Three Things (12/9)

Dec 9, 2024

Clock ticks on TikTok

TikTok faces U.S. deadline

Tech tension … A federal appeals court has upheld a law requiring ByteDance, TikTok’s China-based parent company, to divest the app or face a U.S. ban by January 19. Citing national security concerns, judges supported the law’s intent to block potential data access and content manipulation by the Chinese government. TikTok plans to appeal to the Supreme Court, asserting the law violates First Amendment rights.

TikTok’s explosive growth has redefined social media habits, especially with features like TikTok Shop. Launched in September 2023, TikTok Shop lets users buy items directly through the app, often marketed by influencers in live streams. This innovative approach combines entertainment with e-commerce—QVC on steroids—mimicking Instagram’s (META) shopping feature but amplifying sales via personalized algorithms and viral video culture. During Black Friday, TikTok Shop reportedly surpassed competitors like Shein and Temu (PDD) in U.S. spending, reflecting its impact on online shopping behavior.

While TikTok faces regulatory hurdles, ByteDance remains focused on its AI strategy. The company has aggressively recruited top AI engineers from Chinese rivals, becoming the largest buyer of Nvidia (NVDA) chips in Asia. ByteDance’s AI investments extend globally, powering projects like the Doubao chatbot in China and the Cici AI platform abroad. These advancements could solidify ByteDance’s influence in tech, even as TikTok’s future in the U.S. remains uncertain.

