Join us for our first Summit Series live event, February 11th NYC

A note from Clay on July

Aug 16, 2022

Bulls and bears

Investors finally received a welcomed breather from the relentless selling in capital markets last month. Stock indices rallied across the board, the crypto market reclaimed a $1 trillion market cap, and overall sentiment seemingly reversed course overnight from extremely negative levels.

Corporate profitability remained robust as seen by better-than-expected earnings, and the Fed reminded investors that there would be a day when they cease the interest rate hikes.

But what’s really changed in the world? Not much, in our eyes.

Despite July’s price action, we believe it's important to remember that we’re still working through a challenging global macro backdrop.

What’s the bull case? Given that corporate earnings power is starting from all-time highs, even a shallow recession (driven by the Fed to reduce inflation) will not impact earnings to the extent we have seen in past downturns. If that proves true, corporate earnings may return to all-time highs faster than anticipated after a potential recession. This point is highly positive for stocks.

And the bear case? Inflation is far more entrenched than the market or the Fed understands, requiring higher rates, for longer. The result may be a deeper recession and lower earnings than the market has priced in today. Look no further than the labor market, which remains tighter than historical levels and may be a key driver of “stickier” inflation.

It likely won’t be that black and white - nothing in investing is.

There won’t be a single point in time when we declare it’s time to go “risk-on.” Markets are not binary. Rather, we have a series of signposts we’re tracking for the market and each holding to quantify our conviction in both the potential upside in a bull market and the potential downside.

We’re still in the more cautious camp as evidenced by our defensive positioning but plan to be nimble as needed, and our more cautious posture is an output of our view on the aforementioned signposts.

We had an active last day of the month as we bought more energy stocks and sold some high-growth names that had rallied hard off the lows throughout the month. As a result, we’re quite pleased with our current diversified positioning in each strategy.

My team continues to source ideas at a high velocity, and I’m excited for us to dig in further now that the earnings season has largely wrapped up. We believe there may be some exciting pockets for long-term growth after the historic downward start to the year.

As always, our team is here for you. Reach out to us with any questions, and we hope you have a great end of the summer.

Onwards,

Clay

Co-Founder, Co-CEO, CIO

July Trade Activity

You can read more about our trading activity from July in the updates below.

