Join us for our first Summit Series live event, February 11th NYC

Titan Crypto added to our Portfolio Recommendations

Dec 17, 2024

Titan Research represents some of our thinking on the markets, stocks, and investing. Check out the app for more.

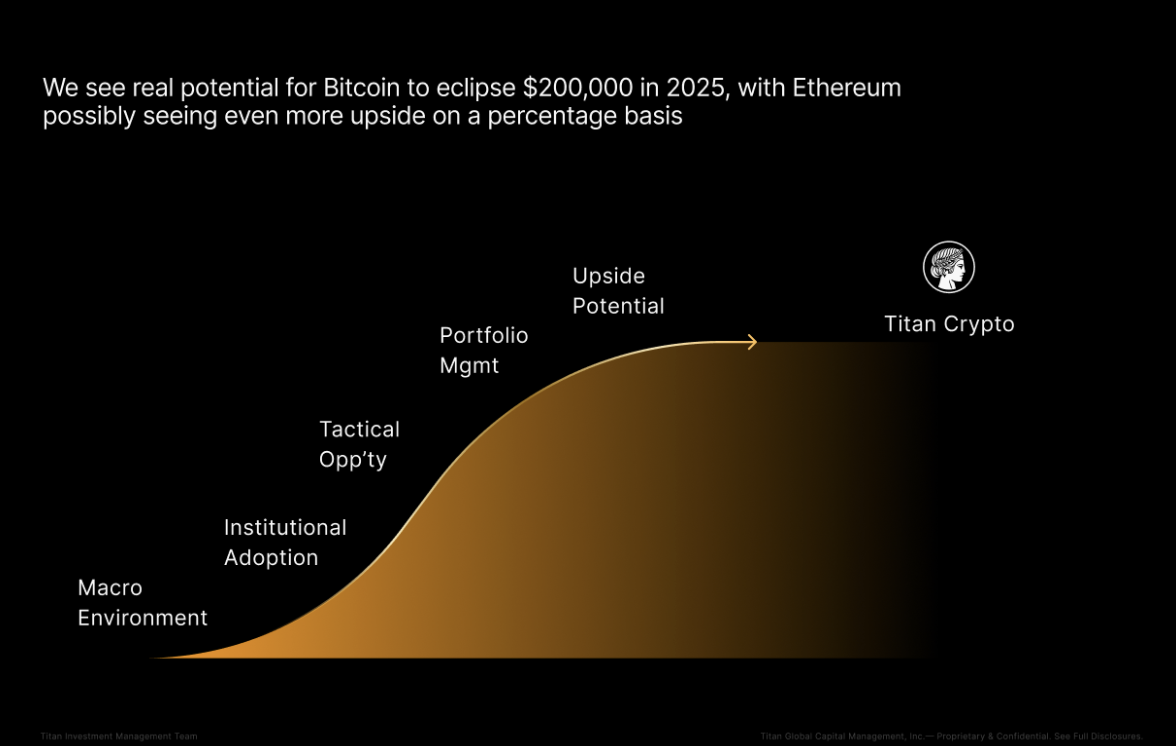

We believe Bitcoin could eclipse $200,000 in 2025 with Ethereum possibly seeing even more upside on a percentage basis. As such, we’re now recommending a 1-5% allocation to Titan Crypto for some clients’ portfolios (depending on your risk tolerance and financial profile).

Below we dive deeper and explain how to get your personalized recommendation from us.

As a reminder: Titan Crypto remains a professionally managed strategy providing equal-weighted exposure to Bitcoin and Ethereum via the iShares Bitcoin Trust ETF (IBIT) and the iShares Ethereum Trust ETF (ETHA), evaluated for rebalance quarterly.

We view Bitcoin (BTC) as “digital gold” and Ethereum (ETH) as the leading smart contract platform, and hence believe our crypto strategy offers a diversified, balanced approach to crypto investing. Our portfolio recommendation here is a function of our long-term thesis on crypto; it is not a short-term bet, and we anticipate plenty of volatility along the way.

Why We’ve Added Titan Crypto to Clients’ Recommended Portfolio Allocations

The short answer: The bull case for crypto continues to grow stronger, especially in 2025, while risks on the regulatory front appear to abate compared to years past. Below are five other key points informing our view, in no particular order:

1.) Growing Institutional Adoption. Institutional interest in crypto has surged, driven by approvals of spot Bitcoin and Ethereum ETFs, increased clarity in regulatory frameworks (which is expected to further increase under the Trump administration), and growing demand from pension funds, endowments, and sovereign wealth funds. This adoption reflects confidence in crypto’s legitimacy as a long-term asset class.

