We've reduced our hedges, reallocated capital

Apr 21, 2021

Based on our internal indicators, we think it's time to reduce hedges and re-allocate capital.

We have reduced your personalized hedge to its minimum level, harvesting tax losses and re-allocating the funds across our strategies' stocks. This decision was based on our investment team's research on the fundamental and technical set-up for equity markets.

Reminder: the objective with our hedging strategy is to reduce the volatility of your Titan portfolio when we believe markets are most susceptible to drawdowns, thereby boosting your Sharpe ratio and risk-adjusted returns.

By reducing your hedge to its minimum level (based on your personalized risk profile), we've harvested losses incurred by the hedge to reduce your 2021 tax bill, while reallocating proceeds to your portfolio stocks where we see even more long-term upside after the recent correction.

Below is our "post-mortem" analysis on our hedging over the past year. We believe it's important to constantly review and re-evaluate investment decisions to continue positioning your capital for growth.

Recap of our hedging since February 2020

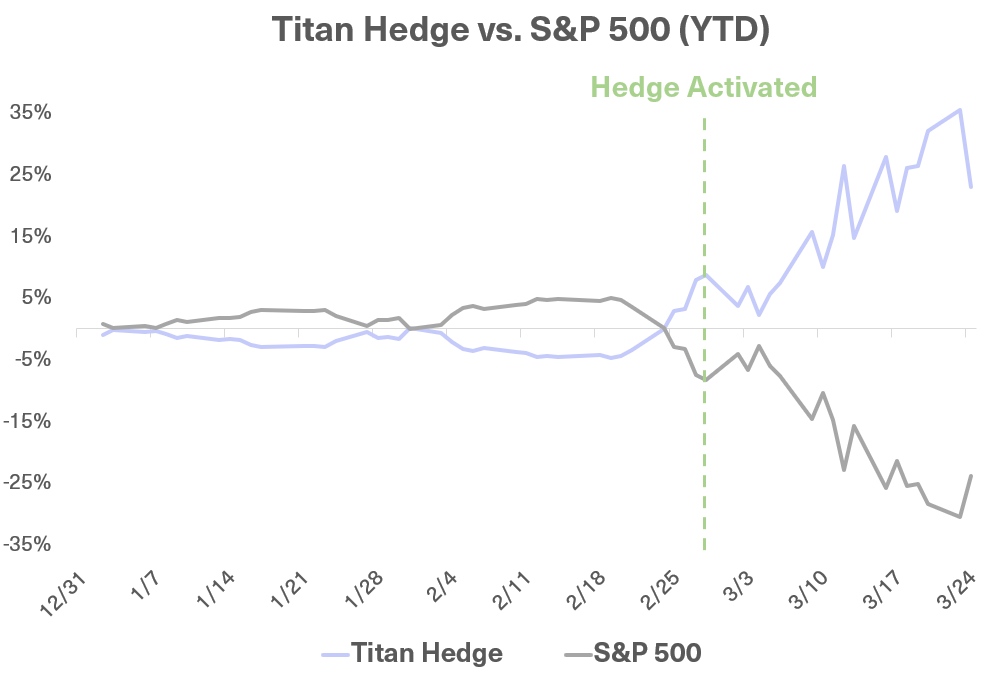

We implemented full hedges for clients in late February 2020 prior to the sharp market sell-off amidst the onset of COVID-19. See our attached deck, "Investing through the Coronavirus," for the hedging thesis we shared a few weeks later.

The main reasons we implemented full hedges at the time were:

1. Fundamentals: We expected a 2nd wave of COVID-19 infections. Our analysis of historical pandemics suggested a 2nd wave of infections was likely to follow, which could meaningfully delay a full economic recovery.

2. Technicals: We hadn't yet seen true capitulation and a technical retest of the lows ("double dip" or "W-shaped recovery"). Most dramatic sell-offs end in "capitulation" -- investors giving up and selling stocks at any price just to end the pain -- along with support at important technical price levels.

In March 2020, this decision to implement maximum hedges protected our clients from substantial losses and actually added some alpha on the short side. It helped us play both defense and offense.

Titan Hedge refers to Flagship's hedge security (inverse S&P 500 ETF; ticker: SH). YTD figures refer to calendar 2020. Chart for illustrative purposes only. Past performance is no guarantee of future results.

However, since the March 2020 lows, markets have rallied at an unprecedented pace, defying our expectations for both fundamentals and technicals.

On fundamentals, we did get a 2nd wave of COVID-19 infections in late 2020, but the market "looked through" it. Financial media outlets like CNBC alluded to the Federal Reserve backstopping asset prices at almost any cost through unlimited stimulus. This seems obvious in hindsight but was not at all guaranteed to put a floor under equity markets at the time.

On technicals, we did get true capitulation but we did not get a retest of those market lows. Most bear markets transition to bull markets once asset prices "retest" their lows and hold firm, forming technical support levels. But the COVID-19 selloff was an exception; it was a V-shaped technical recovery.

As a result, our hedges went from being a net tailwind to a net headwind in the subsequent 12-month period - resulting in a net negative for the hedge, and a net positive for our overall portfolio and broader equity markets.

We believe our decision to keep full hedges on was prudent based on the available data at the time, but the path the market took in 2020 clearly surpassed expectations.

Why reduce hedges and add to longs now?

This brings us to why we're reducing our full hedges to their minimum level now, in line with your personalized risk profile (full details here).

On fundamentals, a strong economic recovery now appears underway. From data points like surging March payrolls, strong retail sales, robust ISM services orders and beyond, the ramp in COVID-19 vaccinations and expectation for herd immunity in the coming months is translating to business momentum.

At the same time, the technicals appear to be lining up in our favor as growth investors. Indicators suggest growth equities (especially U.S. small/mid cap) are oversold, looking at relative strength indicators and exponential moving averages on baskets like the Russell 2000 Growth index.

We see this as an opportune time to harvest tax losses on the hedges that have been in place during the past year's market rally, reducing short exposure and adding to our long positions at attractive prices.

Is this a macro market call? Absolutely not. When the data suggests heightened probability of a protracted downturn, we'll implement full hedges again. When it suggests market environments have improved thereafter, we'll reduce hedges. Simple and unemotional.

We'll continue to refine our hedging strategy and stay nimble in our positioning. As always, let us know if you have any questions.

Best, Titan Investment Team

See full disclosures.