Three Things (11/20)

Nov 20, 2024

Blackstone takes a bite of Jersey Mike’s

8 billion dollar sub

Private feast … Down the shore everything’s all right, especially if you’re Jersey Mike’s CEO Peter Cancro. What began as a single sandwich shop in Point Pleasant is today valued at $8 billion (including debt), as a majority stake in the company was just acquired by PE firm Blackstone (BX). The transaction is expected to close in early 2025, pending regulatory approval.

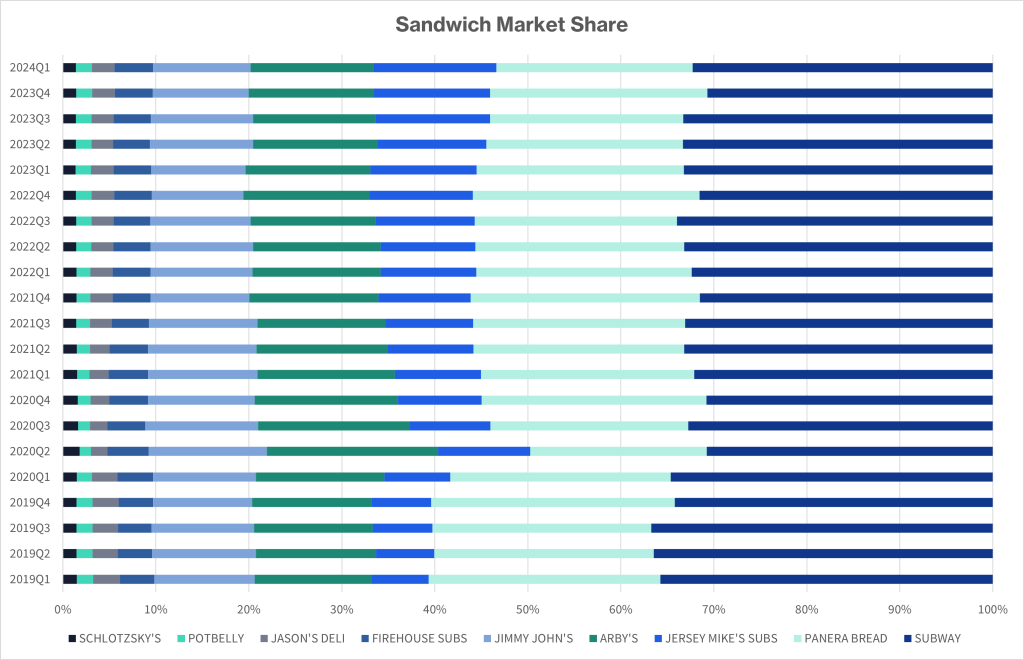

Cancro’s first job was at this very sub shop. He started working there in 1971 and bought the business when he was 17 thanks to a (generous) $125,000 loan from his high school football coach. Last year, Jersey Mike’s netted $3.3 billion in sales; in fact, it's the second-largest U.S. sub sandwich company by market cap, behind Subway. Subway recently sold to Roark Capital for $9.6 billion.

Blackstone’s interest in Jersey Mike’s reflects private equity’s growing appetite for franchise businesses, as they provide scalable growth with minimal upfront capital risk.

The Jersey Mike’s acquisition aims to fuel further U.S. and international expansion while advancing the chain’s technological capabilities. Cancro will retain significant equity and continue leading the company as it plans to broaden to 4,000 locations and $6.5 billion in sales by 2027.

