It’s Bitcoin Season

Oct 6, 2021

Trimming the alts for Old Faithful

TLDR: We've slimmed our other positions to put our weight behind Bitcoin. We believe it’s Bitcoin’s time to shine.

After a very rocky end to September in the crypto markets, October has kicked off with meaningful gains.

Some were surprised that Bitcoin held $40K through September, despite an onslaught of bad news. But—as noted in our previous updates—on-chain data continued to show bullish broader accumulation trends by institutional investors and whales, who seemed wholly unfazed in spite of heightened volatility.

We’ve now seen Bitcoin spike as high as ~$55K this week, but we see more room to run.

There are four reasons why we believe Bitcoin will be the star of October, while other crypto assets will be relatively stagnant this month.

Let’s dive in.

- We believe Bitcoin ETFs are coming: Approval of US-based Bitcoin futures ETFs could come as soon as this month, with promising comments from SEC Chair Gary Gensler.

- Bitcoin is playing catchup: We’ve seen altcoins make new all-time highs over the last month, while Bitcoin has consolidated between $40-50K. We believe Bitcoin is about to catch up to the pack.

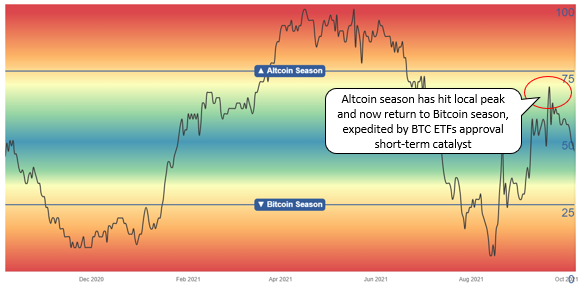

- Taking a pause from Altcoin season: The Altcoin Season Index (below) shows that Altcoin season may have already reached a local peak, with the market returning to Bitcoin season in the short term.

- Institutional flows reversal: After suffering its longest run of institutional outflows, Bitcoin has started to see strong inflows over the last two weeks. We believe this decisive turnaround in sentiment is due to growing confidence in the asset class among institutional investors. Once an institution buys Bitcoin, you can generally expect them to HODL.

Altcoin Season Index: Percentage of Top 50 altcoins performing better than Bitcoin over the last season (90 days). The chart shows a cyclical pattern between Bitcoin vs. Altcoins.

Source: Blockchain Center

Source: Blockchain Center

Why go big on Bitcoin now?

Despite improving inflows across investment products, Bitcoin volumes have remained low, at $2.4B last week compared to $8.4B in May 2021. We believe this indicates huge room for Bitcoin to grow.

Our Titan Crypto weightings continue to reflect our long-term conviction in DeFi, Oracles, and next-gen Layer 1s. We also consider it our responsibility to capture immediate market opportunities when they arise.

With improving sentiment from U.S. regulators re: Bitcoin ETF approvals, this is an opportunity we’re delighted to seize for our clients—and we believe the upside could be significant.

As always, let us know if you have any questions about these portfolio management decisions, and thank you for the opportunity to manage your capital.