A New Era Of VC

Sep 27, 2022

Innovation has powered economic growth over the last thirty years, benefiting investors who have backed waves of disruptive companies. Accordingly, venture capital (VC) has been one of the best performing asset classes in history. The top 25% of venture capital funds outperformed the Nasdaq by 23% from 2005 to 2018, according to an analysis by Morgan Stanley based on data from Cambridge Associates.[1] As returns soared, investors poured billions into the venture asset class, $128 billion[2] in the US alone during 2021.

The early years of venture capital were not easy. Initially called “adventure capital”, high-risk capital was the purview primarily of wealthy families. The American Research and Development Corporation (ARDC) was one of the first structured forays into venture capital.[3] As a public holding company, ARDC raised capital from investors and then backed technology startups capitalizing on WWII-era technological innovations. Its first major win was Digital Equipment Corporation (DEC), which returned $355 million on a $70,000 investment over 14 years. ARDC gave many venture capital legends their big starts.

In 1958, although the Small Business Investment Act paved the way for venture capital firms, investors overlooked Small Business Investment Companies in favor of more common limited partnerships. In 1979, changes to the “prudent-man rule” enabled pension funds to allocate up to 10% of their assets to venture capital, which increased the amount of capital in the ecosystem significantly.[4]

Early-pioneers, including William Henry Draper III, professionalized the industry, while legends like Arthur Rock of Venrock and Don Valentine of Sequoia popularized it. The post-WWII influx of technology researchers to Silicon Valley combined with the computer culture in the rebellious 1960s offered a fertile environment for startups in San Francisco. During the next few decades, computers, software, and the internet created powerful secular tailwinds for venture capital returns, with Microsoft, Apple and Genentech early winners.

In 1978, the venture capital industry raised $216 million[4], or ~$1 billion in 2022 dollars, less than several startups recently have raised in growth-stage rounds. Indeed, today many critics are asking whether too much venture capital is chasing too few sustainable opportunities?

Most Investors Are “Short” Venture Capital

According to ARK’s research, venture capital still is in early days for three reasons:

In 2021, the $128 billion invested in venture capital [5] represented only 0.12% of the capitalization of global public equity markets. [6] In our view, innovation is likely to disrupt and perhaps destroy many of the companies that make up the $105 trillion in global public equity market cap [7], ceding significant share to startups and venture capital.

According to our research, disruptive innovation will scale from $8 trillion in enterprise value to more than $200 trillion during the next decade. Startups and venture capitalists are likely to capture a significant share of that value creation.

