Automated Strategies Q4 Rebalance

Jan 4, 2024

Q4 2023 was a positive quarter for equity and bond markets. Here’s a quick update on what happened in our automated strategies, and what’s to come:

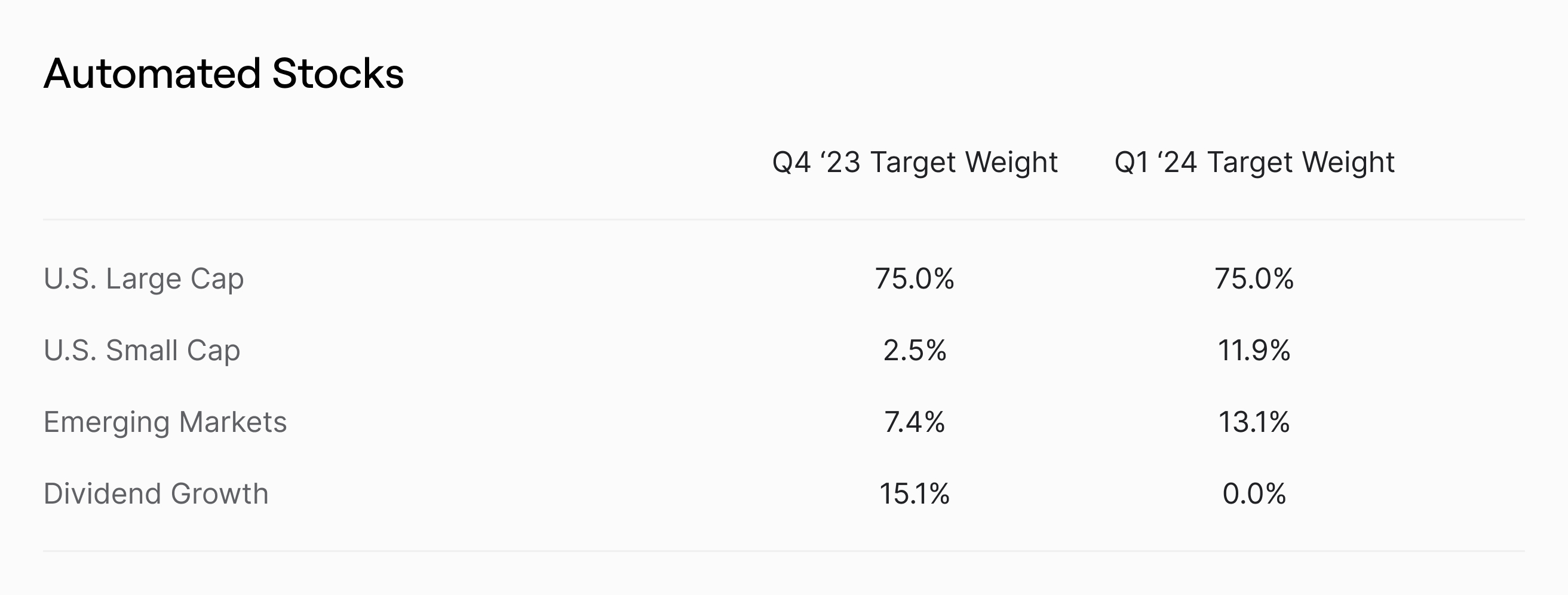

Automated Stocks

Automated Stocks was up 11.6%¹ in Q4 2023, with positive attribution across equity markets broadly.

U.S. Large Cap (VOO), U.S. Small Cap (IJR), Emerging Market (VWO) and Dividend Growth (VIG) equities gained over the quarter as a softer-than-expected inflation report in November drove broadly bullish sentiment. U.S. Small Cap (IJR) outperformed other equity markets, as small-cap stocks exhibited even more interest rate sensitivity to indications that Fed Funds rate had peaked.

Looking ahead into Q1 2024, our automated model’s target weights will change slightly. The chart below summarizes the changes to the strategy:

As a reminder, clients who are more than ± 3% from the model’s target weights may be automatically rebalanced on October 2nd for risk management purposes.

