Three Things (2/10)

Feb 10, 2025

“Do you go to jail for this?”

One big gray area

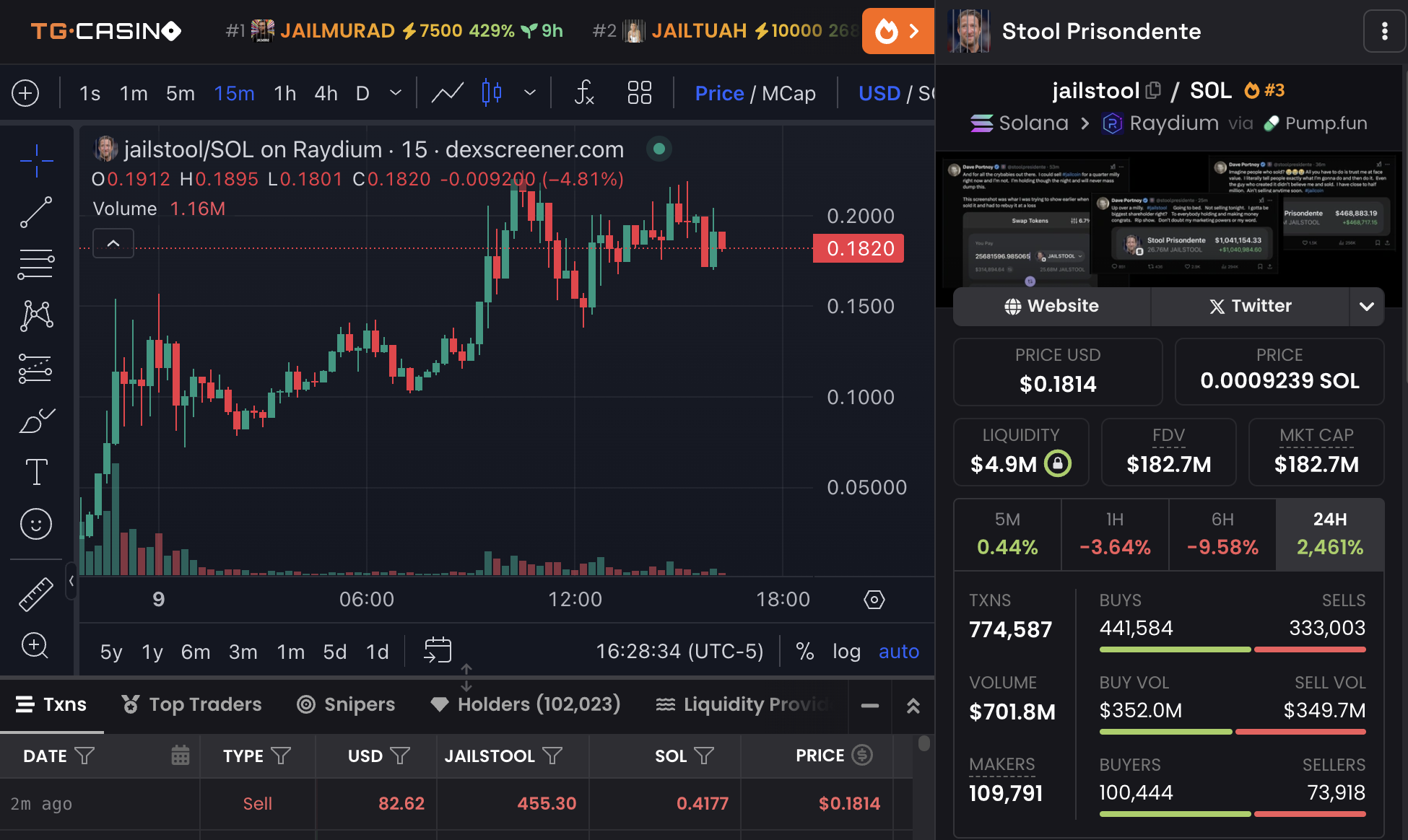

Crypto circus … Dave Portnoy is making headlines again—this time, for his whirlwind weekend trading altcoins and buying up a large position in a new memecoin, “Jailstool.” The Barstool Sports founder first tweeted about turning $10,000 into $75,000 trading meme coins, sending prices soaring before they crashed. Critics accused him of misleading his 3.5 million followers on X, essentially pumping and dumping tokens for personal gain. Portnoy pushed back, saying, “Nobody is misleading anybody” and likening his actions to gambling.