Mood shapes market

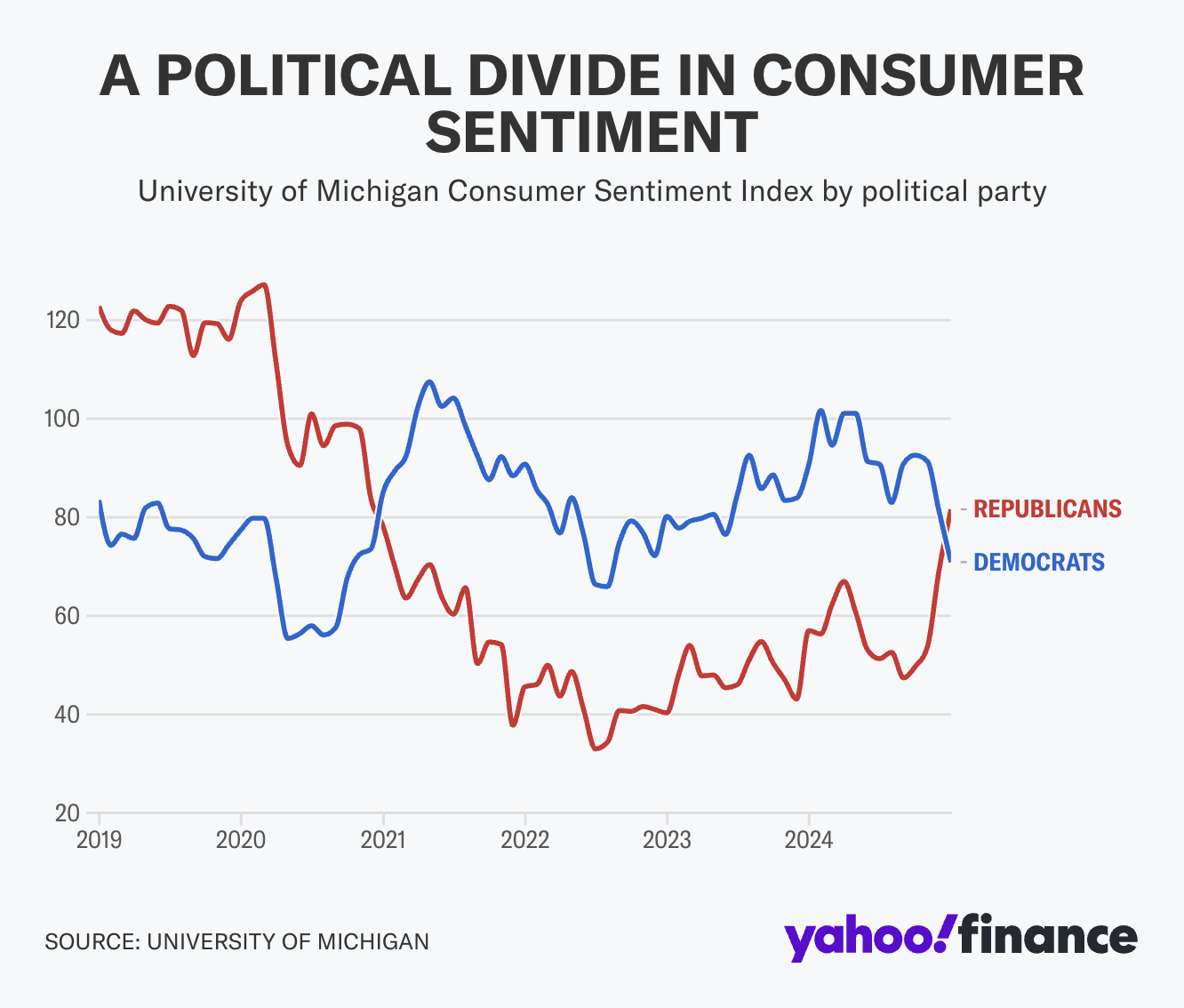

Vibe shift … The latest University of Michigan Consumer Sentiment Survey paints a polarized picture of economic optimism in the wake of Donald Trump’s election. Overall sentiment climbed to 74 in December, up from 71.8 in November. However, a deeper dive reveals sharp divisions across party lines. Republican optimism skyrocketed to 81.6, its highest since November 2020, while Democrat sentiment plummeted to 70.9, its lowest since September 2020.

The survey highlights Republicans’ belief that Trump’s presidency will curb inflation and boost the economy. Meanwhile, Democrats voice concerns that proposed policies, such as tariff hikes, could reignite inflation. Notably, future inflation expectations among all groups rose to 2.9%, the highest in six months, signaling apprehension about price stability.

Interestingly, consumers report improved buying conditions for big-ticket items, driven by expectations of future price hikes. “This rise in durables was primarily due to a perception that purchasing now would avoid future increases,” explained Joanne Hsu, director of the Michigan survey.

This divergence aligns with the broader concept of a “vibecession,” coined by economist Kyla Scanlon. Unlike traditional recessions defined by GDP contractions, a vibecession reflects how collective mood influences economic behaviors. When optimism reigns, spending surges; when worry dominates, growth slows—even without hard data backing either trend.

As the Federal Reserve eyes inflation expectations closely, the question remains: Can optimism alone steer the economy, or will reality catch up?

