Join us for our first Summit Series live event, February 11th NYC

August in review

Sep 12, 2022

Here’s our portfolio snapshot

During the first two weeks of August, equities continued to rally off of the mid-June lows. In last month’s recap, we stated that although stocks were moving higher in a hurry, we must remember that we’re still working through a very challenging macroeconomic environment and that volatility would likely persist.

Just as market participants thought they could roll through the end of summer on a high note, Fed Chairman Jerome Powell traveled to Jackson Hole and reminded the world of his plans to rein in inflation.

The market fell more than 3% that day as Powell committed to "use our tools forcefully" and "for some time," acknowledging that it would inflict "some pain."

Despite the many macro challenges, the U.S. economy had an encouraging read on inflation and saw relief in energy prices, while unfortunately, Europeans weren’t so lucky. The ongoing conflict between Russia and Ukraine has led to an energy crisis in Europe that has left many concerned about the pending winter season.

We’re experiencing a once-in-a-generation supply/demand imbalance in energy markets. In late August, our team continued to expand and diversify our energy exposure as we see no end in sight to this dislocation.

Our strategies outpaced their benchmarks in August primarily due to our reduced long exposure (sizable cash reserves) and our tactical overweight to energy, particularly in Opportunities and Offshore. My team’s plans haven’t changed; we will continue to stay diversified across sectors and deploy our cash reserves as we see opportunities to do so.

As mentioned last week, we’re excited to bring expertly-managed Real Estate and Private Credit funds to the Titan platform. These are two alternative asset classes with long track records of consistent income and non-correlated returns across various market cycles.

We’ll have a ton of information to get you up to speed, including a personalized recommendation to enable you to diversify across our new asset classes. It’s a pivotal time for your wealth, and we appreciate the opportunity to be your partner in the journey.

As always, let us know if you have any questions.

Best,

Clay

Co-Founder, Co-CEO, CIO

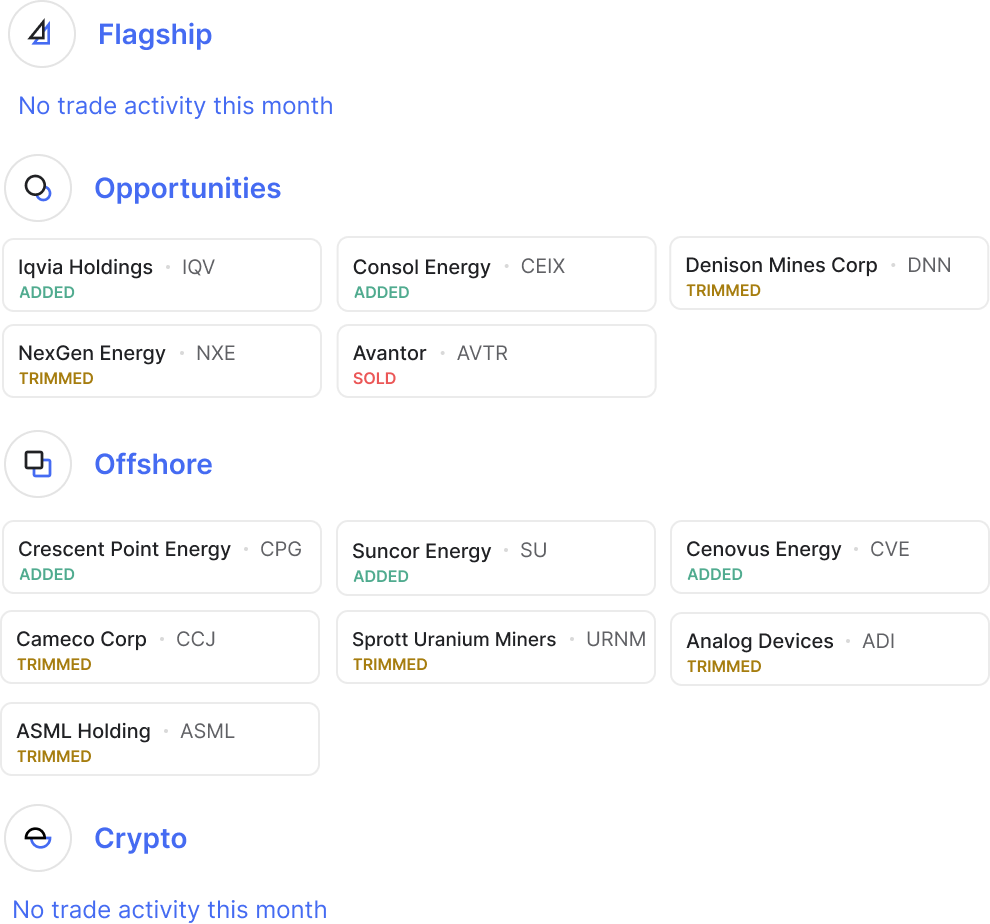

Trade Activity

You can read more about our trading activity from August in the trade update below:

Private investing is coming to the Titan platform

As Clay’s update mentioned above, this week, we’ll be launching alternative asset classes on Titan. We’re starting with Real Estate and Private Credit, two income-focused asset classes that we believe will complement our more growth-oriented equity and crypto strategies nicely.

Professional investors often allocate 40%+ of their capital to alternatives like real estate and credit, whereas individual investors historically have <5% of invested capital in alternative asset classes. The funds we’ll be launching this week are managed by iconic Wall Street firms with 30+ year track records and hundreds of billions under management. We can't wait to share more!

Lean on our team with any questions as you explore these new avenues of diversification. Be sure to update your mobile app, and we’ll send you an email as the funds become available!