In response to the backlash, he bought up 50 million tokens of “Jailstool” on Saturday, joking about the potential legal trouble. “Do you go to jail for this?” he asked in one video. Hours later, Portnoy launched a Jailcoin merch store. As of Sunday evening, Jailstool had more than 100,000 holders, per Portnoy.

Chart via DexScreener, captured 4:30 PM EST on Sunday, Feb. 9.

Legally, Portnoy may be in the clear. Venture capitalist turned Crypto Czar David Sacks recently argued that memecoins should be considered collectibles, not securities, shielding them from SEC oversight. With crypto regulation still murky and Gary Gensler on the way out, enforcement seems unlikely.

Portnoy’s antics fit neatly into what investor Howard Lindzon is calling the “degenerate economy”—a landscape where speculative trading, sports betting, and viral financial schemes thrive. From memecoins to Robinhood’s attempt at launching Super Bowl betting, retail investors are chasing risk like never before. As long as the appetite for high-stakes gambling persists, figures like Portnoy will continue to capitalize on the chaos.

CFPB on ice

Helluva transition … Russell Vought, the newly appointed head of the Consumer Financial Protection Bureau (CFPB), ordered the agency to suspend all operations Saturday evening, effectively shutting down the government watchdog tasked with protecting consumers from financial abuse. He also stated that he would not be withdrawing the CFPB’s next round of funding.

The CFPB, created in 2010 after the 2008 financial crisis, oversees banks, mortgage lenders, payday loan providers, and emerging fintech firms to prevent deceptive and predatory practices. Before its creation, financial oversight was scattered among agencies like the Federal Reserve, FTC, and FDIC, with no single body focused solely on consumer protection.

Elon Musk, a “special government employee” whose platform X is expanding into financial services, has openly called for dismantling the CFPB. His Department of Governmental Efficiency (DOGE) now has administrative access to the agency’s systems. Critics argue Musk’s involvement raises concerns about regulatory conflicts of interest.

Before Vought’s takeover, the CFPB had moved to cap overdraft fees, limit junk fees, and crack down on abusive lending. With its operations frozen (for now) and funding slashed, consumer advocates warn that banks and lenders will face reduced oversight.