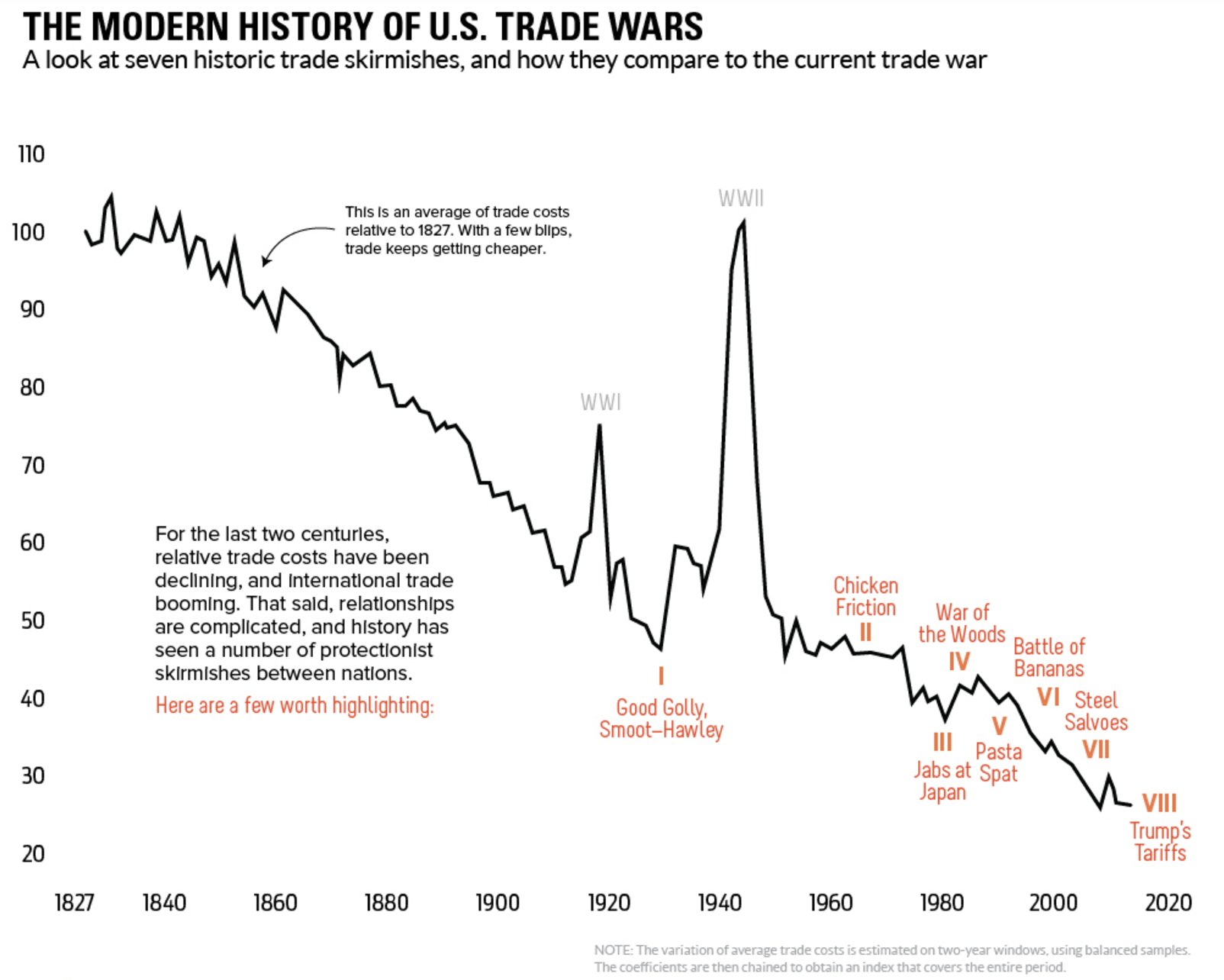

Tariffs stay top of mind

Import impact … Walmart’s (WMT) CFO, John David Rainey, signaled that prices may rise if President-elect Donald Trump’s sweeping new tariffs are enacted. In an interview on Tuesday, Rainey told CNBC, “Our model is everyday low prices. But there probably will be cases where prices will go up for consumers.” While Walmart’s strategy includes sourcing two-thirds of its inventory domestically, Rainey admitted that tariffs—ranging from 10% to 100% on imports—could still impact costs.

Other retail leaders echo Walmart’s concerns. Lowe’s (LOW) CEO Marvin Ellison shared that the home improvement chain is in talks with suppliers about mitigating potential price hikes. In an email statement, the National Retail Federation’s top exec called tariffs “a tax on American families” that could reignite inflation as it moderates.

In a related move, Trump nominated billionaire Howard Lutnick for commerce secretary. Lutnick, CEO of Cantor Fitzgerald and a longtime ally, would oversee trade policies, including tariff enforcement. Known for his staunch support of protectionist measures, Lutnick has called tariffs “an amazing tool to protect the American worker.”

Lutnick’s nomination underscores Trump’s aggressive trade stance, particularly against China. Critics warn of potential global trade disruptions and inefficiencies. However, Lutnick has promised to leverage tariffs to negotiate better deals for the U.S.

