Three Things (1/24)

Jan 31, 2025

Just a meme and/or a dream

Crypto’s coronated council

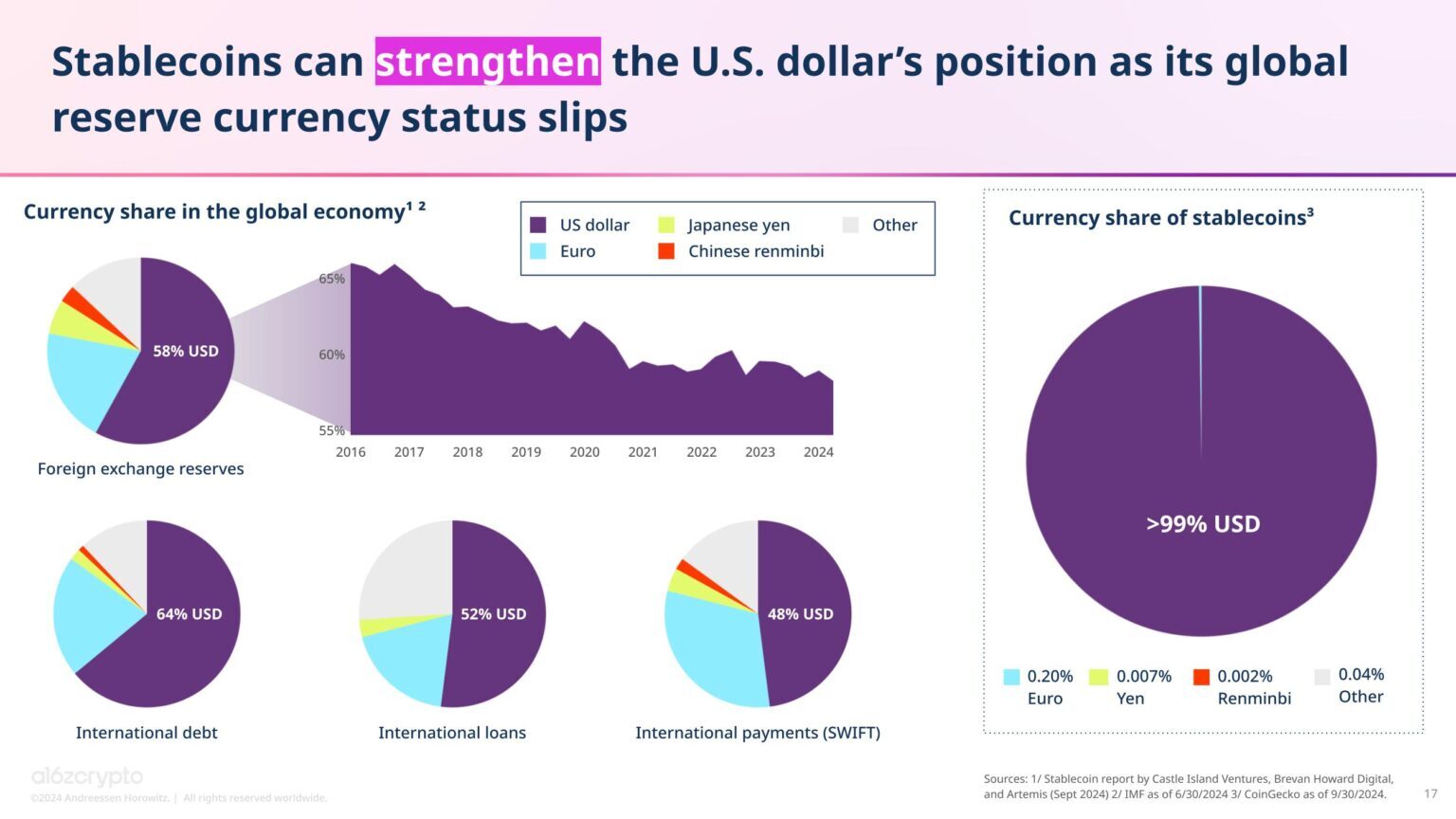

Developing story … On Thursday, President Trump announced the formation of a new federal cryptocurrency working group. According to the executive action, the directive outlines a plan to solidify American leadership in digital financial technology, setting the stage for greater oversight of the burgeoning blockchain and cryptocurrency industry.

The working group includes representatives from the Treasury Department, the Fed, and the SEC, as well as leading voices from academia and the tech sector. Their mission? To create a comprehensive framework for the regulation of cryptocurrencies, stablecoins, and blockchain-based financial systems. The group will also explore the feasibility of a U.S. central bank digital currency.

This chart reflects the perspective of a16z Crypto as of Oct. 2024.

This news comes amid heightened scrutiny of Trump from the crypto sector itself, fueled by criticism of Trump’s pre-inaugural promotion of the $TRUMP meme coin. (His pastor has launched one, too.) Some crypto purists believe the stunt undermined the credibility of the crypto industry and possibly skirted ethical and legal standards. While Trump supporters praised the move as innovative, critics fear it blurs the line between politics and financial markets.

