Trade Update: Increasing our tech exposure in Flagship

Nov 10, 2022

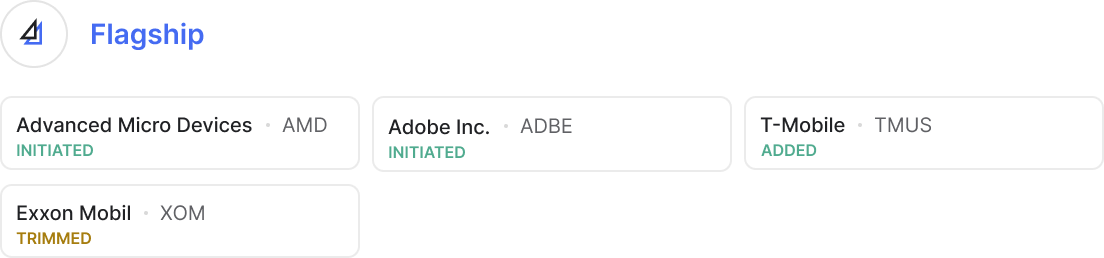

We’ve made trades in Flagship

We initiated positions in Advanced Micro Devices (AMD) and Adobe Inc. (ADBE) on behalf of clients in our Flagship strategy. We also added to our position in T-Mobile (TMUS) and trimmed our position in Exxon Mobil (XOM) to take some profits as it trades close to all-time highs. Let’s dive in.

The foundation for innovation

Advanced Micro Devices (AMD) is a leading fabless semiconductor company well positioned to capitalize on and enable emerging technology trends as we enter a transformational era of accelerated computing. Trading near its all-time low multiple due to trough cycle dynamics and broader macroeconomic uncertainty, we believe AMD represents an attractive long-term risk-reward proposition for Flagship clients.

A fabless semiconductor provider, like AMD, is responsible for the design and sale of hardware solutions and semiconductor devices while outsourcing their fabrication to a specialized manufacturer (a “foundry” or “fab”). This allows the company to operate an asset-light business model and focus on its core competency: designing chips. As a result, AMD is less capital intensive, reinvests profits into R&D, and provides the optionality to choose different foundries based on changing needs.

The stock is down ~60% YTD due to multiple compression and investors pricing in a 2023 recession. As such, the market seems to be overlooking the value of AMD’s expected share gains in a rapidly growing data center end market. Its performance has been impressive, to say the least.

We believe that AMD is a generational semiconductor company at the forefront of innovation in an age of exponential data growth. We expect volatility into the end of the year, so we’re starting with a small position, and plan to scale this position up as our thesis tracks if/when the valuation becomes even more compelling.

Designing the future

Adobe is a high-quality software provider with a solid track record of growth and execution. It has grown topline sustainably at high-teens/low-double digits over the last five years at industry-leading margins of 30%+.

Best known for its design tools such as Photoshop, Illustrator, and Lightroom, Adobe’s core product has been in its Creative Cloud suite where it has been unrivaled in quality and execution. Over time, Adobe has been able to reinvest capital to expand into the Digital Experience Cloud (Enterprise Marketing Stack) and Document Cloud through organic growth and M&A.

The recent decline in share price driven by both the pricey Figma acquisition in addition to broader market weakness, presents an attractive buying opportunity with asymmetric risk-reward.

While the deal to purchase Figma is undeniably expensive, we believe that the purchase was critical for Adobe to defend its moat as the industry undergoes a paradigm shift towards web-based collaborative design. Since the announcement of the deal, Adobe’s market capitalization has declined more than the entire deal value, suggesting that the market is assigning little to no value to Figma. The deal does not come without its risks – potential attrition, integration failure, antitrust concerns, all of which we are closely monitoring. Based on our research we believe that this deal will further solidify Adobe’s dominant franchise in the design software space.

The excellent track record of management, large install base, and ability to continue to cross-sell via their expansive go-to-market channels gives us confidence in the long-term prospects for growth.

Touching up the edges

Following an impressive earnings report, our thesis for T-Mobile (TMUS) continues to track as expected. Adding more exposure to this high quality compounder is a tactical way to increase strategy net exposure, in our eyes.

We also took the opportunity to take profits in Flagship’s best-performing stock of late: Exxon Mobil (XOM). We trimmed the position to lock in some gains and manage our energy exposure following a move toward all-time highs. Our thesis is still playing out nicely and we expect market dynamics to favor this global energy conglomerate over the medium term.

The results of the trade have increased our net exposure slightly. Although we expect near-term volatility to continue, the recent market dislocation has allowed us to initiate positions in generational companies, at attractive multiples, that we expect to hold for the next several years. As long-term investors, we are thrilled to have had the opportunity to initiate positions at these prices and will continue to tactically allocate capital as market uncertainty persists and creates further dislocations in equity prices.

Best,

Titan Investment Team

The content contained in this material is intended for general informational purposes only and is not meant to constitute legal, tax, accounting, solicitation of an offer, or investment advice.

Disclosure