Titan Opportunities Trade Update: Diving into HAYW

Oct 27, 2021

We’ve also sold UPWK and added to DNN, NXE, CARG

Led by a rally in our uranium positions, Titan Opportunities is up more than 13% net of fees in October through the market close on 10/25/21, materially outperforming the strategy’s benchmark over that period.

This dynamic backdrop for markets has created several changes in the risk/reward profile of our current holdings and presented new opportunities for us to put capital to work.

As a result, we’re initiating a position in pool equipment manufacturer Hayward (HAYW), adding to existing positions in Denison Mines (DNN), NexGen Energy (NXE), and CarGurus (CARG), and liquidating our position in Upwork (UPWK).

TLDR: We’ve sold UPWK after a 300% gain since inception through 10/25/21 and put the profits to work in HAYW, a leading pool equipment manufacturer. We’ve also expanded our existing positions in uranium holdings DNN and NXE and auto industry leader CARG.

UPWK and to the right

Since being added to the Opportunities strategy at inception in August 2020, Upwork has been one of the portfolio’s best performers, returning more than 300% over that period.

These strong returns over the last ~15 months have resulted in Upwork becoming one of the largest holdings within Opportunities, but this appreciation also makes the current risk/reward for shares more challenging.

Upwork remains at the forefront of a labor market being reshaped in real-time, and the value workers now place on flexibility after the pandemic serves as a great example of COVID pulling forward trends that were expected to play out over the next decade.

At its current valuation, however, our work suggests Upwork shares are fully valued. As a result, we’re exiting our position.

