Why we're bullish on Ethereum

Aug 12, 2021

Introducing Crypto Spotlights which outline the investment theses on our holdings.

Titan Crypto: Spotlights

Yesterday, we officially launched Titan Crypto, our actively managed portfolio of cryptoassets that we believe are positioned for outstanding long-term returns with minimal correlation to U.S. equities and with attractive hedging qualities.

For the next few days, we'll be sending a Crypto Spotlight outlining our investment thesis on a current portfolio holding. The goal is to give you a better sense for the types of cryptoassets that make it into this new portfolio.

To check out Titan Crypto, be sure to update your Titan mobile app in the Apple or Google Play store now.

Spotlight #1: Ethereum (ETH)

Thesis: Ethereum powers the world’s largest decentralized apps ecosystem. Its impressive fundamentals, coupled with long-term secular tailwinds and near-term catalysts, makes it our most bullish crypto investment at a 47.5% weight.

When it comes to innovation, Ethereum is king. While Bitcoin was always meant to be a digital currency, Ethereum is the world's largest decentralized computing platform for running immutable, programmatic applications. These unique applications allow users to transact with each other peer-to-peer without the need to trust or know each other (or owner of the application), because rules and conditions are governed by smart contracts that sit on the Ethereum blockchain. These applications are essentially tamperproof, have no downtime, and cannot be censored because the blockchain is maintained by a large number of servers across the globe – impenetrable to attacks by any single malicious actor. Today, Ethereum hosts thousands of these applications, all powered by its native currency, Ether (ETH).

Ethereum has the greatest path-dependent network effect, achieved through years of growing pain and development.

Smart contracts are public on Ethereum and can be thought of as open API or “lego pieces.” The ecosystem builds upon itself due to Ethereum's open-source nature and streamlined standards. Protocols and applications can easily plug into each other, combining to create something entirely new. The result of this inherent synergy is an unbeatable network effect in line with Metcalfe's law.

Ethereum currently accounts for ~80-90% developer mindshare within the crypto ecosystem. It will take a long time for other competing smart contract platforms to build up a similar level of network effects around liquidity, usage, developers, community, and infrastructure.

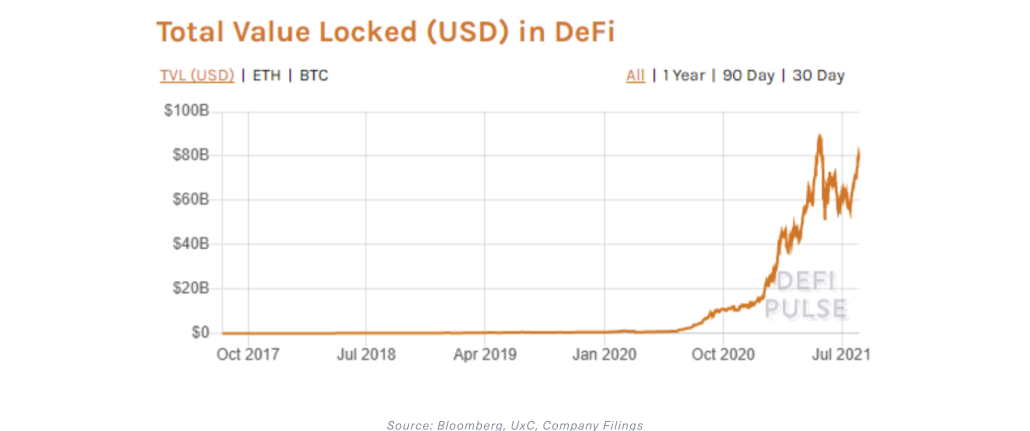

Ethereum powers the most established ecosystem of Decentralized Finance (DeFi) – the first real product-market fit in crypto.

DeFi recreates traditional financial systems with automation in place of middlemen. These applications let users trade, exchange, lend to earn interest, or borrow without an identity, credit score, or a bank – all from the comforts of their crypto wallets and web browser. Etherem’s DeFi ecosystem has garnered significant first-mover advantage and network effect, with now ~$80Bn worth of assets, up ~1,580% since one year ago. Of the top 100 DeFi projects, more than 80-90 are built on Ethereum.

Despite this momentum, the DeFi movement is still in its very early stages. The space offers an unprecedented level of financial innovation that traditional fintech has been unable to provide due to legacy constraints. There is huge untapped demand, and an application that satisfies customers’ needs can quickly reach a market cap size of several billion dollars in a matter of weeks. Going forward, we expect DeFi to continue to institutionalize with the user base evolving beyond crypto insiders to a much broader group that may well include much of the nearly two billion unbanked globally.