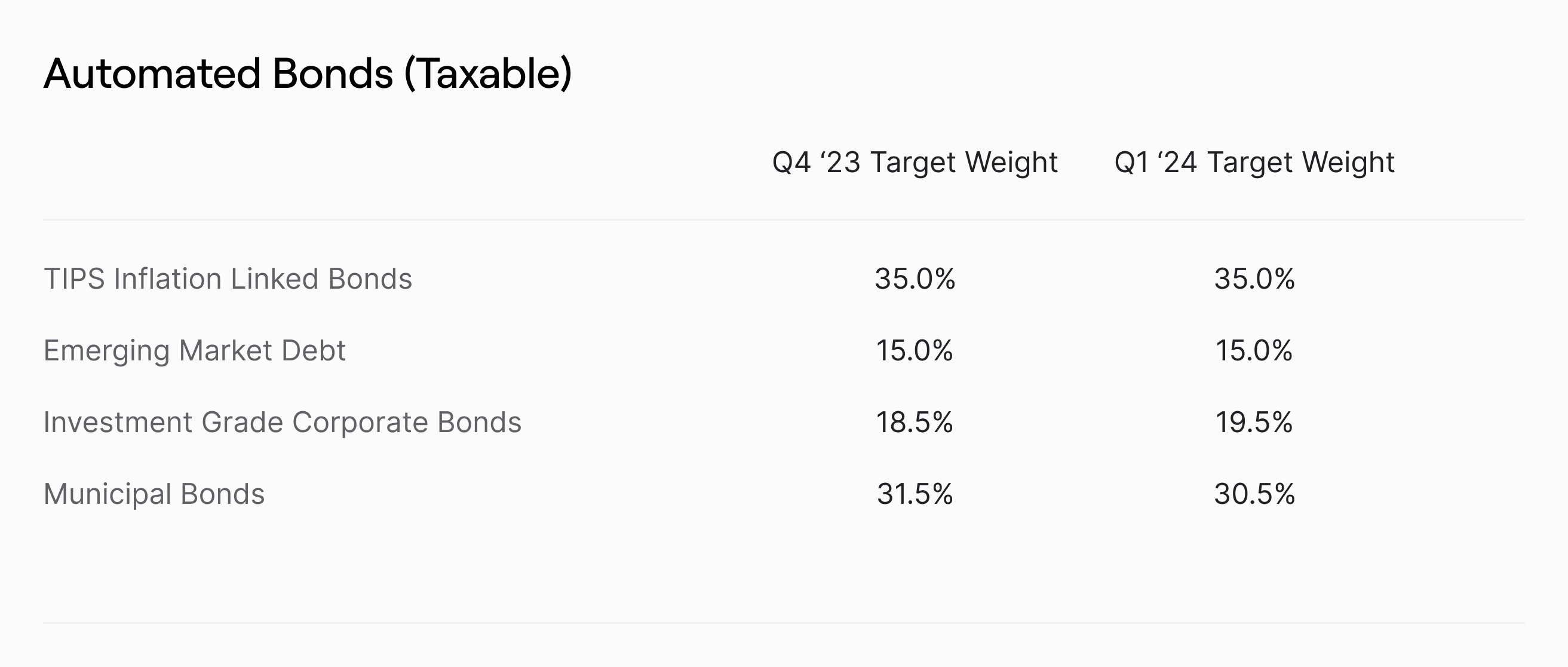

Automated Bonds

Automated Bonds was up in Q4, returning 6.1% (taxable)¹ and 5.0% (retirement)¹ with positive attribution across bond markets.

Expectations of interest rate cuts in the first half of 2024 and favorable inflation data drove a shift in bond markets, leading broadly positive returns across global bonds. U.S. Municipal (VTEB, not included in retirement accounts), U.S. Corporate (VCIT) and Emerging Market Deb (EMB) bonds benefited from the decline in long yields over the quarter, rallying in November with gains continuing through the end of the year. U.S. Inflation-Linked Bonds (VTIP) also gained as the inflation data came in lower than expected.

Looking ahead towards Q1 2024, our automated model’s target weights will change slightly. The chart below summarizes the changes to allocation for the upcoming quarter.

Automated Bonds (Taxable Accounts)

