Is capital a moat?

Oct 23, 2020

Quibi's failure suggests that capital can help strengthen and accelerate a moat, but is not a moat in and of itself.

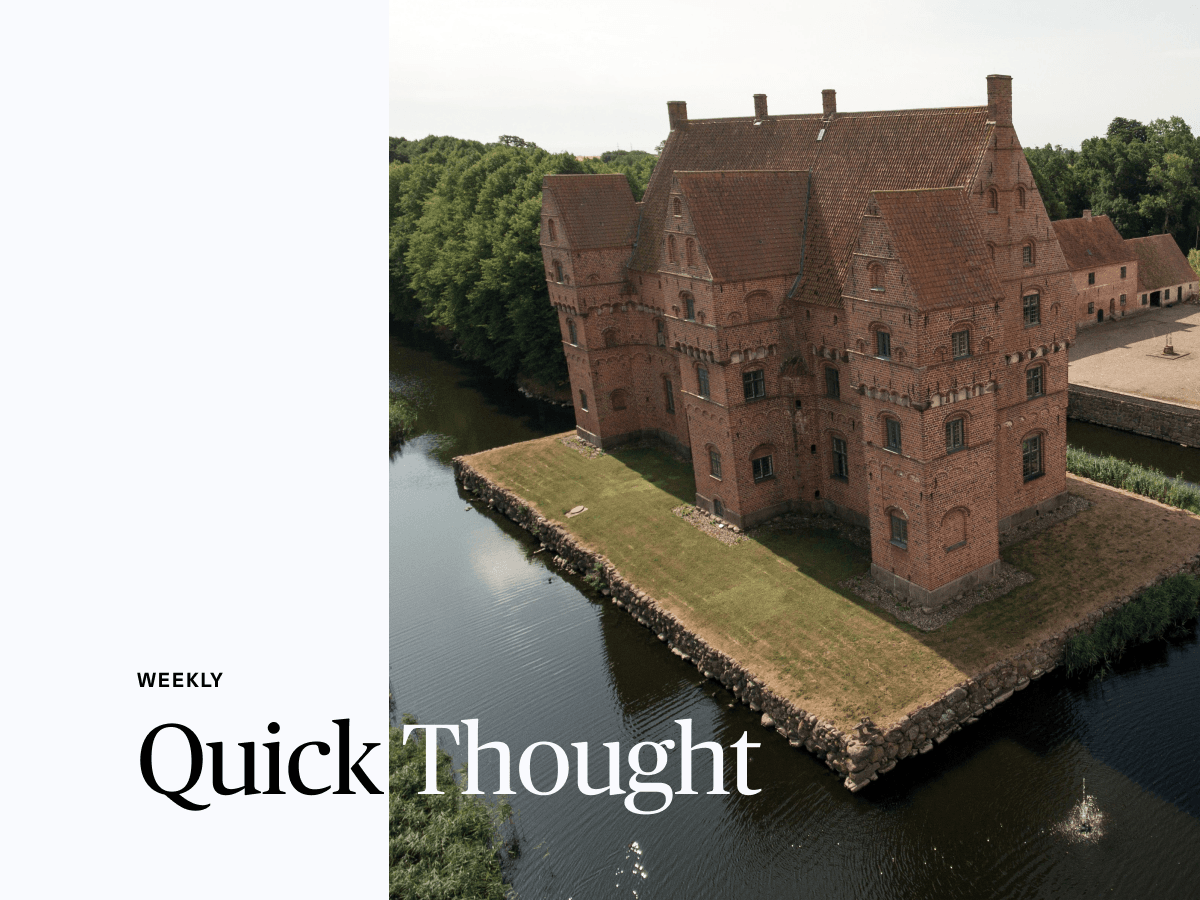

The most important thing [is] trying to find a business with a wide and long-lasting moat around it … protecting a terrific economic castle with an honest lord in charge of the castle." - Warren Buffett

In investing, identifying the type and strength of a company's moat is paramount. There are various types of moats, including economies of scale, high switching costs, and network effects -- to name a few.

But what about capital itself? Is having a large cash hoard a moat? This week's shutdown of video startup Quibi suggests it's not. Let's analyze.

Quibi was born in 2018 when successful Hollywood and tech execs had an idea for a new business: short, high-quality video formatted for your mobile phone on the go. They raised billions of dollars to produce gobs of expensive content before even launching the app, setting expectations that they could build a viable Netflix competitor in just a few years. To quote an ex-Quibi employee:

“Look how much money Apple, Amazon, YouTube, Netflix, Hulu, and Disney+ bring to the table. We’re not raising $1.75 billion to start a pizza parlor in the East Village. We’re doing it to try to compete for content with some of the world’s biggest streamers."

Fast forward to today, and just six months after launch, Quibi is shutting down. It underwhelmed lofty expectations and failed to find product-market fit with consumers. It could not buy its way onto our smartphones sustainably.

Quibi's failure suggests that capital can help strengthen and accelerate a moat, but is not a moat in and of itself.

On the one hand, streaming video is a capital-intensive industry. Being able to raise boatloads of money from investors is what helped Netflix grow to 100+ million users and build a scale-based moat, enabling it to produce content at cheaper per-user costs than anyone else. Capital was a moat enabler.

On the other hand, even with ~$2 billion in capital, Quibi was not able to buy its way to mainstream success. Capital was not a moat itself. And in fact, it may have been the source of the company's death (getting hooked on burning all its cash before finding product-market fit which is critical to survival).

Moats are derived from the results of capital, not capital itself. Even the wealthiest lords need to execute to protect the castle.