Google: A Compelling Risk/Reward?

Jun 3, 2019

Some investors consider GOOG to be one of the most compelling risk/reward opportunities on the market today.

Alphabet (GOOG) fell -6% on Monday on the news that the U.S. Department of Justice (DOJ) is preparing an investigation of Google.

DOJ Investigation##

There is no case against Google yet; there isn't even an investigation. However, it's worth understanding why the DOJ is potentially going after Google, and how the stock is valued on a risk/reward basis here.

We love this thought from Stratechery's Ben Thompson:

"Tech companies gain market power, at least in the beginning, by offering a superior solution. They leverage that advantage into market dominance through network effects. And only then, when they have picked all of the low-hanging fruit in their market, do tech companies start to leverage their size into adjacent markets, which is what triggers antitrust scrutiny."

Why DOJ Is Concerned##

The DOJ is primarily concerned with Google's search business and its Android operating system business:

- Both of these segments have tremendous market share (well over 50% depending on how you cut their "addressable markets" in different geographic regions).

- The DOJ is digging into whether such high market share is preventing adequate competition and thus hurting consumers' best interests.

It's too early to tell if an investigation will actually happen, and if it does, what the result could be. But we think the valuation is already baking in a lot of this risk.

GOOG at its Lowest Valuation in Years##

Here's a chart of GOOG's stock recently:

Source: Sentieo

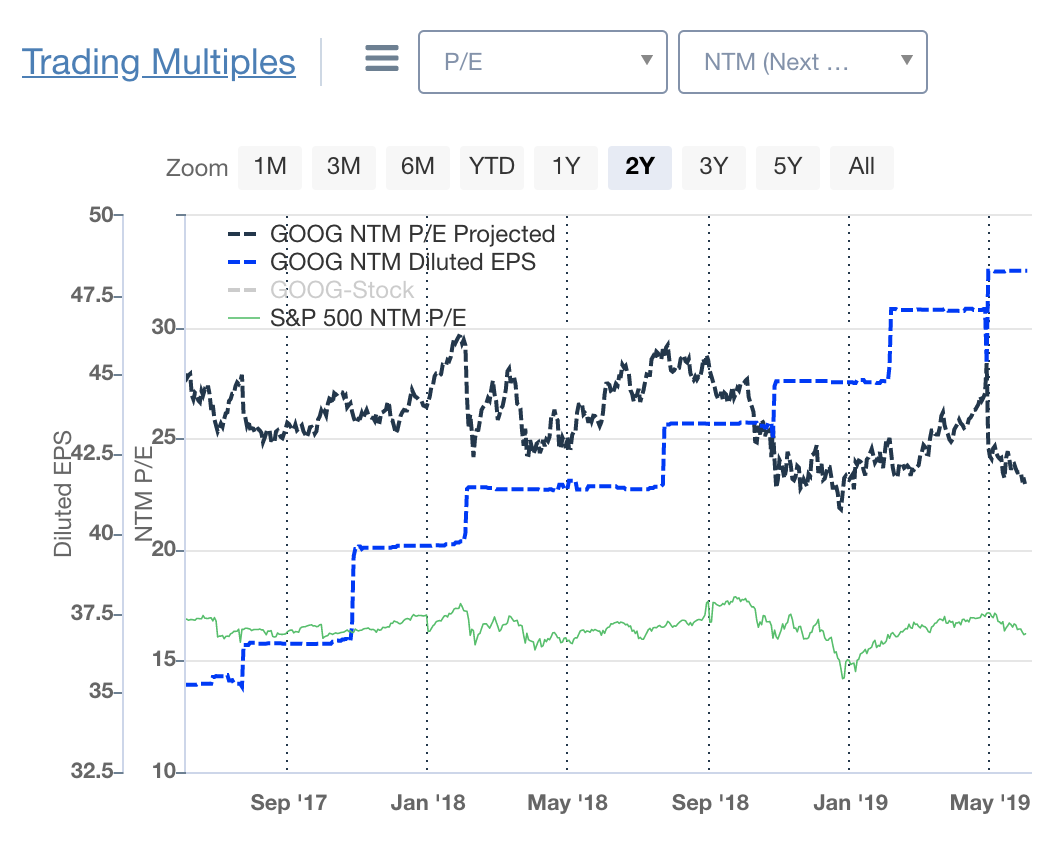

Its valuation has fallen to the lowest level in 2 years, despite revenue and earnings continuing to grow +15-20% annually (more than 2x faster than the S&P 500):

Source: Sentieo

You're now being offered GOOG stock at less than 12x 2019 P/E compared to the S&P 500 at ~16x 2019 P/E (!). We're hearing a number of sharp long-term investors calling the stock a "no-brainer" at these levels.

Alphabet has three businesses inside the company (YouTube, Google Cloud Platform, and Waymo) which are potentially worth a lot more than is reflected in the stock price given the secular trends + growth rates + leading technology position of each relative to the contribution profit that each is making to Alphabet P&L today.

It's not clear how any of these businesses would come under DOJ antitrust review either (versus Android). We doubt any of them will anytime soon.

Stepping Back##

- We think it's hard to find any other company with so many large valuable technology platforms that are scaling in massive global industries.

- While each of these businesses certainly benefit from being part of Alphabet, they should each eventually be able to stand on their own as separate entities--or at a minimum, could be broken out a la AWS to highlight the value and growth.

- YouTube is particularly interesting here because there is almost nothing to get in the way of its continued growth over the next 10 years in terms of hours viewed/better monetization around the world -- as long as Google can manage the regulatory concerns of being a global user-generated content platform.