Performance Update

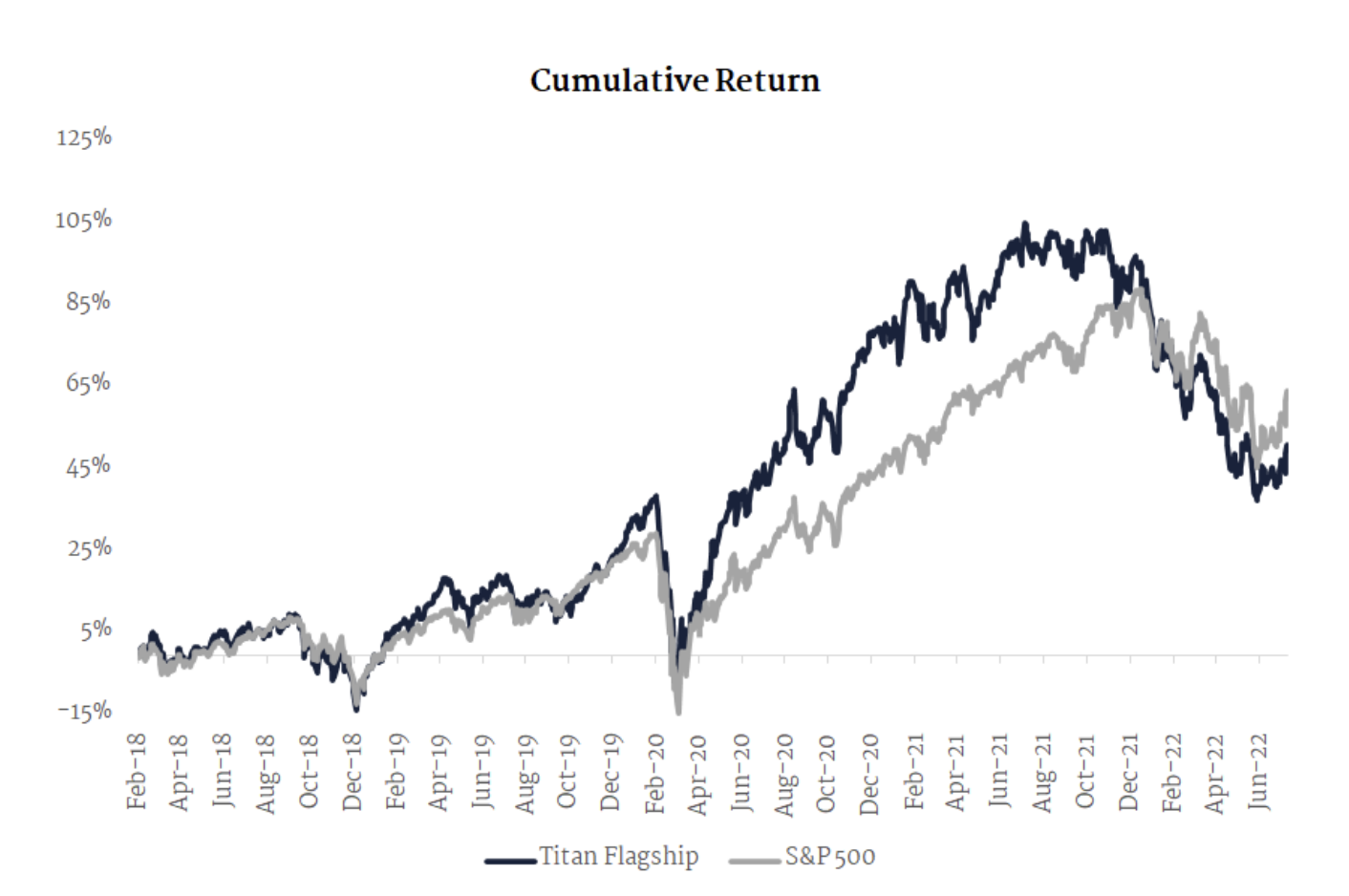

Flagship

Our Flagship strategy is now up 51.4% after fees since February 2018 inception (aggressive risk profile), following a 6.9% return, net of fees, in July.

By comparison, the S&P 500 rose 64.4% since Flagship's inception, with a 9.2% return in July.