Private equity evolves

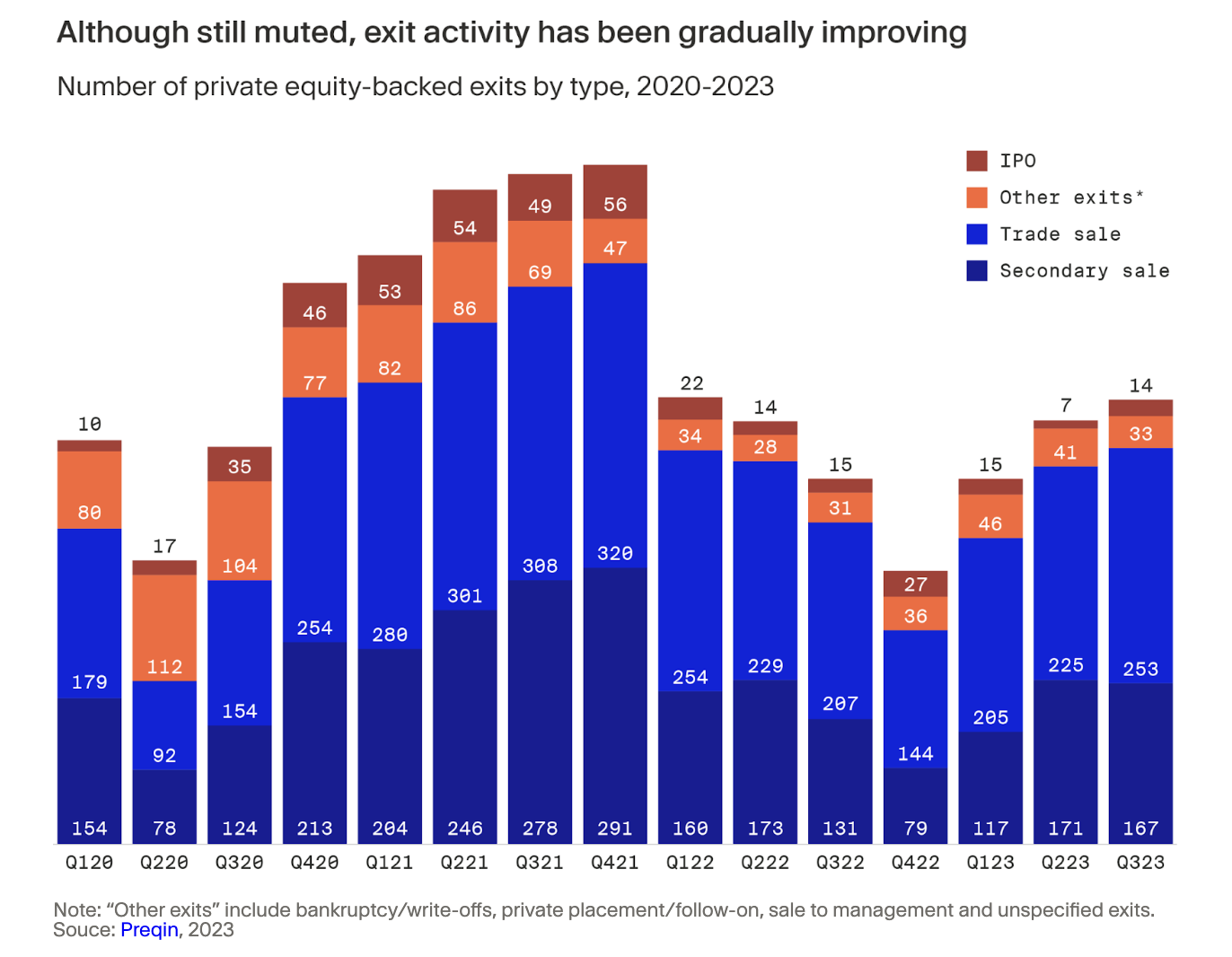

Before the bell … Private company employees and early investors are no longer waiting for an IPO to cash out. In a growing trend, startups are using tender offers—prearranged trades that allow employees to sell shares to investors—to provide liquidity. This year alone, private companies have sold over $6 billion in stock via tender offers, nearly double last year’s total.

Big names like SpaceX and Stripe are leading the charge, regularly offering employees the chance to sell stock, sometimes through direct facilitation and other times through platforms like EquityZen and Nasdaq Private Market. These deals not only let workers cash in but also allow companies to remain private longer, avoiding the costs and scrutiny of public markets. The number of private “unicorns” valued at over $1 billion has soared to 1,250 from just 47 a decade ago, according to data from CB Insights.

Image via Moonfare

Investment access is expanding too. Platforms like EquityZen serve accredited investors, but funds like ARK’s Venture Fund and Cashmere Fund are opening doors for the public. ARK, for example, pools capital to invest in private firms, letting everyday investors access pre-IPO opportunities. Similarly, Cashmere Fund offers a public vehicle for private equity. Proposed legislation could further democratize private markets, allowing any investor to qualify through a financial knowledge exam.

Back in the public markets, PwC predicts that IPOs may rebound in 2025, driven by a strong pipeline of companies, rate cuts, and favorable market conditions.

One more thing: Apollo Global Management (APO) and Workday (WDAY) have joined the S&P 500, replacing Qorvo (QRVO) and Amentum Holdings (AMTM), with changes effective Dec. 23. Apollo’s market value surged to $100 billion, driven by strong earnings and asset growth, while Workday’s shares soared 9% on projections of sustained growth.

Disclosures:

As of writing, SpaceX is a 12.4% holding in the ARK Venture Fund. NVDA and META are holdings in Titan's Flagship strategy. ARK Venture fund, Apollo Diversified Credit fund, and Apollo Diversified Real Estate fund are all offered on Titan.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.