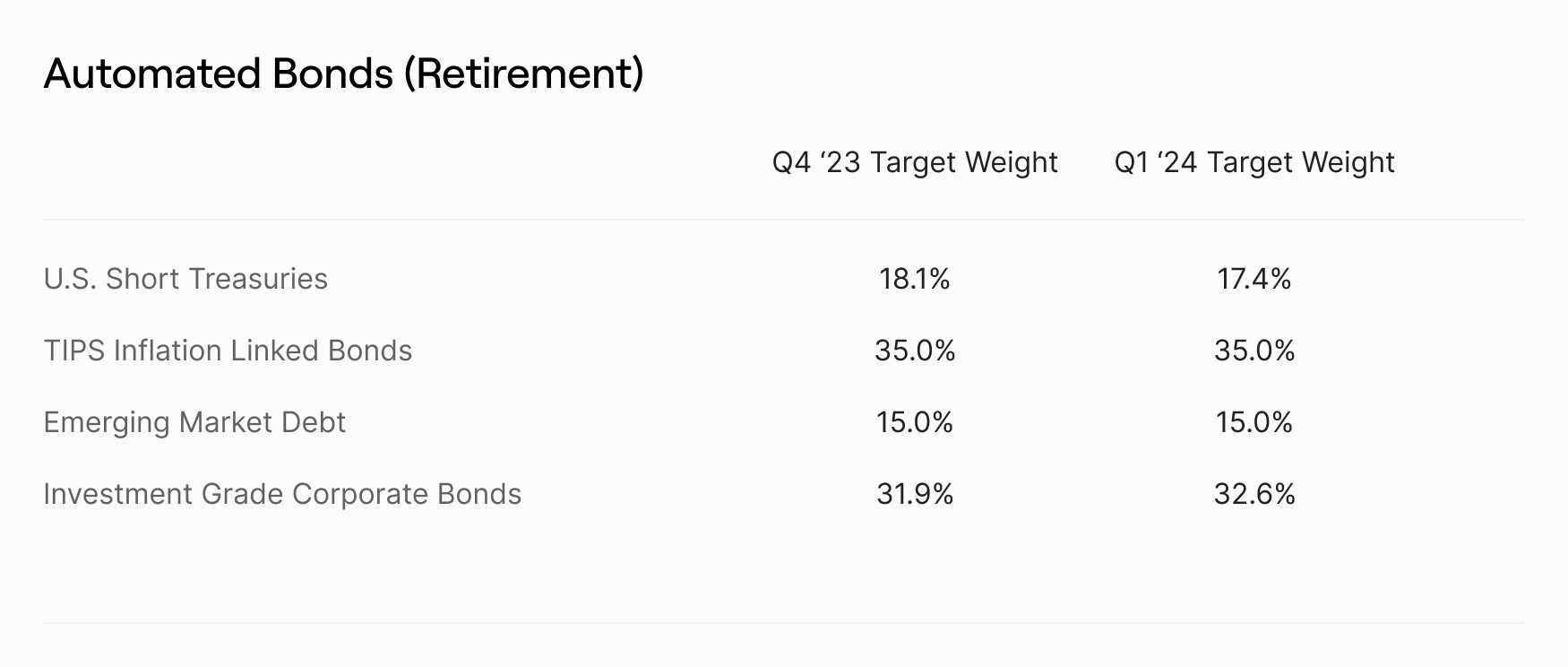

Automated Bonds (Retirement Accounts)

Automated Bonds for IRAs follows the same investment model as the taxable accounts strategy, but excludes Municipal Bonds (VTEB) from its investment universe, as the tax-advantaged nature of municipal bonds is not applicable to IRAs.

Refresher: Automated Strategies Model

Titan’s Automated Strategies select weights algorithmically based on constrained mean-variance optimization models. The goal is simple: our models aim to optimize the risk-adjusted return of each strategy. This type of model favors diversification, meaning that as asset classes appear less risky, less correlated, or higher returning, the model will assign more weight to them (within reasonable constraints).

Estimates that the models use can change slightly quarter-over-quarter, which leads to changes in weights. Clients who are more than +/-3% from our model’s target weights may be automatically rebalanced at the start of the quarter for risk management purposes.

For more information, feel free to reach out to our team and we’re more than happy to assist.

Disclosures:

Performance assumes distributions are reinvested. Titan does not charge advisory fees for the Automated Bonds or Automated Stocks strategies. Performance figures provided do not represent actual investment results of any specific client. Actual client performance will vary based on numerous factors, including the timing of when the client began investing and market conditions. Quarterly performance figures represent cumulative returns, compiled from the beginning to the end of the given quarter. Performance for Automated Bonds differs between taxable and retirement accounts since retirement accounts do not invest in U.S. Municipal Bonds. Past performance is not indicative of future results.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Contact Titan at support@titan.com.

Trade communications are meant for informational purposes only. All investments involve risk and the past performance of a security does not guarantee future results or returns. Any historical returns, expected returns, or probability projections are based on a model portfolio incepted on 2/3/2023, and may not reflect actual performance of a given account, due to price movements and timing of investments.

Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party.

Investing in securities involves risks, and there is always the potential of losing money. The rate of return on investments can vary widely over time, especially for long term investments. Past performance is no guarantee of future results.