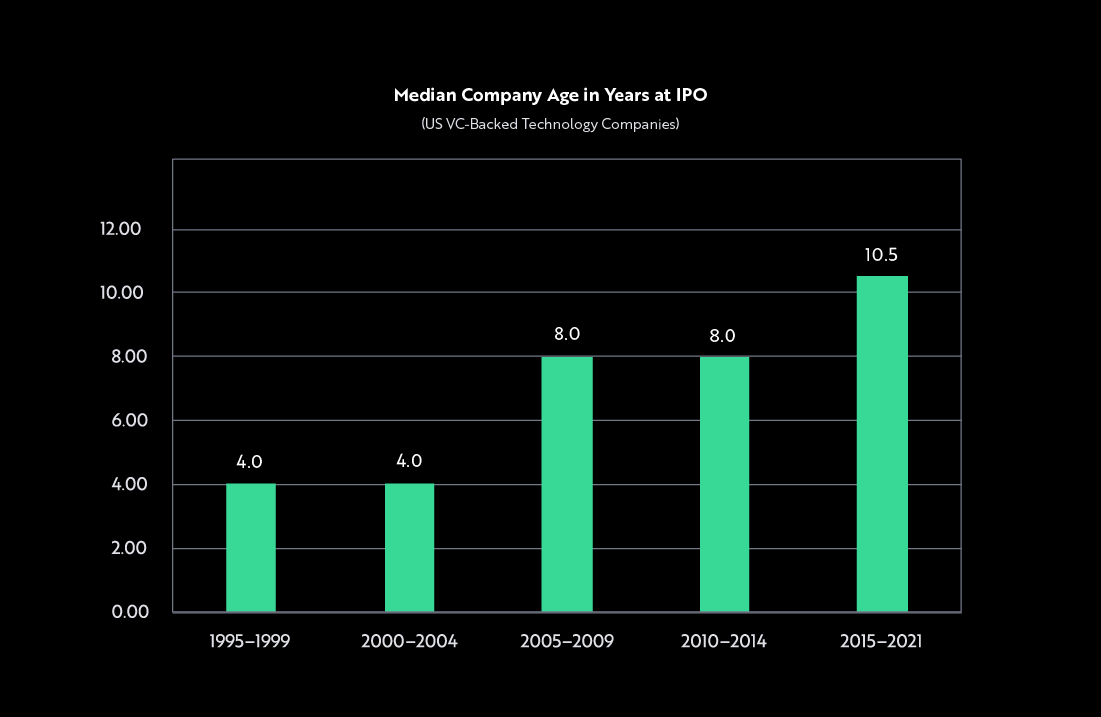

Because the tech and telecom bust in the early 2000s and the Global Financial Crisis in 2008-09 precipitated Sarbanes-Oxley and other regulations that have burdened public companies, startups are choosing to stay private longer than historically has been the case. Previously, many startups raised two to three rounds of venture capital and then went public at ~$100 million valuations. Today, startups like Stripe and SpaceX have raised many private rounds and have scaled to $100+ billion valuations, as shown below. Facilitating liquidity for employees and other shareholders, secondary markets have created even more capacity for venture capital.

Source: ARK Investment Management LLC, 2022 An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail investors.

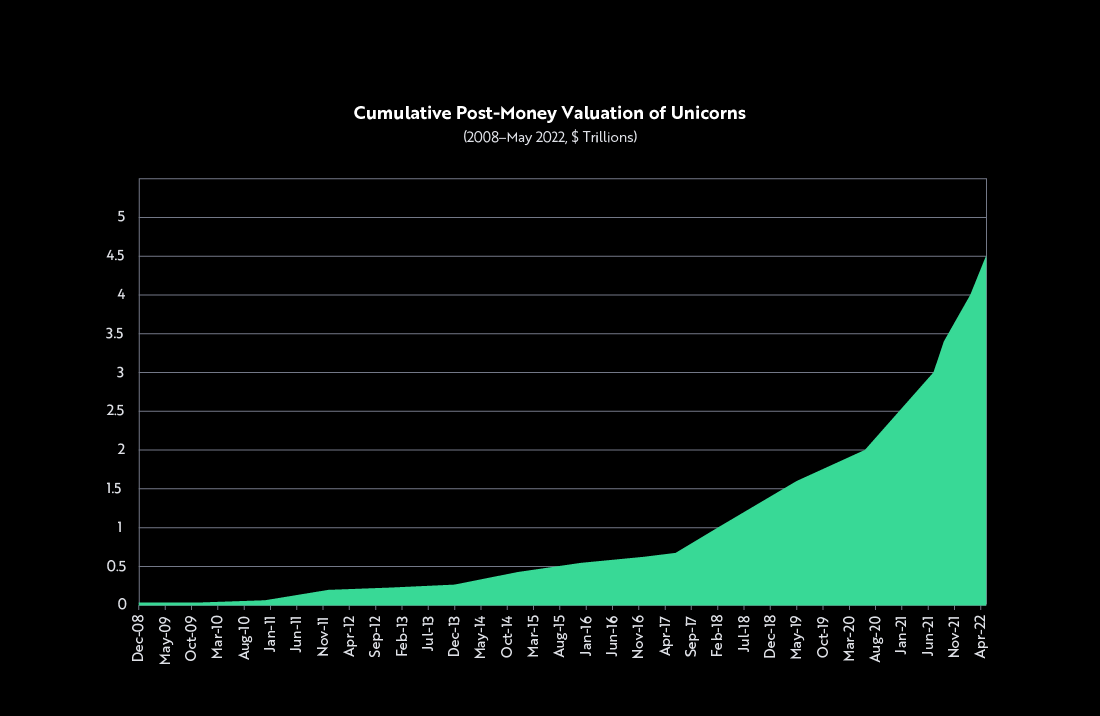

Source: ARK Investment Management LLC, 2022 In business, a unicorn is a privately held startup company valued at over US$1 billion. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures.

Traditional Venture Capital Models Are Ripe for Change

The two reasons we believe the traditional venture capital model is likely to change are: 1) limited access that favors wealthy individuals and institutional investors, and 2) “short-term” investment time horizons. Traditional venture capital funds cater to accredited or qualified investors who meet significant income and asset thresholds. Often, the minimum investment is $1 million+, and even wealthy individuals meeting the thresholds have trouble gaining access, locking most of the population out of an asset class that we believe will capture trillions in value over the coming decade. Registered investment advisors direct their retail investors to indexes populated increasingly by public companies that we believe are in harm’s way, while institutional investors have access to the disruptors. Moreover, venture capital faces multi-year lockups, precluding the participation of individuals who value liquidity.