Trade gap grows

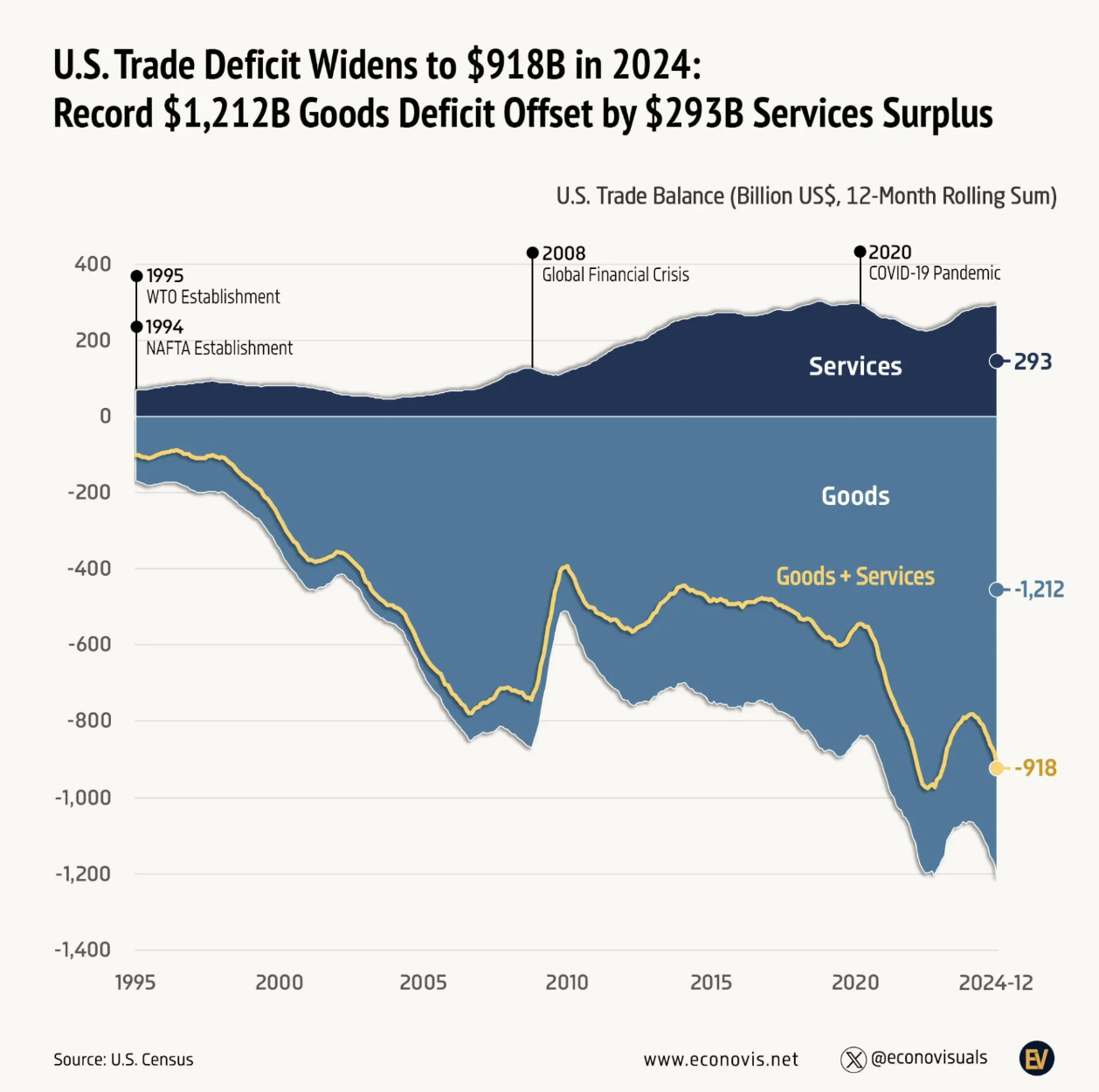

Give and take … The U.S. trade deficit—the difference between what we buy from the rest of the world and what we sell to the rest of the world—reached a record $1.2 trillion in 2024, marking the fourth consecutive year above the $1 trillion mark.

Despite the president’s ire toward trade deficits in concept, economists say they are not inherently bad. Deficits can indicate strong domestic demand and allow consumers access to a wider variety of goods, though persistent deficits may raise concerns about economic sustainability and competitiveness.

Looking at trade deficit in aggregate doesn’t tell the complete picture, since different countries specialize in different industries. For example, Japan, which lacks natural resources, imports oil and raw materials but runs a surplus in high-value exports like cars and electronics. Similarly, the U.S. imports large quantities of manufactured goods but excels in exporting services and high-tech products. This kind of trade imbalance is normal and reflects the global division of labor, where countries focus on what they produce most efficiently.

Despite arguments that say tariffs can reinvigorate manufacturing in the U.S., doing so may not guarantee that these will be well-paying jobs. Many low-cost goods, like toys and textiles, are produced in countries where labor is cheaper. Returning these industries to the U.S. would likely mean higher consumer prices or lower wages.

The biggest trade deficits in 2024 were with China, Mexico, Vietnam, and Ireland. Germany, Taiwan, Japan, South Korea, Canada, and India also ranked in the top ten. While tariffs have shifted trade patterns, they have not reduced the overall deficit. The real challenge lies in balancing economic growth with sustainable trade policies.

One more thing: The data center boom isn’t slowing down—Meta (META), Alphabet (GOOG), Amazon (AMZN), and Microsoft (MSFT) poured $180 billion into infrastructure last year, driving a global total of $465 billion. With 11,000+ data centers using as much power as the entire Netherlands and just 2.8% of North American space left unoccupied, supply can’t keep up. AI demand is set to triple by 2026, keeping tech firms investing despite supply chain delays and zoning restrictions.

As of writing, META, AMZN, GOOG, and MSFT are holdings in Titan's Flagship strategy.