Join us for our first Summit Series live event, February 11th NYC

Titan ranked #1 investment advisor in Q3

Nov 10, 2020

Titan has ranked #1 out of 80+ advisors for four consecutive quarters now.

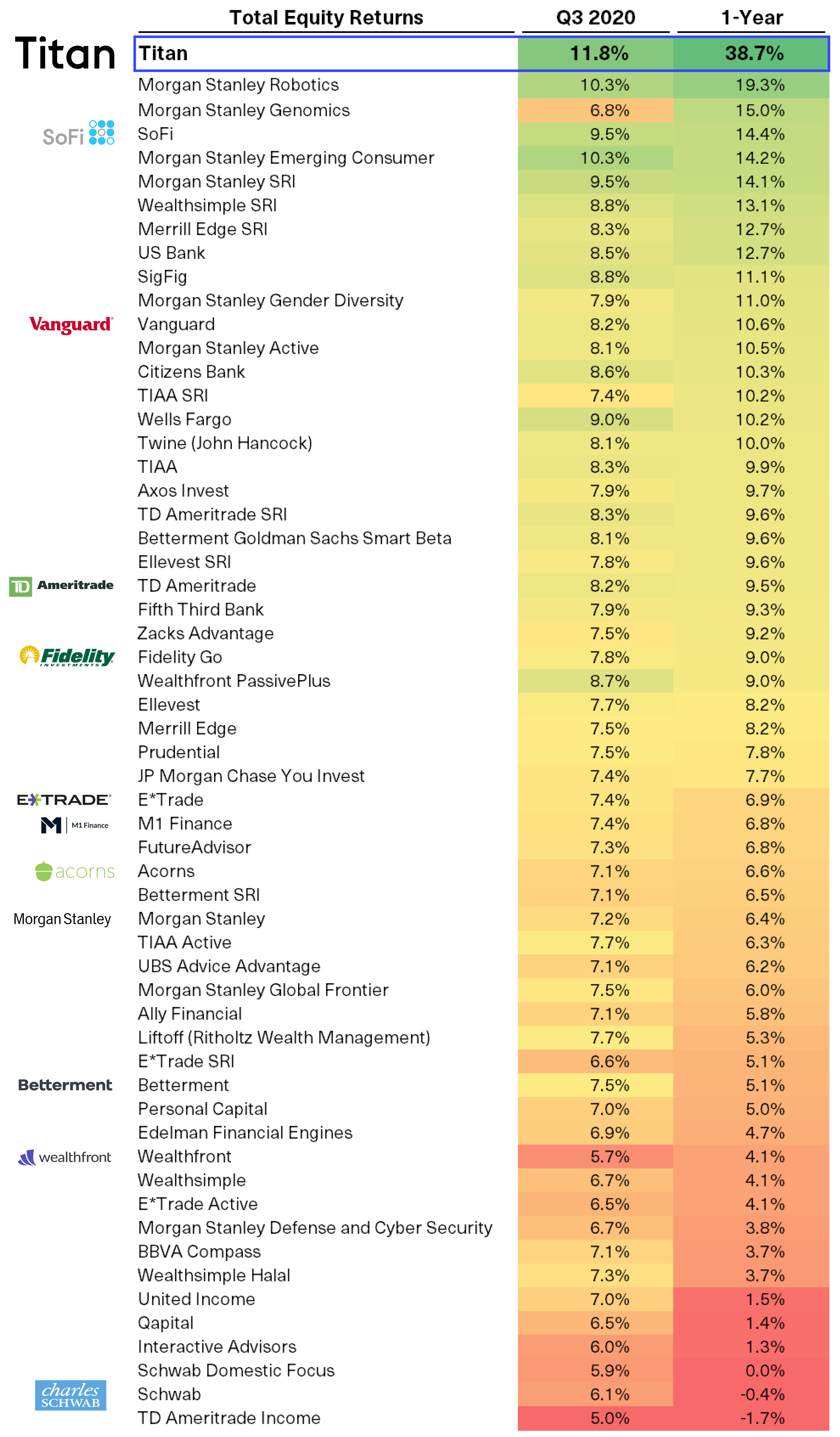

We're pleased to announce that Titan was once again ranked #1 out of 80+ investment advisors for both total equity returns and excess returns.

As of Q3, Titan's after-fees results continue to top those of every other investment advisor tracked by Backend Benchmarking, including Fidelity, Vanguard, Personal Capital, TD Ameritrade, E*Trade, Wealthfront, and Betterment.

Titan has now been ranked #1 for excess returns for four consecutive quarters. Over the past year, Titan has outperformed the next best performer on equity returns by nearly 2x while delivering stronger excess returns and risk-adjusted returns.

Below are some highlights from the Q3 Robo Report. For the full report, please click the View Full Report button above.

Source: Backend Benchmarking. Represents total taxable equity portfolio returns through Q3 2020. The Robo Report is published each quarter. It measures portfolio performance from real accounts tracked by Backend Benchmarking, a third-party financial portfolio analytics platform. Results show Titan's net returns (after fees) for an Aggressive client in Q3 2020. See page 23.

Looking ahead##

"Titan continues to shine with its stellar active management." - Backend Benchmarking (Nov. 2020)

Reminder: We make high-conviction bets in first-class companies that we believe can deliver outsized returns, while hedging your portfolio to protect your capital during periods of volatility.

Just yesterday, positive vaccine data from Pfizer brought prospects of a broader economic recovery even closer to reality, driving portfolio companies Booking (BKNG), Disney (DIS), Mastercard (MA), and Transdigm (TDG) each up >9%.

While most investors today are focused on the impact of additional coronavirus developments on the forward outlook, we believe that the Titan strategies are extremely well-positioned regardless of the exact path of events from here on out.

If you've been holding excess cash on the sidelines, we would recommend deploying it. You should own a bigger piece of these companies with a cyclical recovery now in clearer sight.

Let us know if you have any questions. As always, we'll be working hard to deliver you the best results for your capital.

Disclosures: The returns shown above are based on a "normalized benchmarking" process undertaken by Backend Benchmarking: "The percentage allocated to equities in a portfolio is one of the largest drivers of returns. Because of this, comparing two portfolios that have a different level of equity allocation is difficult and can be misleading. Normalized Benchmarking controls for differences in equity holdings by adjusting the benchmark to match the equity/fixed income ratio of the portfolio. When this is done across a group of portfolios, the portfolios can then be measured against each other by their return above or below the benchmark specific to the portfolio."

In the Ranking portion of the report, Backend Benchmarking limits the robos to those that had a minimum of 2.25 years performance history within the account they track. This is why Titan among many other robo advisors are not covered in the Robo Ranking section of the report yet. We look forward to being covered in the full Robo Ranking in the future.