Diving into HAYW

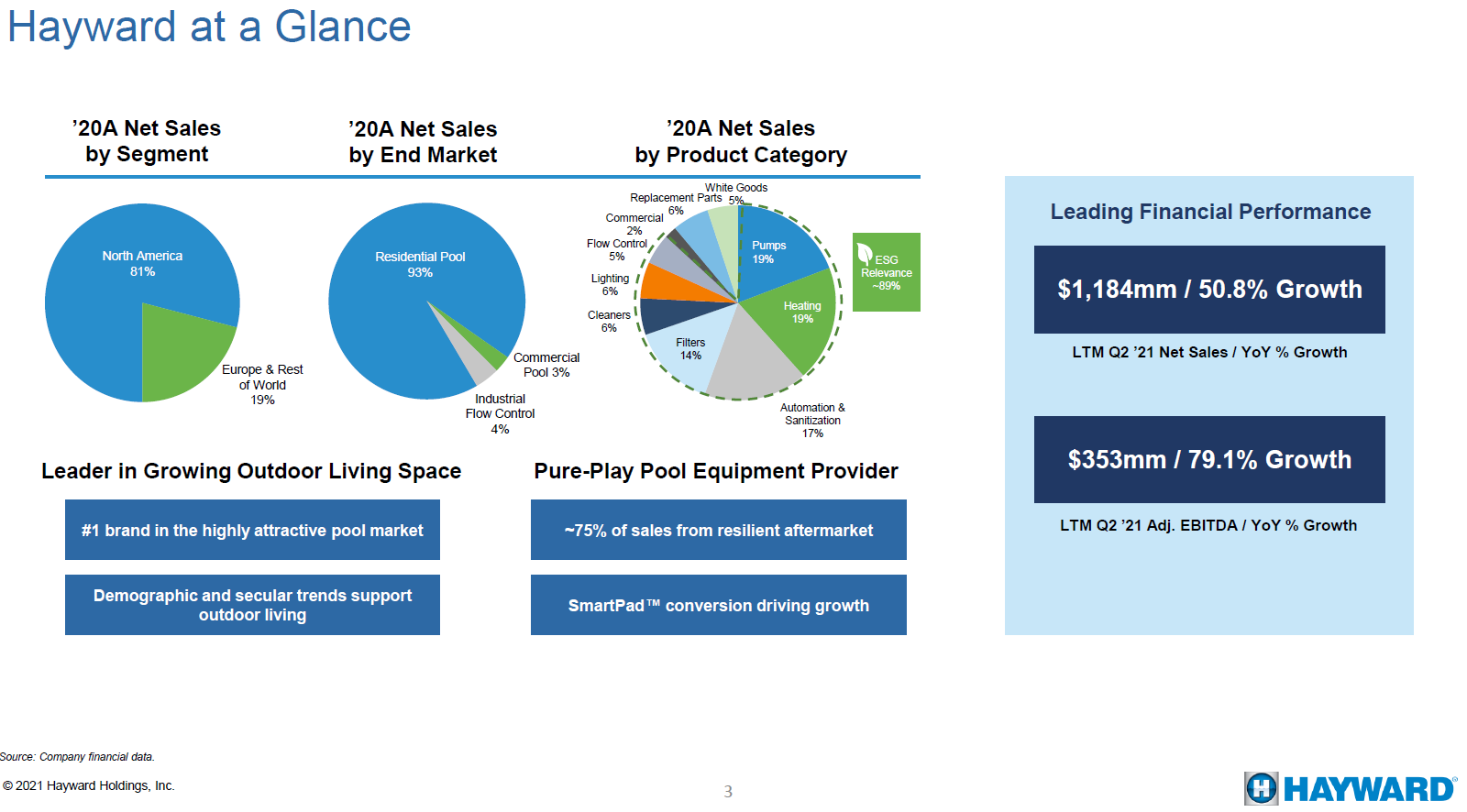

With the proceeds from our Upwork position, we’re excited to initiate a new Opportunities holding that plays right in your backyard: pool equipment manufacturer Hayward.

Hayward makes the pumps, filters, automation systems, and everything else that helps keep a pool clean and in good working order. The company’s current revenue mix is roughly 75% recurring with around 25% of sales coming from new construction. The majority of its sales are in North America.

After nearly 4 years of private equity ownership, Hayward made its public debut in March 2021. The IPO was priced at $17 per share and the stock has traded in the mid-$20s for the last ~5 months. Our initial work on Hayward suggests returns may average 17.5% over the next 3-5 years.

As a highly specialized industry, the pool business has long been a favorite of disciplined investors. High levels of recurring revenue, specialization and rational competition among the industry’s biggest players, and durable pricing power are features of the pool business, and shares of industry leader Pool Corp. (POOL) have compounded at a rate of 35% over the last decade.

In addition to a favorable competitive structure, COVID-related tailwinds are also at the industry’s back. Rising household net worth alongside increased time spent at home is driving an upgrade and installation cycle for pools.

Moreover, migration trends out of the Northeast and Midwest and into the Sun Belt and Florida bolster demand for pools as more households are established in climates that accommodate outdoor lifestyles.

This backdrop, however, does not come without some risks, both for the industry and Hayward. Current investor debate surrounds the outlook for 2022, notably risks that rising inventory levels at distributors like POOL could create an “air pocket” of demand that results in slower revenue growth next year. Our view is that these concerns are overstated, with POOL executives noting that dollar inventory values increased due to cost inflation while days of inventory have actually decreased.

Given this risk-reward skew, we’ve opted to make Hayward a “starter position” in Opportunities, weighting our position at about half the size we’d normally take for a new holding.

Adding power to DNN, NXE, and CARG

Our decision to keep the new Hayward position smaller than normal also allows us to deploy additional capital generated from our UPWK exit into three current Opportunities holdings — Denison Mines (DNN), NexGen Energy (NXE), and CarGurus (CARG).

Titan clients are well-aware of our team’s conviction in the outlook for uranium, and Denison and NexGen offer us ownership of what we consider best-in-class uranium miners. Appreciation in shares of both Denison and NexGen has made these the two largest positions in Opportunities and we believe the risk/reward profile for both names warrants additional capital at this time.

CarGurus has been a holding in Opportunities since inception, and we believe the story remains underappreciated by the market. The digitalization of the auto market has accelerated during the pandemic, and we believe CarGurus’ strong market position, coupled with the explosive growth of its CarOffer platform, is being overlooked by investors. Our current price target of $50/share by the end of 2023 implies an IRR of 18%, an attractive risk/reward opportunity.