Ethereum’s long-term fundamentals strengthen by the day; the network utility continues to grow as new use cases and applications continue to be discovered.

DeFi is merely the financial part of a wide-ranging movement towards Web3 and the broader “self-ownership economy.” Over the past 6 months, there have been an explosion of non-DeFi use cases such as non fungible tokens (NFTs) and Decentralized Autonomous Organizations (DAOs). NFTs, for example, have found applications in arts, collectibles, gaming, voting, asset-backed tokenization, and more. We believe DeFi and Web3 will continue to grow, and more value will substantially accrue to Ethereum, the “value layer” of this next iteration of the internet.

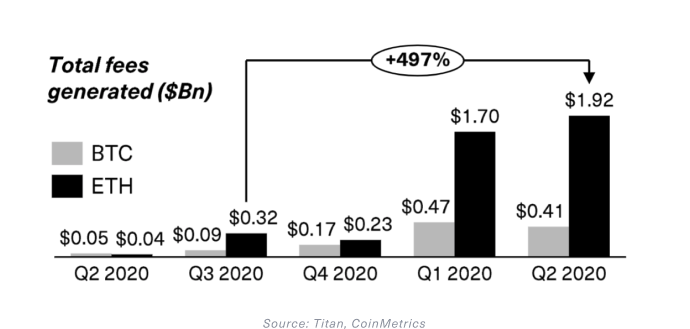

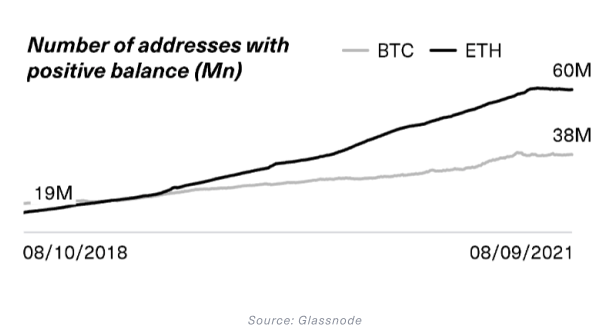

On-chain analysis reveals Ethereum is overtaking Bitcoin on key metrics.

Etherem has settled $2.5 trillion dollars (2.2x Bitcoin) in Q2 2021, and is on pace to settle $8 trillion dollars in 2021. On fees earnings, Ethereum recorded $1.9 billion dollars in Q2, up ~500% YoY and 4.6x higher than Bitcoin.

The number of addresses with a positive balance in Ethereum has outpaced Bitcoin since early 2019. The gap has continued to widen, with positive Ethereum balances in over 60 billion addresses today, up ~50% YoY over three-year span.

Investors’ conviction in Ethereum’s long-term fundamentals is at the highest level it has ever been, with now over 6 million ETHs staked in preparation for Ethereum 2.0.

Ethereum 2.0 is an ambitious multi-year upgrade plan to switch the blockchain from its current Proof-of-Work consensus algorithm to a Proof-of-Stake one. Phase 2.0 commenced end of 2020 with the launch of the Beacon Chain. The Beacon Chain brings staking to Ethereum, lays groundwork for the future upgrades, and may eventually coordinate the system.

Since launch, inflows of ETH into the Ethereum 2.0 deposit contract have grown considerably. There is now ~6.6 million ETHs (~21 billion dollars), over 13 times more than what was required to deploy Phase 2.0.

Ethereum is catalyst-rich, with recent and upcoming network upgrades significantly improving ETH’s monetary economics. The public at large is still unaware of the kind of impact and impending narrative shift these catalysts will have on ETH as a monetary asset.

For the rest of our memo on ETH and more, see our launch materials.

Reminder: Why invest in Crypto?

Growth Runway

- We believe the next big tech paradigm shift will be driven by crypto and blockchain technologies. The crypto space is experiencing an extraordinary level of software development and innovation, and has immense growth potential over the coming decade.

It's Still Early

- There are many signs suggesting that those who invest in crypto today are still “getting in” near the beginning. There is still a great deal of skepticism and disillusionment from the public at large: typical of any technology that is very early in its life cycle . Existing infrastructure is still too complicated and confusing for mainstream adoption. Even regulators are still debating on how to regulate the space.

Diversification

- Crypto is generally uncorrelated to the behavior of other asset classes, and could serve as a strategic allocation in portfolios. Extensive research has shown that a small allocation of cryptos would have consistently and significantly increased both the cumulative and risk-adjusted returns of a portfolio.

Update your app!

To check out Titan Crypto, be sure to update your Titan mobile app in the Apple or Google Play store now.

Onwards, The Titan investment team