Three Things (11/15)

Nov 15, 2024

Burberry’s down plaid

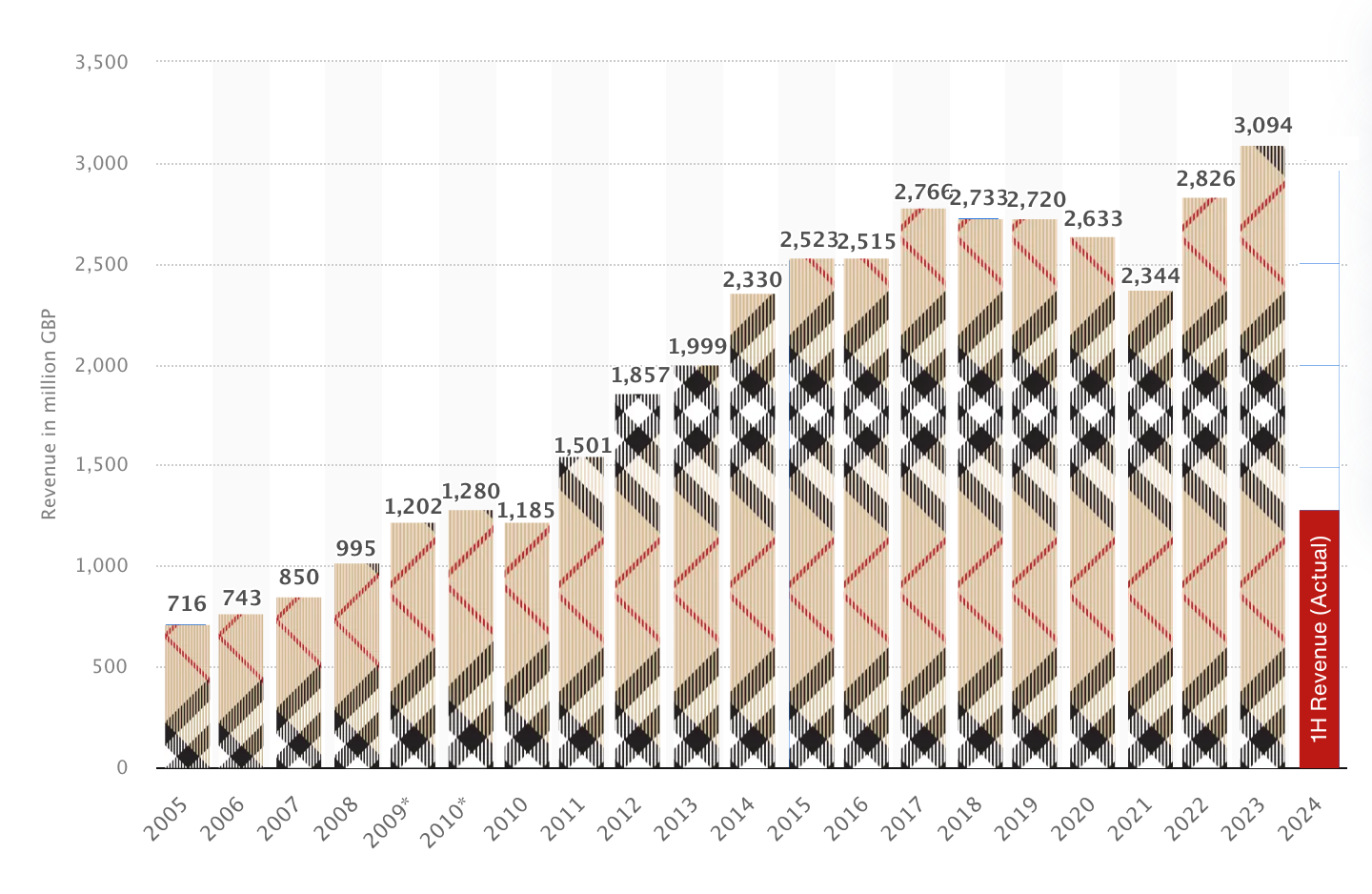

Back to basics … Sales at British luxury icon Burberry (BURBY) dropped 20% for the second quarter in a row, spurring new CEO Joshua Schulman to announce a sweeping turnaround plan on Thursday. Dubbed “Burberry Forward,” the strategy aims to refocus on core products like coats and scarves while cutting costs by £40 million annually.