2.) Macroeconomic Environment. With inflation cooling and central banks signaling potential rate cuts in 2025, the macroeconomic backdrop is increasingly favorable for risk assets like crypto. Historically, crypto has performed well during periods of monetary easing and increased liquidity.

3.) Portfolio Diversification and Risk-Adjusted Return Contribution. Historical data shows that adding a modest BTC/ETH allocation to one’s portfolio could have boosted portfolio-level returns without major changes to the portfolio’s volatility or maximum drawdown, boosting its Sharpe ratio. It can also provide a hedge against macroeconomic uncertainties such as systemic financial risks and currency devaluation (the latter of which we view as increasingly likely).

4.) Ethereum’s Potential Upside. We outlined the broad case for ETH in our October research note. Right now, we think Ethereum remains undervalued relative to Bitcoin, with the ETH/BTC ratio still near multi-year lows. As regulatory clarity on crypto improves, particularly under a Trump administration, institutional adoption is likely to accelerate, driving billions in inflows into ETH ETFs and potentially unlocking significant upside. We also see the narrative shifting positively in 2025 amidst massive growth in stablecoins and tokenized projects built on Ethereum.

5.) Tactical Opportunity. Bitcoin recently crossed the $100,000 milestone, a key psychological level that has surprisingly not garnered nearly as much media attention as we expected. Similarly, positioning and sentiment in crypto appear muted which means more fuel for the trend higher in 2025. While our multi-year thesis for Bitcoin remains “digital gold,” these near-term factors create a compelling entry point today. We don’t think investors on the sidelines have missed the boat, so to speak.

Our Recommended Allocation Range

Our recommended allocation range to Titan Crypto, where suitable, is 1-5% of a client’s portfolio based on their personal risk tolerance and financial profile. Note, however, that large drawdowns (i.e. losses of ~80% from peak to trough) are common in crypto and can be vicious. Conservative clients with little ability to stomach losses should steer clear, while clients with more aggressive risk tolerances might consider investing up to 5% of their portfolios.

In terms of the 1-5% recommendation: we arrived at this range based on an analysis of historical portfolio risk contribution from incorporating crypto into a traditional 60/40 stocks/bonds portfolio. A year ago, our friends at the leading crypto asset manager Bitwise Investments published a fantastic whitepaper outlining the case for adding Bitcoin to a diversified portfolio and arrived at a similar conclusion: even just a 2.5% allocation to Bitcoin would have boosted the three-year risk-adjusted return of a traditional 60/40 stock/bond portfolio by 12 percentage points.

While this whitepaper predated the approval of spot ETH ETFs, we see its conclusion holding broadly true when incorporating ETH alongside BTC in a small portfolio allocation. This allocation range also aligns with recent recommendations from leading investment firms like BlackRock and many other advisors, reflecting a growing consensus on the role of crypto as part of a balanced portfolio.

What This Means For You

To be clear, we will not be automatically adding Titan Crypto to your managed portfolio. In other words, you will not be auto-opted into a crypto allocation.

Instead, to get your own personalized recommendation for how much of your portfolio (if any) to allocate to Titan Crypto, just reply to this email and we can assist. If you wish, we can set up a call with one of our advisors to walk you through a custom allocation and how to set it up in the app.

As always, if you have any questions, please let us know. Wishing you and yours a happy holiday season and a happy new year.

Best,

Clay

Co-Founder and Chief Investment Officer

Disclosures:

Advisory services are offered by Titan Global Capital Management USA LLC ("Titan"), an SEC registered investment adviser. This content is intended for informational purposes only, and is not a recommendation for any specific investor to buy or sell any security, including the securities held in Titan’s Crypto strategy (“Titan Crypto”). Nothing in this content should be construed as specific investment advice. Investment markets fluctuate, and all investments carry risk. Past performance does not guarantee future results. Investors are responsible for their investment decisions and should consider their objectives and risks carefully. The value of investments can go up or down, and investors may lose money, including their principal. For more detailed information and disclosures, please visit www.titan.com/legal.

PLEASE NOTE: INVESTMENTS WITH EXPOSURE TO CRYPTO ASSETS ARE ONLY SUITABLE FOR INVESTORS WHO ARE WILLING TO BEAR THE RISK OF LOSS AND EXPERIENCE SHARP DRAWDOWNS, AS THEY STILL CARRY INHERENT RISK ASSOCIATED WITH CRYPTOCURRENCIES. YOU ARE SOLELY RESPONSIBLE FOR EVALUATING THE MERITS AND RISKS ASSOCIATED WITH THE USE OF ANY INFORMATION, MATERIALS, CONTENT, USER CONTENT, OR THIRD PARTY CONTENT PROVIDED BEFORE MAKING ANY DECISIONS BASED ON SUCH CONTENT.