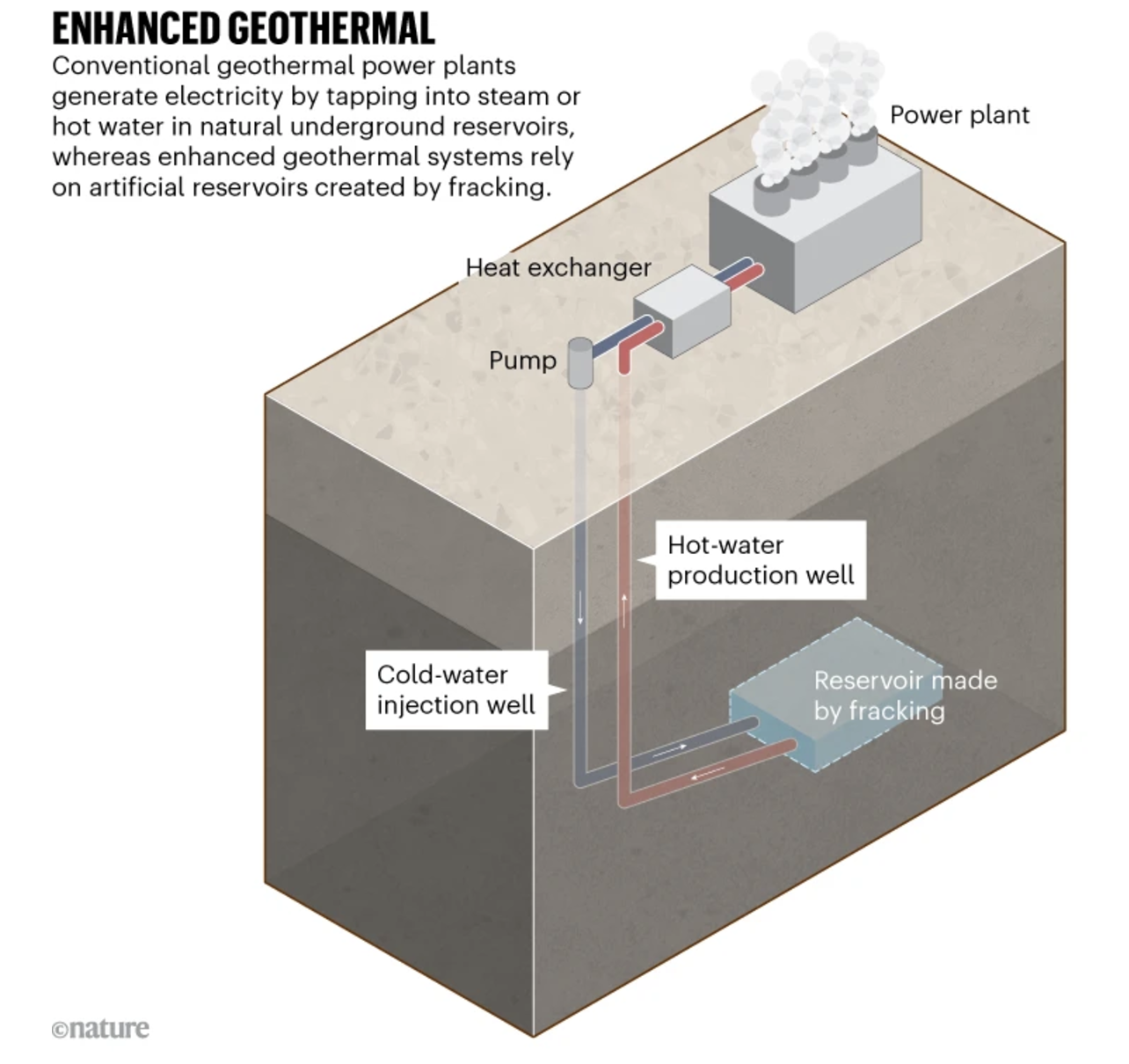

Earth’s heat, energy’s future?

Hot rocks … Geothermal energy, a clean power source harnessed from Earth’s internal heat, is heating up as a key player in renewable energy. Recent advances in enhanced geothermal systems (EGS) from Clemson University are pushing the industry closer to widespread adoption. With private sector support and new technologies reducing drilling costs, geothermal could complement solar and wind energy as a reliable, round-the-clock power source.

Startups like Fervo Energy are leading the charge. Their Utah project, approved in October, could eventually supply 2,000 megawatts—enough for two million homes. Meanwhile, Sage Geosystems has partnered with Meta (META) to bring geothermal power to data centers. Companies like Ormat Technologies (ORA) and Eavor, backed by Chevron (CVX) and BP (BP), are also exploring innovative ways to tap underground heat, with some avoiding fracking altogether to reduce seismic risks.

However, challenges remain. High upfront costs, lengthy permitting processes, and environmental concerns like induced seismicity have slowed growth. Federal incentives, including tax credits in the Inflation Reduction Act, aim to address these barriers. Policy shifts under a new administration (e.g. killing off green energy subsidies) could change things; however, Trump’s pick for Secretary of Energy, Chris Wright, was an early investor in Fervo.

Geothermal has another advantage: it’s dispatchable. Unlike solar and wind, geothermal plants can provide consistent, on-demand energy. With estimates projecting a 90-gigawatt capacity by 2050, this energy source could power 65 million homes and help stabilize the grid.

One more thing: The Department of Justice plans to ask a federal judge to force Google (GOOG) to sell its Chrome browser, a major move to curb the company’s dominance in web technology. This follows a federal judge’s earlier ruling that Google violated antitrust laws by monopolizing digital advertising and search.

Disclosures:

As of writing, META is a holding in Titan's Flagship strategy.