Schulman, who joined Burberry in July, blamed the slump on past management’s push toward higher-end pricing and niche products, which alienated customers. He emphasized a return to “heritage designs” and Burberry’s staple outerwear to stabilize performance and rebuild brand loyalty. “We’re acting urgently to course correct,” Schulman declared, highlighting plans to target £3 billion in annual revenue over time.

Burberry's global revenue from 2005 to 2024 (in million GBP)

The market responded optimistically, with Burberry shares rising 22% during Thursday’s trading, marking their largest intraday gain ever. Despite this, the brand’s stock remains down 39% year-to-date. Analysts called the overhaul a potential “turning point” for the struggling fashion house, though some cautioned that alignment between Schulman’s vision and creative execution will be crucial to success.

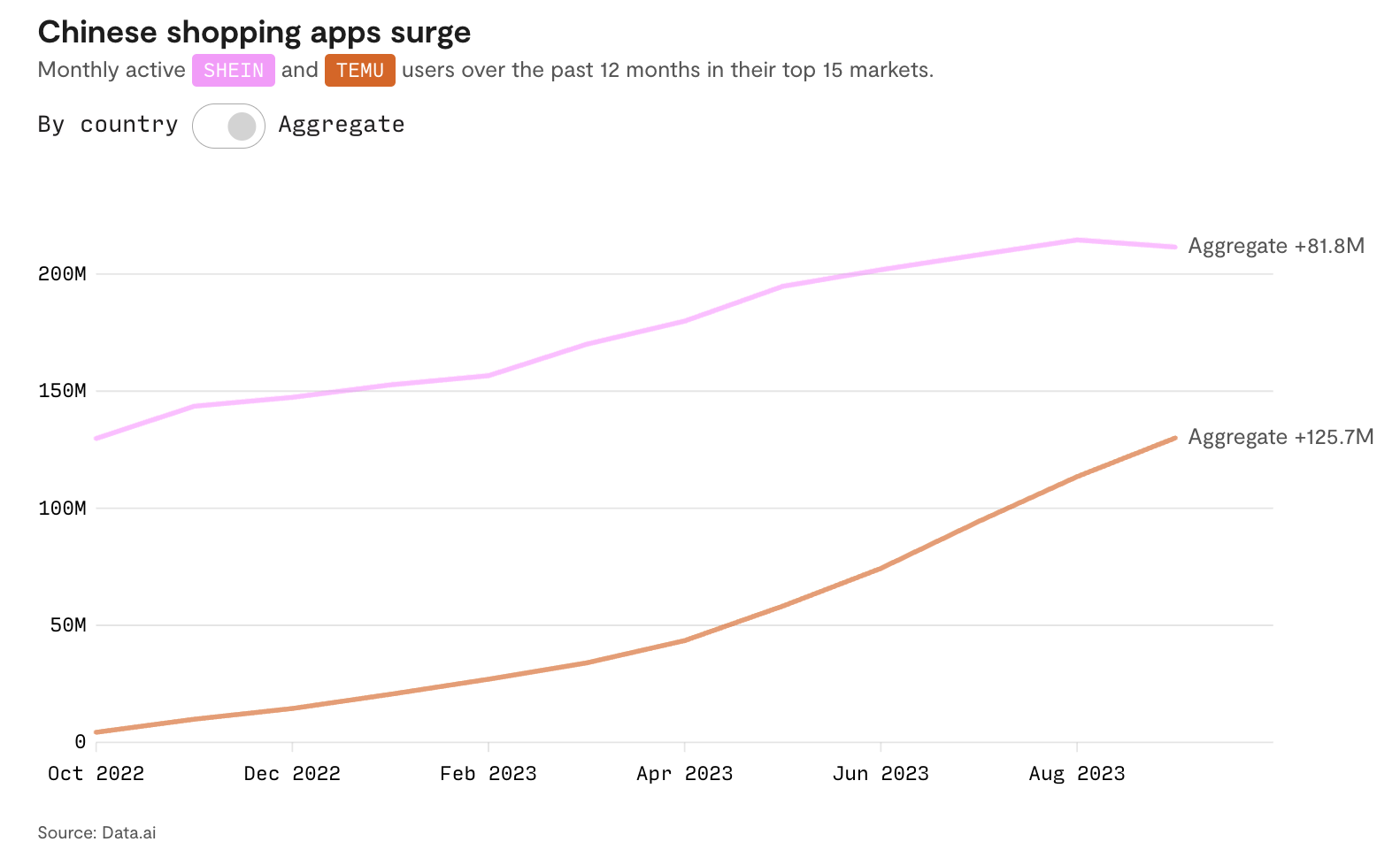

Burberry’s troubles also reflect a broader challenge for luxury brands: the rise of “dupe culture.” Affordable replicas, often sold online, erode the exclusivity that defines high-end goods. Counterfeit products accounted for some $500 billion in global sales, with e-commerce sales making up 40% of this total. As imitation goods flourish, maintaining prestige has become an uphill battle for brands like Burberry.

Speaking of dupes

Amazon answers … Amazon (AMZN) is making waves in the e-commerce world with the debut of Amazon Haul, a storefront dedicated to products under $20. Announced this week, the platform positions Amazon directly against budget-focused giants Temu (PDD) and pre-IPO Shein, which have gained traction by offering ultra-cheap goods sourced from Chinese manufacturers.

Available through the Amazon app and mobile site, Amazon Haul promises “crazy low” prices in categories like fashion, home goods, electronics, and lifestyle products. Nearly half of its offerings are priced under $10, with some items going as low as $1. Customers can earn additional discounts—5% on orders over $50 and 10% on purchases exceeding $75—encouraging bulk shopping.

