy to assist.

1. Performance assumes distributions are reinvested. Titan does not charge advisory fees for the Automated Bonds or Automated Stocks strategies. Performance figures provided do not represent actual investment results of any specific client. Actual client performance will vary based on numerous factors, including the timing of when the client began investing and market conditions. Quarterly performance figures represent cumulative returns, compiled from the beginning to the end of the given quarter. Performance for Automated Bonds differs between taxable and retirement accounts since retirement accounts do not invest in U.S. Municipal Bonds. Past performance is not indicative of future results.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Contact Titan at support@titan.com.

Trade communications are meant for informational purposes only. All investments involve risk and the past performance of a security does not guarantee future results or returns. Any historical returns, expected returns, or probability projections are based on a model portfolio incepted on 2/3/2023, and may not reflect actual performance of a given account, due to price movements and timing of investments.

Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party.

Investing in securities involves risks, and there is always the potential of losing money. The rate of return on investments can vary widely over time, especially for long term investments. Past performance is no guarantee of future results.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Please visit www.titan.com/legal for important disclosures.