Titan ranked #1 advisor for returns in Q2 2020

Aug 11, 2020

This represented Titan's 3rd consecutive quarter of ranking #1 in excess returns vs. normalized benchmarks.

.jpg)

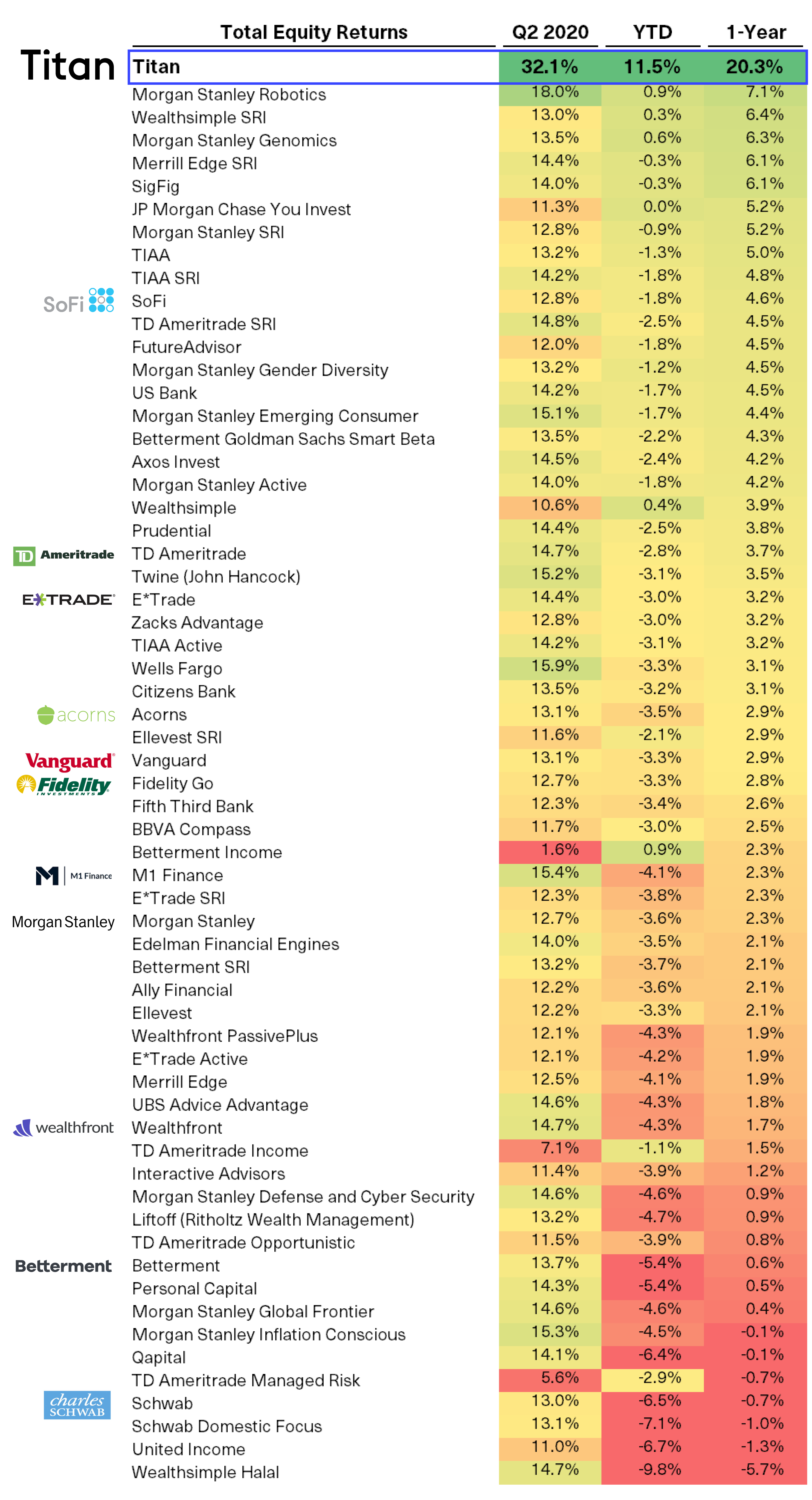

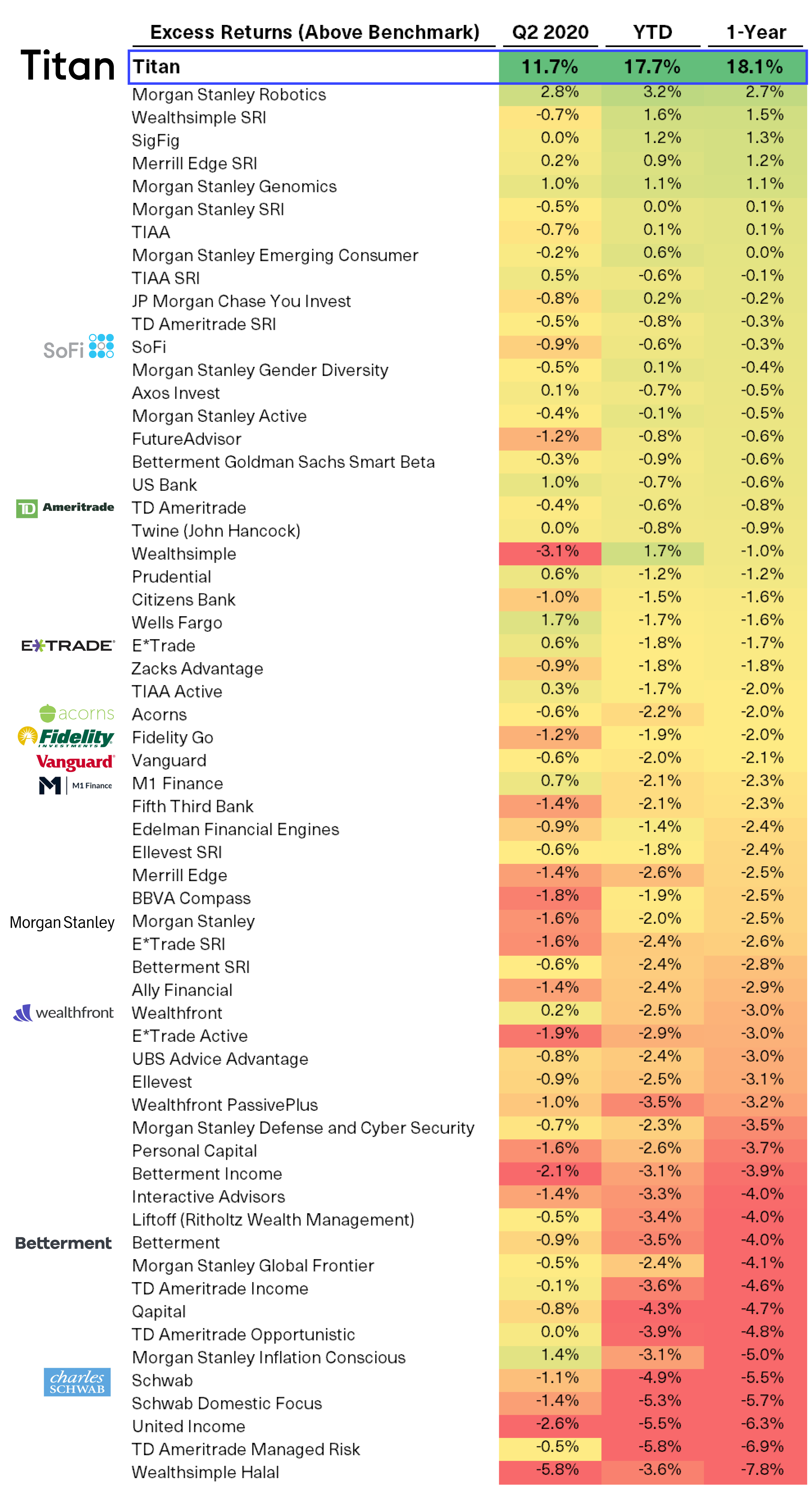

We're pleased to announce that Titan was again ranked #1 out of 60+ investment advisors for both equity returns and excess returns through Q2 2020, according to The Robo Report.

We beat out numerous platforms on an after-fees basis, including Fidelity, Vanguard, Personal Capital, TD Ameritrade, E*Trade, Wealthfront, and Betterment.

This represented Titan's 3rd consecutive quarter of ranking #1 in excess returns (over normalized benchmarks) and its 2nd consecutive quarter of ranking #1 in overall equity returns.

As shown in the report, Titan was one of the only advisors to generate positive returns in the YTD period, thanks in part to our downside hedge which we fully activated for clients in early March.

Below are some highlights from The Robo Report and our overall rankings. For the full report, please click the "Download Report" link above.

Source: Backend Benchmarking. Represents total taxable equity portfolio returns through Q2 2020.

"Titan Invest was the top performer over the second quarter, the year-to-date period, and the 1-year trailing period... Titan shines by making tactical moves and holding the right stocks." - Backend Benchmarking

Source: Backend Benchmarking. Represents excess taxable portfolio returns (above normalized benchmarks) through Q2 2020.

These results suggest that Titan is delivering higher absolute and relative returns versus every other investment advisor covered.