The implications are significant. Clearer guidelines could bring legitimacy to blockchain innovation in the U.S., attracting investment and driving adoption. However, heavy-handed regulation might stifle smaller players in the market. BTC rose briefly on the news before falling back to pre-announcement levels.

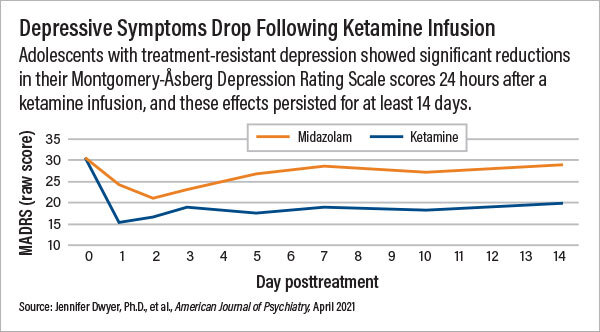

Ketamine spray approved

FDA OK … A nasal spray developed by Johnson & Johnson (JNJ) has received FDA approval as a standalone treatment for adults with treatment-resistant depression (TRD). The spray, marketed as Spravato®, builds on the antidepressant potential of ketamine, a compound initially developed as an anesthetic in the 1960s.

This latest development means that Spravato can be used without pairing it with oral antidepressants, marking a pivotal expansion of treatment options. JNJ made a cool $1 billion from Spravato in 2024—without the increased access that comes with its approval as a standalone offering.

Ketamine’s use in depression research began in 2000 when early studies revealed its rapid antidepressant effects, especially for individuals unresponsive to traditional therapies. By 2019, J&J secured FDA approval for Spravato, but only as an adjunctive therapy.

This new approval is significant, as roughly 7 million Americans suffer from TRD, a significant subset of the 21 million adults experiencing major depressive disorder annually. It also signals a growing market for innovative mental health solutions. While J&J expects to see continued revenue growth from Spravato, the move could also invigorate biotech research into new treatment modalities.

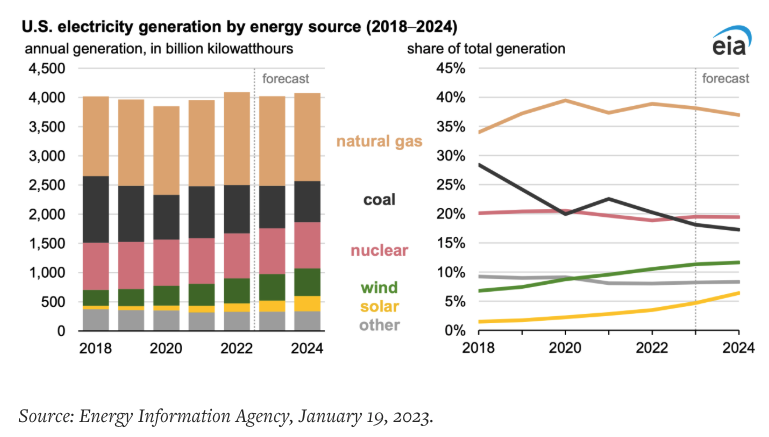

Trump shouts into the wind

Clean clash … President Donald Trump has issued an executive order halting all new federal approvals for wind energy projects. The directive suspends offshore wind leasing and mandates a comprehensive review of federal wind permitting, aiming to assess environmental and economic impacts. Trump’s move seeks to favor fossil fuel development, despite wind being one of the cheapest and fastest-growing sources of energy per some reports.

Trump has long criticized wind power, citing aesthetic concerns and potential harm to wildlife. He has also questioned its reliability, though industry data shows wind accounts for about 11% of U.S. electricity generation, a sharp increase from just 2% in 2010.

Jason Grumet, CEO of the American Clean Power Association, told one reporter that he predicts the executive order could impact “more than half” of all wind projects under development in the U.S.

The wind power industry employs over 125,000 American workers and has drawn billions in investments. (The Inflation Reduction Act of 2022 pumped nearly $150 billion into clean energy manufacturing across the U.S., with a big chunk of that supporting wind energy projects.)

While Trump’s order pauses clean energy momentum, its long-term impact remains unclear. For relevant clean energy players, the executive order was largely priced in. NextEra Energy (NEE) stock is down 3% YTD but has been relatively flat since the executive order was issued. The company reports Q4 earnings today. GE Vernova (GEV), a wind turbine manufacturer, reported strong earnings this week. Its share price is up 29% so far in 2025.

One more thing: OpenAI just announced “Operator,” an AI assistant that can handle tasks like making to-do lists or helping plan vacations by interacting with web pages (on their own!). Currently available to ChatGPT Pro users in the U.S., Operator can click buttons, fill out forms, and navigate websites to get things done.

Disclosures

As of writing, IBIT is a holding in Titan's Crypto strategy. OpenAI is a 4.24% position in the ARK Venture Fund.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.