July in review

Aug 7, 2023

Staying Vigilant as Risks Loom Large

TLDR: In July, the market continued to rally on the back of mostly positive results from the Q2 earnings season. Many investors think we’re heading for a “soft landing” (e.g., no major economic recession or market pullbacks). But we’re not so sure we’re out of the woods yet. That’s why we remain positioned with some strategic cash in our equity strategies – to take advantage of upcoming volatility and market corrections that we believe are increasingly likely.

1/ Major stock indexes logged their fifth consecutive monthly gain in July while the S&P finished the month only 3.5% off its all-time highs. As of month end, more than half of the S&P 500 companies had reported Q2 earnings and ~80% of those reporting saw a positive earnings surprise. Consensus on the Street is that the economy will have a soft landing and avoid a recession – a dynamic that has fueled valuation multiple expansion and positive momentum across markets.

2/ Under the surface, a “catch-up trade” was in full swing, as sectors that underperformed to start 2023 saw a rebound in performance. July’s leading sectors, Energy, Communication Services, and Financials, have been 2023’s laggards. We saw the breadth of the market rally broaden a bit, with more companies across more sectors (not just Big Tech) starting to join the rally.

3/ At Titan, we were able to get some of our dry powder (strategic cash) to work in our Flagship and Offshore strategies as we identified a few compelling opportunities to add net exposure (now ~80-85%). In case you missed them, you can find those trade updates here and here.

4/ That said, we believe the likelihood of a soft landing is low. Leading economic indicators like the inverted yield curve suggest a recession is unavoidable.* This is why we remain positioned relatively defensively vs. broad equity indexes and other long-only investment managers. We’re ready to buy more of the companies in our portfolios and on our watchlists as volatility strikes.

5/ Policymakers at the FOMC meeting voted unanimously to hike interest rates by 25bps, resuming the Fed’s path higher after a pause in June. We believe rates will be higher for longer, although the most recent inflation and labor reports suggest some cooling in the economy. We don’t expect dramatic policy changes until the Fed has a clearer picture on the direction of inflation and economic growth.

6/ International equities offered mixed results as developed economies (Japan and Europe) underperformed relative to their emerging market peers (China and Latin America). Xi Jinping’s government has taken several steps in recent weeks to rebuild confidence in the private sector and the perception of a more accommodative regime should be constructive for Chinese technology. Citadel’s Ken Griffin agrees: “Irrespective of who’s the US president in the next cycle, I don’t think that’s going to change Citadel’s strategy…the scale and scope of the Chinese equity market is incredibly attractive to us as investors.”

7/ Interest in artificial intelligence once again topped headlines as core infrastructure for AI growth, semiconductors, continued their outperformance. Better than expected earnings and continued leadership from Nvidia sent the complex higher, but we wouldn’t be surprised if we saw near-term consolidation in the space. With a handful of names underwritten in the event we see a pullback, we may get another bite at the AI apple soon.

8/ Commercial real estate has made headlines recently as evolving market conditions, waning demand, and strict regional banking standards have caused stress on the system. Not all property types are created equal, however, as industrial and multifamily real estate continue to shine despite cracks emerging around the edges.

9/ Global venture capital funding almost halved in the first six months of 2023, highlighting a lack of enthusiasm on the part of investors in a higher rate environment. Valuations from public markets continue to trickle down to private investments as price discovery, especially in the growth stage, and exit opportunities have become increasingly difficult. We expect this trend to continue as long as this higher-for-longer rate environment persists.

10/ We launched Smart Cash in mid-July and we’ve loved hearing the early feedback from clients. Yielding up to 5.17%**, Smart Cash automatically moves your cash to our highest after-tax yield for you, so you can leave chasing better rates behind. If you haven’t enabled Smart Cash yet, we encourage you to check it out here.

As always, don’t hesitate to reach out to us with any questions.

Best,

Clay

Co-CEO and Chief Investment Officer

*Since the 1970s, every instance of an inverted yield curve (short-term bond yields higher than long-term yields) has resulted in a recession. An inverted yield curve often occurs as concerns of an impending recession increase, leading investors to buy long-dated Treasury bonds based on the premise that they offer a safe haven from falling equities markets, provide preservation of capital, and have the potential for appreciation in value as interest rates decline. As a result of the rotation to long maturities, yields can fall below short-term rates, forming an inverted yield curve. While this historical trend is significant, it doesn't assure a future recession.