However, Haul trades Amazon Prime’s hallmark fast shipping for slower, cost-efficient delivery. Orders take one to two weeks to arrive and incur a $3.99 shipping fee, waived for carts over $25. This approach mimics rivals Temu and Shein, which have popularized delayed shipping for deep discounts.

Amazon’s timing is strategic. Chinese e-commerce competitors face mounting regulatory scrutiny in the U.S. and Europe over counterfeit goods and copyright issues. To avoid similar pitfalls, Amazon claims Haul’s products are vetted for safety and compliance. Some analysts suggest Haul may mitigate trade tensions by sourcing selectively and ensuring quality standards.

Gold rollercoaster

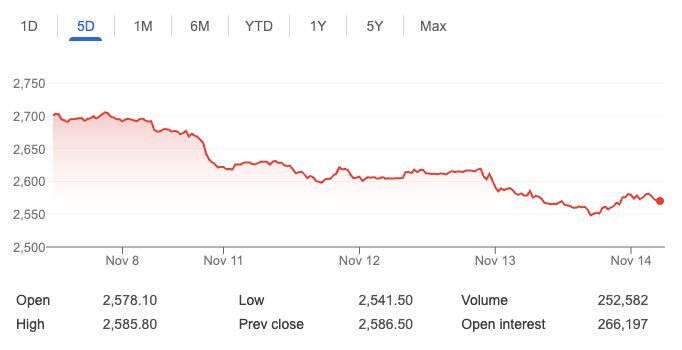

Highs and lows …Gold has hit a rough patch after soaring to an all-time high of $2,800.80 an ounce on October 30. Just two weeks later, prices have dropped 8.1%, settling in under $2,600 per ounce on Thursday. The slide marks the longest losing streak for gold futures since February.

Gold Futures: Five-Day View

Analysts point to two key drivers behind the decline. First, the strength of the U.S. dollar and rising Treasury yields are increasing the opportunity cost of holding non-yielding assets like gold. The 10-year Treasury yield nears 4.5%, reflecting a “hawkish repricing” of future U.S. interest rates.

Second, geopolitical uncertainty—a consistent bullish factor for gold—is waning. President-elect Donald Trump’s perceived ability to ease tensions in the Middle East and Eastern Europe has reduced the urgency for safe-haven assets.

Despite this, fundamentals like central bank gold purchases remain strong. The World Gold Council reports robust demand from foreign institutions, although 2024’s totals lag behind 2023’s record highs.

Still, the outlook isn’t all bearish. Rising inflation fears and Trump’s economic policies could reinvigorate gold’s appeal as a hedge. For now, however, investor focus has shifted to equities and cryptocurrencies, with Bitcoin briefly surpassing $93,000 amid market optimism.

Disclosures:

As of writing, AMZN is a holding in Titan's Flagship strategy. GLD and GDJX are holdings in Titan Opportunities strategy.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.