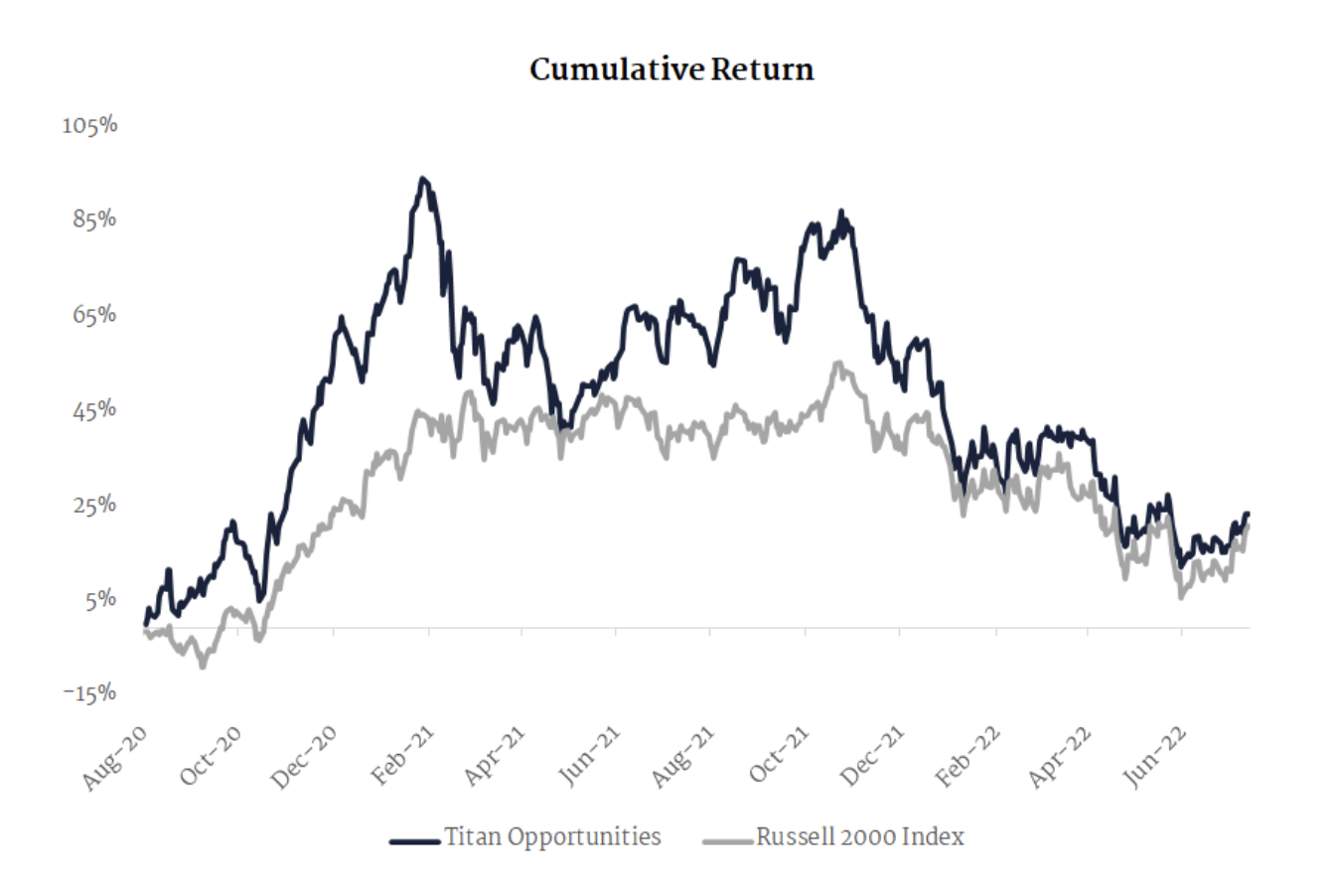

Opportunities

Our Opportunities strategy is now up 23.9% after fees since August 2020 inception (aggressive risk profile), following a 6.8% return, net of fees, in July.

By comparison, the Russell 2000 rose 21.5% since Opportunities’ inception, with a 10.4% return in July.

