Join us for our first Summit Series live event, February 11th NYC

The Coronavirus Crisis

Jan 27, 2020

How does the coronavirus outbreak impact your portfolio?

U.S. stocks fell sharply on Monday as the death toll of the coronavirus outbreak continues to rise and pressure grows on China's political leaders and its economy.

TLDR: we believe the impact of this coronavirus outbreak on your portfolio companies is small from a long-term investment perspective.

The health ramifications of the virus are obviously severe for anyone impacted, and they are a reason for greater caution during travel. That said, historical cases like these have generally presented great buying opportunities for long-term investors.

The latest information##

- The coronavirus outbreak is believed to have begun at a wholesale animal market in the central Chinese city of Wuhan (though some patients claim to have never visited the market)

- This coronavirus, like SARS and MERS, "jumped the species barrier" to infect people on a large scale

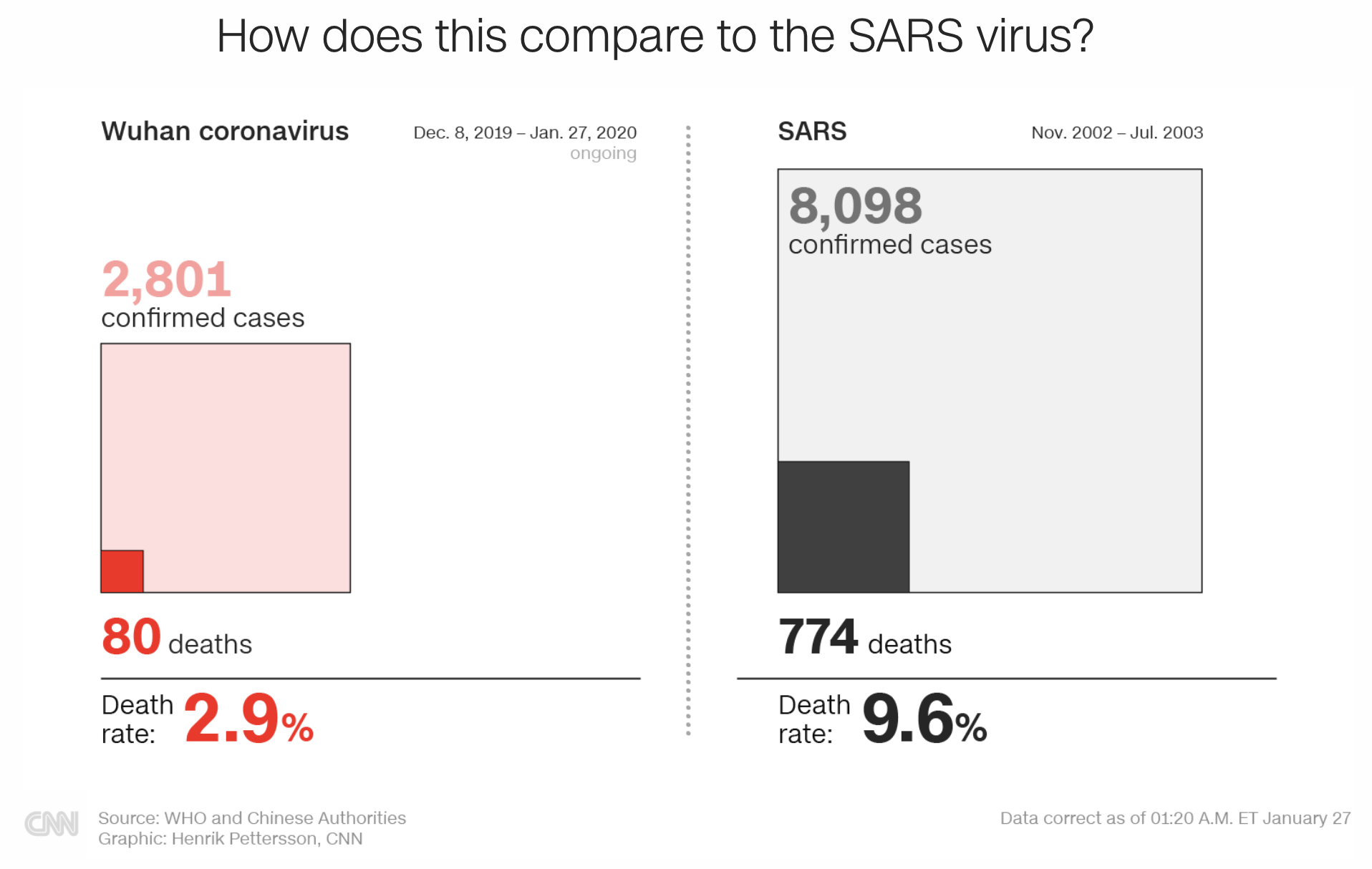

- The death toll now stands at ~80, with almost 2,800 cases confirmed across China and infections now reported outside of China too

- Economic reactions to the outbreak have been swift (e.g., Chinese consumer spending already dropping, multi-national companies like Disney (DIS) closing locations out of precaution)

- The CDC says the risk to Americans is low, but there's still a lot about the virus they don't know, hence they're preparing as if this is a pandemic

Why you're positioned well##

Firstly, almost none of the Titan portfolio companies has material exposure to Chinese consumer spending.