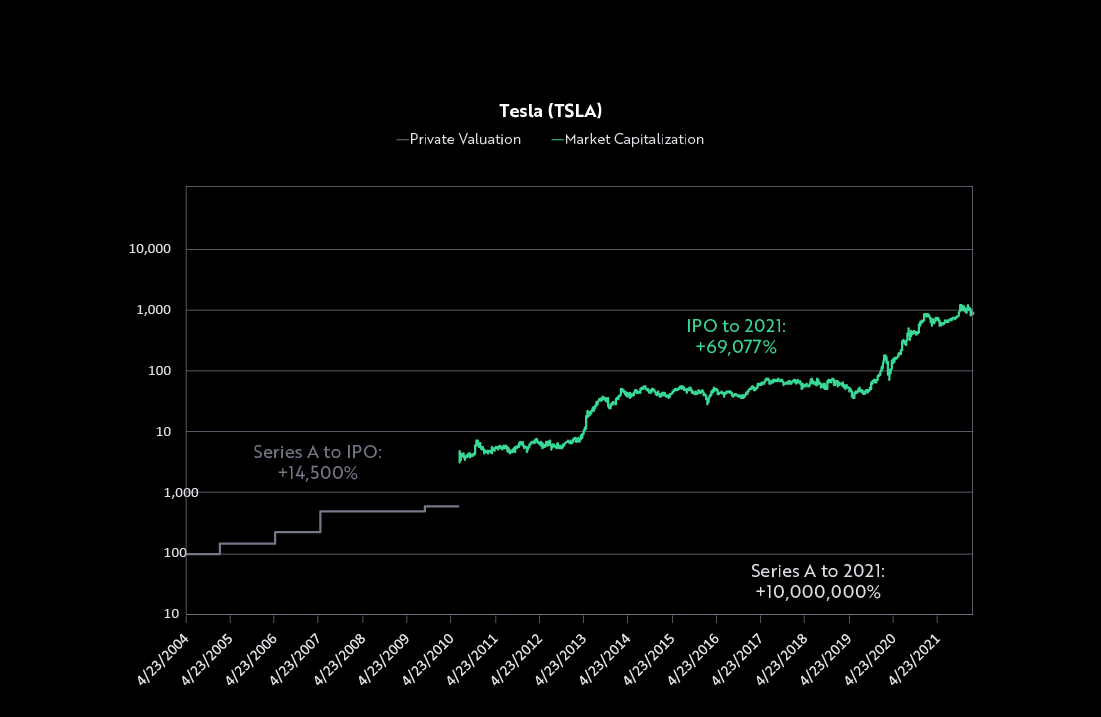

More often than not, VC funds also have to sell companies after they go public or at the end of fund lifecycles. Yet, we believe truly disruptive and innovative companies can generate exceptional returns from their startup days in private markets to their maturation in the public markets. Tesla [8], for example, generated a total return of greater than 10,000,000% from its early-stage Series A funding round in 2004 through 2021, as shown below. In our view, innovation creates moats, like network effects, that widen with scale. According to our research, thanks to artificial intelligence and its important role in the convergence among technologies, the most innovative companies in the world are likely to dominate large markets, generating outsized returns across their private and public market lifecycles.

Source: ARK Investment Management LLC, 2022 Forecasts are inherently limited and cannot be relied upon. Not a recommendation to buy, sell, or hold any particular security. Past performance is no guarantee of future results.

Occasionally, we surface significant valuation dislocations between the public and private markets. While many traditional venture capitalists have little choice but to invest in private markets and many public market investors have little opportunity to capitalize on the arbitrage opportunities in private markets, ARK aims to create an innovative investment solution.

The ARK Venture Fund Is Rethinking VC

ARK Invest focuses exclusively on technologically enabled disruptive innovation, not only in our research and investment strategies, but also our products and services. With actively managed, truly transparent equity ETFs, we disrupted the public equity market. Now we seek to disrupt venture capital with the ARK Venture Fund.

The ARK Venture Fund is an actively managed, evergreen, crossover fund that invests not only in public and private companies focused on technologically enabled innovation but also, selectively, in other venture capital funds. Importantly, we aim to democratize venture capital, enabling any investor with a minimum of $500 to invest in private and public companies that we believe are going to change the way the world works, without encountering qualification or accreditation thresholds. In addition, the Fund offers liquidity up to 5% of NAV (net asset value) on a quarterly basis.

