Join us for our first Summit Series live event, February 11th NYC

Titan Crypto: ETH Launch

Oct 1, 2024

We've added Ethereum back to Titan Crypto.

Today we are excited to announce that we have added Ethereum to our Titan Crypto strategy’s portfolio via the professionally managed iShares Ethereum Trust ETF (ticker ETHA).

Titan Crypto is now an equal-weighted strategy with exposure to Bitcoin and Ethereum (via the iShares ETFs for each of those two cryptocurrencies), evaluated for rebalance quarterly. We also are prepared to take advantage of tactical tax-loss harvesting opportunities within Titan Crypto when we believe it’s in your best interest.

For context: you may remember that up until mid-February 2024, Titan Crypto included both BTC and ETH holdings. However, in mid-February, we chose to move away from our prior crypto execution provider and invest our clients in crypto ETFs (for both lower risk and lower costs) instead of the individual cryptocurrencies directly. At the time, only Bitcoin had a spot ETF approved and launched on the market. But on July 23, 2024, that changed with the approval and launch of spot Ethereum ETFs, which led us to revisit the question: should Ethereum be a part of Titan Crypto via these new ETFs?

After patiently waiting for Ethereum ETFs to gain traction as we conducted our diligence on them over the past few months, we have decided the answer is yes. Below I’ll give some context for this addition of Ethereum back to Titan Crypto broadly and the choice of spot Ethereum ETF specifically.

Why Add Ethereum to Titan Crypto?

We believe adding exposure to Ethereum (ETH) back to Titan Crypto (this time via an ETF) provides our clients with more diversified, balanced, and contrarian crypto exposure than Bitcoin (BTC) only.

More Diversified Exposure to Crypto

Bitcoin and Ethereum have historically made up 60-80% of the global crypto market, and each has unique use cases and value drivers:

We think of Bitcoin primarily as a store of value (“digital gold”)

Today, it is one of the only ways to store digital wealth without relying on a centralized entity like a bank

To frame the potential upside of Bitcoin as “digital gold,” gold’s global market cap today is ~$18 trillion while Bitcoin’s is only ~$1.3 trillion.

We see Ethereum, on the other hand, as bringing crypto into the real world

It is the leading “smart contract” platform powering applications across decentralized finance (DeFi), stablecoins, non-fungible tokens (NFTs) and more

Unlike Bitcoin, Ethereum’s value is driven directly by the use of the Ethereum blockchain

With so much of the global crypto market cap being made up by Bitcoin and Ethereum, and with their unique strengths and use cases, we believe both deserve a place in the Titan Crypto strategy.

Balanced Weightings

While both Bitcoin and Ethereum have strong track records and unique investment characteristics, neither’s future is certain. We believe an equal-weighted strategy gives our clients balanced exposure to both themes in crypto while avoiding having to pick a winner. By rebalancing to 50/50 weightings on a quarterly basis, we aim to keep their relative exposures in check as the crypto market evolves.

It’s also worth noting: since we are investing in Bitcoin and Ethereum via ETFs, and since there are now multiple ETFs available for each of these crypto assets, it is possible to implement tax-loss harvesting within Titan Crypto when opportunities arise. For example, if Bitcoin has fallen materially in price such that an unrealized loss is created, we are able to sell the iShares Bitcoin ETF and replace it with another low-cost Bitcoin ETF from another issuer, capturing that tax loss for the benefit of applicable Titan Crypto clients. We are prepared to take advantage of these tactical tax-loss harvesting opportunities when we believe it’s in your best interest.

A Contrarian Bet

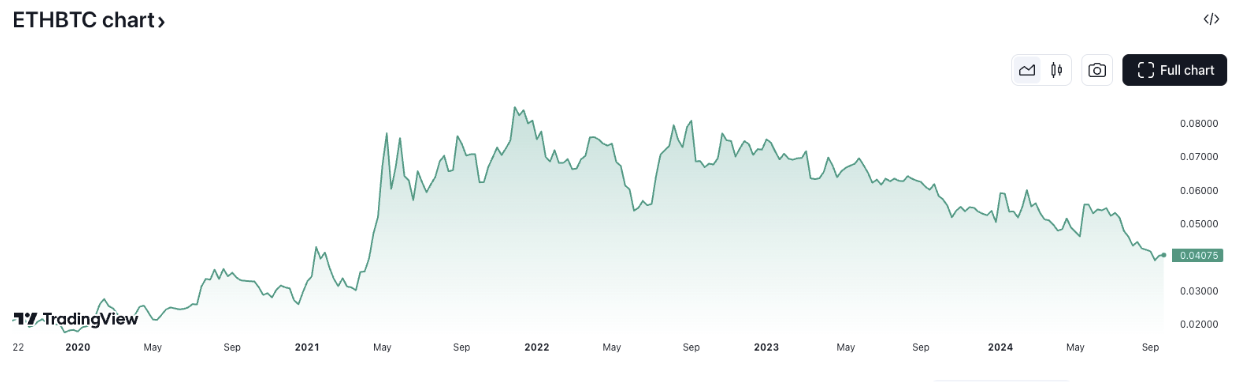

Ethereum is currently very out of favor in the investor community. As of this writing, Ethereum is only up +13% YTD while Bitcoin is up +50%. And looking back over a longer period, the ETH/BTC ratio (which compares the price of Ethereum to Bitcoin) recently hit its lowest level in three years.