Companies like Apple and Disney rely heavily on seasonal iPhone sales and theme parks in China, while Booking Holdings relies on global travel growth. Those companies could see earnings impact if the outbreak grows in scale and duration. The other 17 of your 20 companies, however, appear minimally impacted.

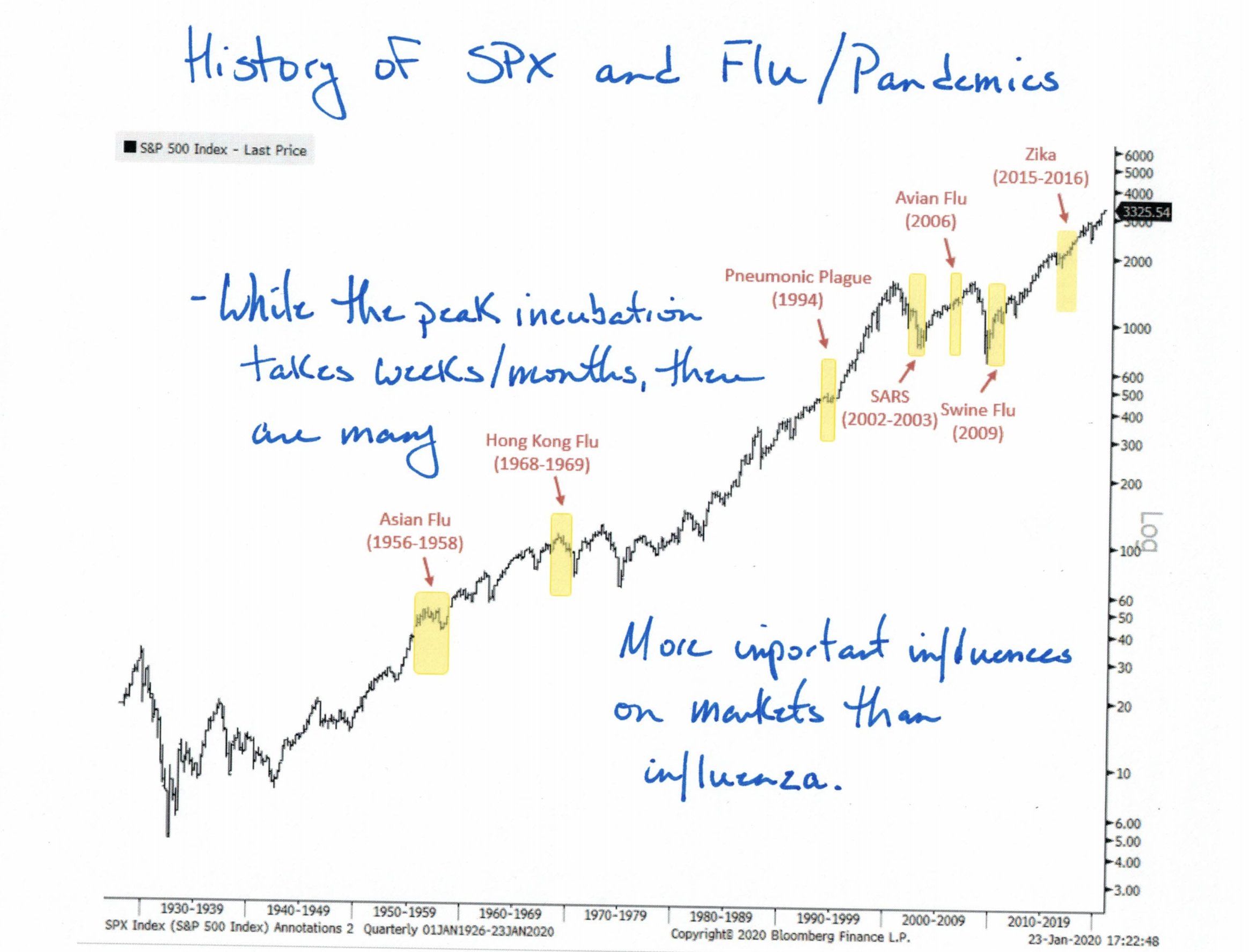

Second, looking at the history of the S&P 500 during pandemic outbreaks, we don't see any strong negative correlations. This suggests a widespread selloff in stocks could be short-lived.

Furthermore, the assumption that it's a pandemic as bad as, say SARS, may be a far too conservative one. The coronavirus outbreak is still ongoing, so it could be too early to tell, but thus far, it pales in comparison to the SARS outbreak in the early 2000s.

Finally, in the six weeks since this coronavirus has been tracked, ~80 people have died worldwide. In the same six weeks, over 80,000 people have predictably died of influenza (the flu). This is not a perfect comparison, but by order of magnitude, the data suggests the media may be sensationalizing the impact here.

To be clear, this is an extremely deadly virus that is not to be taken lightly as a consumer and global citizen. It's still ongoing and its ramifications could prove far worse than we've outlined above. Everyone should take precautions to stay safe.

However, if it's not an extreme outlier, the economic impact of the coronavirus could be far less negative than headlines suggest, based on the data above.

If that turns out to be the case, days like these could end up being opportune times to load up on high-quality companies.