Unlike traditional venture funds, the ARK Venture Fund does not charge carried interest. We believe that, long term, our 2.75% management fee will be more cost-effective than a fee structure that charges ”2 and 20” (2% management fee, 20% carried interest). Read our full paper on fees.

The ARK Venture Fund’s investment mandate is similar to our flagship ETF, ARKK, but expands the opportunity set into the private markets. Like our public equity strategies, our top-down and bottom-up research is the lens through which we screen and select investments. We believe our differentiated value proposition combined with our network of co-investors, public companies, founders, and academics offers access to the most promising private technology companies.

You can learn more about the ARK Venture Fund at ark-ventures.com and you can see all risks in the prospectus.

Disclosures & Footnotes

1. According to Morgan Stanley Analysis as of October 26, 2021.

2. According to Pitchbook, January 19, 2022. https://pitchbook.com/news/articles/2021-record-year-us-venture-capital-six-charts

3. Source: https://ventureforward.org/education/history-101/

4. According to The Rise and Fall of Venture Capital, 1994. https://thebhc.org/sites/default/files/beh/BEHprint/v023n2/p0001-p0026.pdf

5. According to True Bridge Capital Partners, June 14, 2022.

6. https://www.forbes.com/sites/truebridge/2022/06/14/state-of-vc-2021-breaking-every-record/?sh=2b6e835b5fbe

7. According to ARK Invest, 2022.According to Statista, June 2022.

8. https://www.statista.com/statistics/274490/global-value-of-share-holdings-since-2000/To

View the full portfolio, click here: https://ark-ventures.com/portfolio/

You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this presentation. Past performance is not a guarantee of future results.

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing. An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

The principal risks of investing in the ARK Venture Fund include: Equity Securities Risk. The value of the equity securities the ARK Venture Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme. Information Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Fintech Innovation Companies may not be able to capitalize on their disruptive technologies if they face political and/or legal attacks from competitors, industry groups or local and national governments. A Fintech Innovation Company may not currently derive any revenue, and there is no assurance that such company will derive any revenue from innovative technologies in the future. Cryptocurrency Risk. Cryptocurrencies (also referred to as “virtual currencies” and “digital currencies”) are digital assets designed to act as a medium of exchange. Cryptocurrency is an emerging asset class. There are thousands of cryptocurrencies, the most well-known of which is bitcoin. The Fund may have exposure to cryptocurrencies, such as bitcoin indirectly through an investment in the Bitcoin Investment Trust (“GBTC”), a privately offered, open-end investment vehicle that invests in bitcoin. Leverage Risk. The use of leverage can create risks. Leverage can increase market exposure, increase volatility in the Fund, magnify investment risks, and cause losses to be realized more quickly. New Fund Risk. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board may determine to liquidate the Fund if it determines that liquidation is in the best interest of shareholders. Non-Diversification Risk. The Fund is classified as a “non-diversified” investment company under the 1940 Act. Therefore, the Fund may invest a relatively higher percentage of its assets in a relatively smaller number of issuers or may invest a larger proportion of its assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on the Fund’s NAV and may make the Fund more volatile than more diversified funds. Communications Sector Risk. The Fund will be more affected by the performance of the communications sector than a fund with less exposure to such sector. Cyber Security Risk. As the use of Internet technology has become more prevalent in the course of business, funds have become more susceptible to potential operational risks through breaches in cyber security. Future Expected Genomic Business Risk. The Adviser may invest some of the Fund’s assets in Genomics Revolution Companies that do not currently derive a substantial portion of their current revenues from genomic-focused businesses and there is no assurance that any company will do so in the future, which may adversely affect the ability of the Fund to achieve its investment objective. Privately Held Company Risk. The strategy invests in privately held companies. Investments in privately held companies involve a number of significant risks, including the following: these companies may have limited financial resources and may be unable to meet their obligations, which may be accompanied by a deterioration in the value of any collateral; they typically have shorter operating histories, narrower product lines and smaller market shares than larger businesses, which tend to render them more vulnerable to competitors’ actions and market conditions, as well as general economic downturns; they typically depend on the management talents and efforts of a small group of persons; there is generally little public information about these companies and these companies and their financial information are not subject to the Securities Exchange Act and other regulations that govern public companies, and there may be an inability to uncover all material information about these companies; they generally have less predictable operating results and may require substantial additional capital to support their operations, finance expansion or maintain their competitive position; changes in laws and regulations, as well as their interpretations, may adversely affect their business, financial structure or prospects; and; they may have difficulty accessing the capital markets to meet future capital needs.

ARK Investment Management LLC is the investment adviser to the ARK Venture Fund.

Foreside Fund Services, LLC, distributor.