Three Things (12/6)

Dec 6, 2024

Inside the SEC’s pro-crypto pivot

Gensler out, Atkins in

Chair change … President-elect Donald Trump announced the nomination of Paul Atkins, a pro-cryptocurrency advocate, as the next chair of the Securities and Exchange Commission. This decision marks a clear pivot from the agency’s recent leadership under Gary Gensler, known for his stringent crypto enforcement.

Atkins, a former SEC commissioner and CEO of Patomak Partners, has long championed free-market principles and innovation. As chair, he is expected to bring a lenient regulatory approach, focusing on transparency and reducing red tape in the digital assets space. Congressman Patrick McHenry expressed confidence in Atkins, calling him a leader who could “restore faith in the SEC” and promote clarity for digital assets.

In contrast, critics like Congressman Brad Sherman fear Atkins’ approach may lead to lax oversight, potentially exposing investors to fraud. Still, the crypto community is optimistic, with Coinbase’s legal officer praising Atkins’ balanced perspective.

Image via PixelPlex

The SEC plays a vital role in U.S. financial markets, overseeing securities, enforcing regulations, and protecting investors. Under Gensler, the SEC adopted a rigorous stance on cryptocurrencies, classifying many as securities and filing lawsuits against major platforms like Binance and Coinbase.

In other news, Bitcoin reached a record high of $100,000 this week, boosted by renewed investor optimism following the incoming administration’s promises of crypto-friendly policies.

Benioff bets big on AI

Earnings recap … Salesforce’s (CRM) latest earnings reveal a mixed performance but shine a spotlight on its ambitious AI-driven future. The company reported Q3 revenue of $9.44 billion, surpassing Wall Street’s estimate of $9.34 billion, but missed on earnings per share at $2.41 versus the $2.44 forecast. Despite this, shares surged 10% as investors rallied around Salesforce’s AI initiatives.

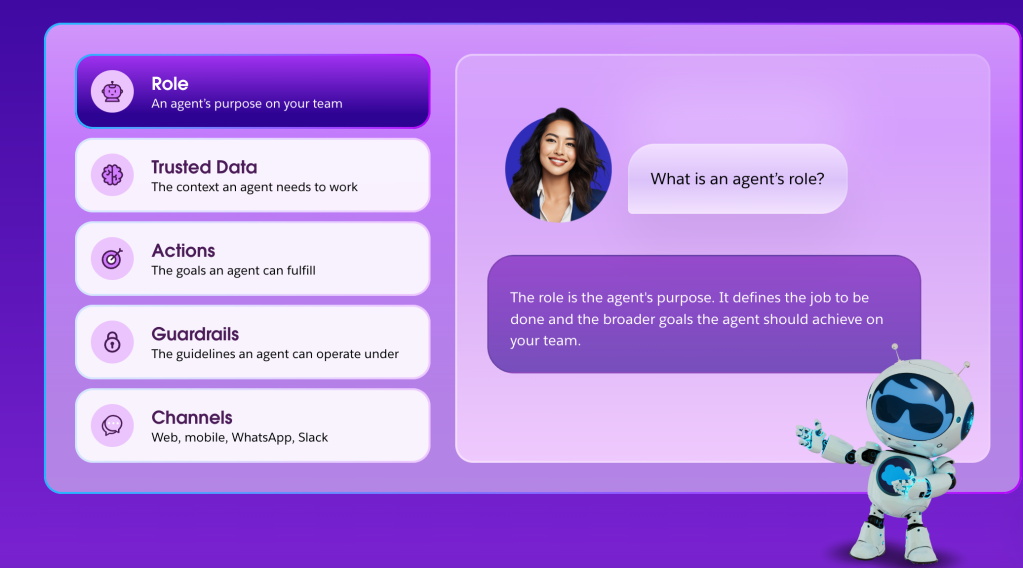

At the heart of the buzz is Agentforce, the company’s new platform featuring autonomous digital agents. CEO Marc Benioff described this as a pivotal moment in technology, likening the rise of AI to a “revolutionary transformation.” Agentforce, introduced just days before quarter-end, has already secured 200 deals, with thousands more in the pipeline.

Benioff envisions AI agents complementing human efforts by handling repetitive tasks with speed and efficiency. “We’re fundamentally reshaping how businesses operate,” he emphasized, hinting at a future where AI could extend to robotic automation layers. Analysts are optimistic; Wedbush raised its price target to $425, citing Agentforce as a potential growth catalyst.

Still, skeptics question the pace of AI monetization. Salesforce’s cautious Q4 guidance, slightly below consensus, tempered some enthusiasm. Salesforce’s challenge now lies in delivering on Agentforce’s potential while navigating Wall Street’s heightened expectations.

Record travel fuels airlines

Winners and losers … Airline stocks soared this week after key players upgraded their fourth-quarter guidance, citing robust holiday travel demand and strategic improvements. American Airlines (AAL) and Southwest Airlines (LUV) both reported stronger-than-expected revenue, lifting investor confidence. American anticipates up to 1% growth in revenue per available seat mile (RASM), reversing prior projections of a decline. Meanwhile, Southwest boosted its outlook to a 7% increase in unit revenue, thanks to network optimization and capacity tweaks.

These updates cap a strong year for the sector, in aggregate. The U.S. Global JETS ETF is up over 35% in 2024, with United Airlines leading the S&P 500 with a staggering 157% gain.

However, not all airlines are flying high. Spirit Airlines (SAVE), still reeling from a blocked merger and pilot shortages, filed for bankruptcy last month. Chief Commercial Officer Matthew Klein claimed legacy carriers are “gunning for us,” accusing competitors of exacerbating pilot shortages and gate restrictions.

This week in Washington, airline executives clashed with senators over so-called “junk fees.” Critics labeled baggage and seat selection charges as a form of extortion, while airlines defended them as consumer choice. Frontier Airlines’ (ULCC) controversial “bounty bag” program drew ire, with senators demanding greater transparency in ticket pricing.

One more thing: Google DeepMind’s (GOOG) new AI weather model, GenCast, is outperforming the world’s most accurate forecasting systems, including predicting extreme events shaped by climate change. By leveraging machine learning, it delivers faster, probability-based projections up to 15 days into the future.

Disclosures:

As of writing, GOOGL is a holding in Titan's Flagship strategy.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.