Source: TradingView.com

Why? The reasons for ETH’s relative underperformance include its additional regulatory risk (at least compared to Bitcoin), lackluster adoption of Ethereum ETFs thus far (again, at least compared to Bitcoin), and competition from newer blockchains like Solana.

However, we don’t believe any of these overhangs will persist forever. In fact, the upcoming election may actually clear some of them if we get regulatory clarity or additional adoption of ETH ETFs from institutional investors and advisors as risk appetite re-emerges amidst the start of the Fed’s rate cut regime. If and when the overhangs begin to clear, we believe ETH could see meaningful absolute and relative upside from here.

Why the iShares Ethereum ETF vs. Other ETH ETFs?

We chose iShares Ethereum Trust (ETHA) after careful due diligence of 8 different spot Ethereum ETFs for a few reasons:

Cost - It's currently one of the lowest cost spot Ethereum ETFs in the market. ETHA has only 0.12%* expense ratio for the first $2.5B AUM into the ETF during the first 12 months from its launch (which was July 23, 2024); then 0.25% thereafter. Other spot Ethereum ETFs we analyzed have long-term expense ratios in the 0.15-0.25% range, but with far lower liquidity/organic AUM growth profiles than ETHA thus far (see our next point).

Liquidity - It is the most liquid spot Ethereum ETF in the market as of this writing, with $35M daily volume on an average 20-day volume basis (vs. other ETFs with $1M-26M). Liquidity matters because it is what allows us to trade in and out of the market for clients as quickly as possible, with the best execution and least price impact possible.

Brand - iShares is a collection of ETFs managed by BlackRock, one of the largest asset managers in the world. iShares’ longevity and credibility in the ETF space gives us the peace of mind that the ETF likely can not only endure for many years, but also gain the adoption of institutional investors and financial advisors looking to add Ethereum exposure to their clients’ portfolios (which, as a consequence, might further catalyze price appreciation for Ethereum over time as growing demand meets limited supply).

If you have any questions, please do not hesitate to reach out to us directly, or set up a call with our Investor Relations team.

Disclosures:

*Please note that if ETHA exceeds $2.5B in assets prior to the end of the 12-month period, the fee charged on assets over the threshold will be 0.25%. All investors will incur the same fee, calculated as a weighted average of these fee rates.

Advisory services are provided by Titan Global Capital Management USA LLC ("Titan"), an SEC registered investment adviser. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Brokerage services are provided to Titan Advisory Clients by Titan Global Technologies LLC (“TGT”) and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. Both Titan and TGT are subsidiaries of Titan Global Capital Management, Inc. Contact Titan at support@titan.com. Please read the prospectus for each Crypto ETF included in Titan Crypto before investing.

Tax-loss harvesting. The impact on an investor’s tax liability depends on their entire tax and investment circumstances, including but not limited to their income, state of residence, the purchases and dispositions of assets in the investor’s accounts outside of Titan, type of investment accounts held, and applicable investment holding periods. Titan is not a tax advisor, and you are responsible, with your tax professional, for reporting transactions to the IRS or any tax authority. Titan assumes no responsibility for the tax consequences of any tax-loss harvesting transactions.

Investments with exposure to crypto assets, including Crypto ETFs, are only suitable for investors who are willing to bear the risk of extreme volatility and substantial losses, including the potential for sharp drawdowns as they still carry inherent risk associated with cryptocurrencies. Extreme volatility in the future, including further declines in the trading prices of bitcoin and ether, could have a material adverse effect on the value of the Crypto ETF shares and the shares could lose all or substantially all of their value. Such investments may be negatively impacted by market events, including liquidity issues, bankruptcies, and heightened regulatory scrutiny. You are solely responsible for evaluating the merits and risks before making any investment decisions, including consideration of any information, materials, or third-party content provided.

Trade communications are meant for informational purposes only. Statements made in these communications represent opinions and conjecture, and should not be construed as a guarantee of future results. Communications may contain forward-looking statements, which reflect our current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. References to specific security or crypto performances are provided for historical context and are not indicative of future results. Please note that any mention of Titan Crypto gains or losses in our trade communications reflects those at the strategy level. Actual gains or losses realized in individual client accounts may vary based on factors such as the timing of individual trades, new or recurring deposits, and the specific cost basis for each holding in a client's account. As such, the figures presented may not represent the actual gains or losses experienced by any individual client. Valuation assessments in our communications are based on internal analysis and are for informational purposes only. They should not be the sole basis for investment decisions and may differ from others' views or assessments. No warranty is made regarding their accuracy or completeness.

Investments in securities are: Not FDIC Insured • Not Bank Guaranteed. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. There is always the potential of losing money. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. The rate of return on investments can vary widely over time, especially for long term investments. Past performance is no guarantee of future results. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or investment products.