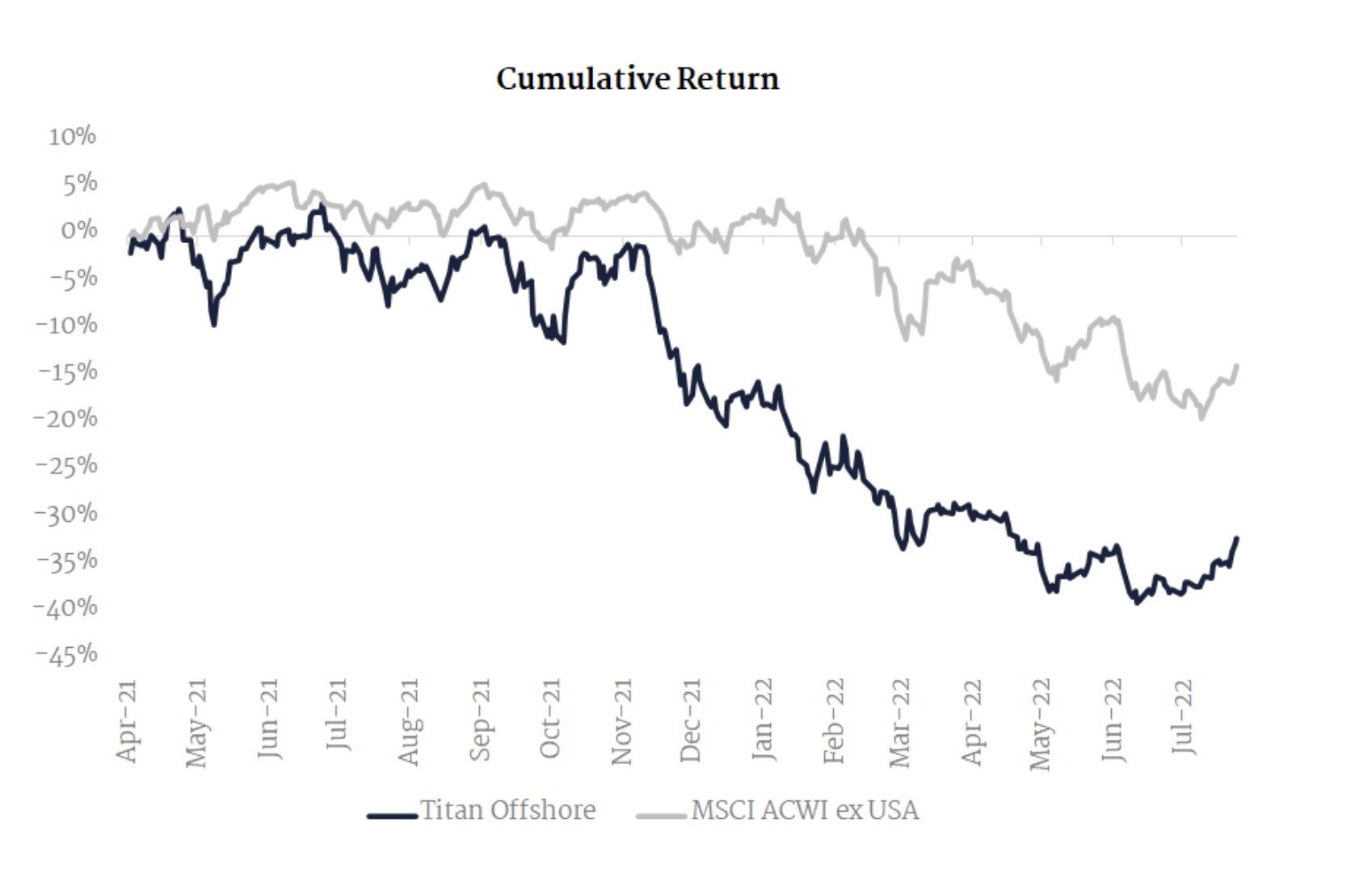

Offshore

Our Offshore strategy is now down 32.1% after fees since July 2021 inception (aggressive risk profile), following a 9.1% return, net of fees, in July.

By comparison, the MSCI ACWI ex-USA is down 13.8% since Offshore’s inception, with a 3.4% return in July.