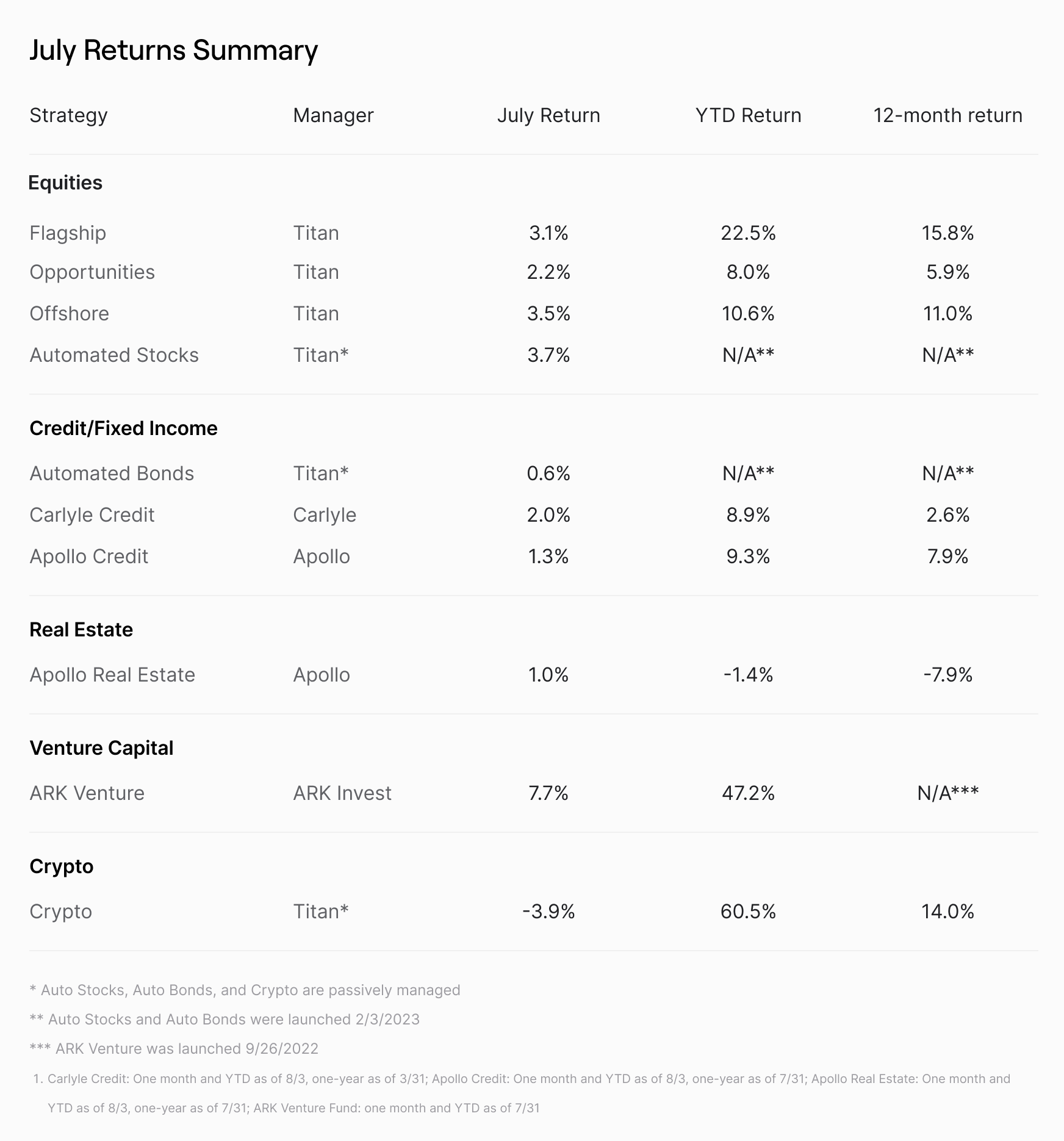

Returns at a glance

In the table below, you can see how each strategy performed in July, year-to-date, and over the last 12-months where applicable.

Disclosures:

**Yield is as of 8/3/23. This represents the highest 7-Day Yield currently available among our options. Certain funds have specific investment minimums, which can be up to $10,000. Investors who invest amounts below these minimums may experience lower yields than those advertised. Yields will fluctuate over time, and are not a forecast or guarantee of future earnings.