The Robo Report is published each quarter. It measures portfolio performance sourced from real accounts tracked by Backend Benchmarking, a third-party financial portfolio analytics platform. They started tracking Titan in Q3 2019.

The Robo Report shows Titan's net returns (after fees) for an Aggressive client in Q2 2020. See page 39 of The Robo Report for more details.

Other Notes

- Some of the above advisors' portfolios had more equity than fixed income. Titan, for example, is 100% equity; other advisors are 60% equity / 40% fixed income. The percentage allocated to equities in a portfolio is one of the largest drivers of returns; generally, higher equity allocations drive higher returns than fixed income over time, but equity is also higher risk. Because of this, comparing portfolios that have a different level of equity allocation can be misleading.

- Backend Benchmarking's Robo Report does a great job of normalizing returns for these allocation differences. The table above shows each advisor's "Excess Return vs. Normalized Benchmark" which attempts to normalize their varying equity vs. fixed income allocations. The result is a more apples-to-apples comparison of returns than just looking at their nominal portfolio returns, in our view.

- Backend Benchmarking's illustrative Titan account represents an account with an Aggressive risk profile; clients with Moderate and Conservative risk profiles would have experienced lower returns. See website for full disclosures.

- In the Ranking portion of the report, Backend Benchmarking limits the advisors to those that had a minimum of 2.25 years performance history within the account they track. This is why Titan among many other robo advisors are not covered in the Robo Ranking section of the report yet. We look forward to being covered in the Robo Ranking in the future.