Crypto

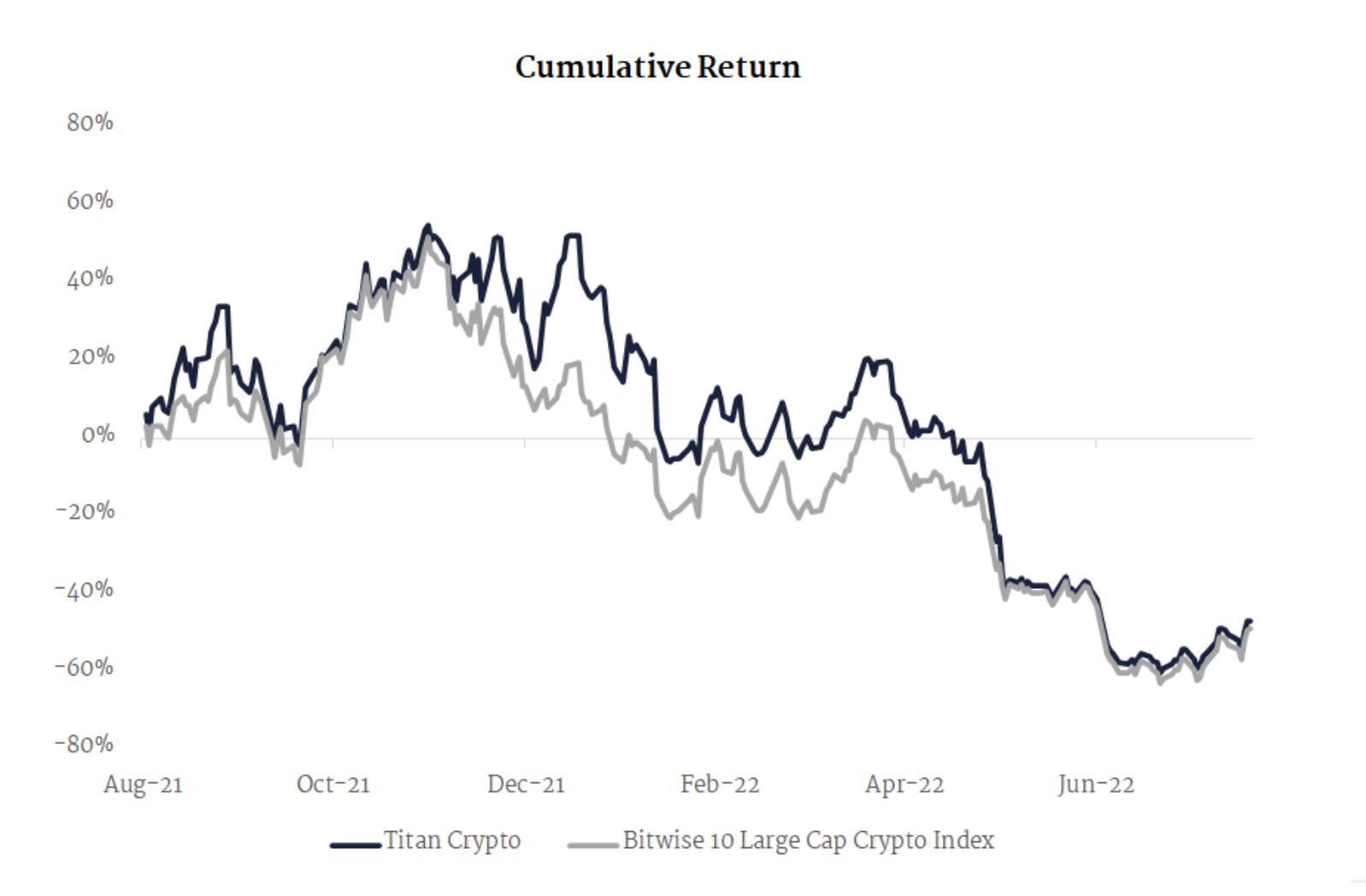

Our Crypto strategy is now down 46.9% after fees since August 2021 inception (aggressive risk profile), following a 32.8% return, net of fees, in July.

By comparison, the Bitwise 10 is down 48.9% since Crypto’s inception, with a 37.1% return in July.

Coming soon to a computer near you

Titan’s web experience has always been “lite” - to say the least. We’ve received feedback that clients want to monitor portfolios, read updates, and move capital while on their computers. As Titan clients ourselves, we’re excited about this possibility!

In the coming weeks, we plan to launch Titan for Web with full function parity to the mobile app. Much more to come, and as always, we welcome any and all feedback as we roll out these enhancements.

ICYMI: Titans in the wild

Listen here as co-founder and co-CEO Joe Percoco joins Fast Company's Most Innovative Companies podcast to discuss how tough market conditions can bring key growth opportunities...for some.

Read here about the basics of crypto staking in an interview that Gritt Trakulhoon, lead crypto analyst, did with Forbes' David Rodeck.

Read here about the type of tech and talent Titan is looking to add as we continue to scale our offering. Joe joins Asia Martin from Business Insider for this interview.