Three Things (11/18)

Nov 18, 2024

Netflix glitches, Nvidia on deck

60M tune in, errors ensue

Buffering … Netflix’s (NFLX) ambitious livestream of the Jake Paul vs. Mike Tyson boxing match attracted a staggering 60 million households, peaking at 65 million concurrent streams. However, the platform’s biggest live sports event was marred by widespread streaming issues. Buffering and freezing plagued users, with the #NetflixCrash hashtag trending as frustrations mounted. Downdetector reported over 1 million outages across 50 countries, peaking at 530,000 complaints in the U.S. alone.

Netflix has faced similar hurdles before, including a delayed (and somehow more entertaining) “Love is Blind” reunion last year. Despite these setbacks, the platform has been building a portfolio of live events, including NFL games this Christmas. Some fans worry the glitches could resurface. With the Kansas City Chiefs’ Super Bowl win last year drawing 123.7 million viewers, Netflix’s infrastructure will need to rise to the challenge.

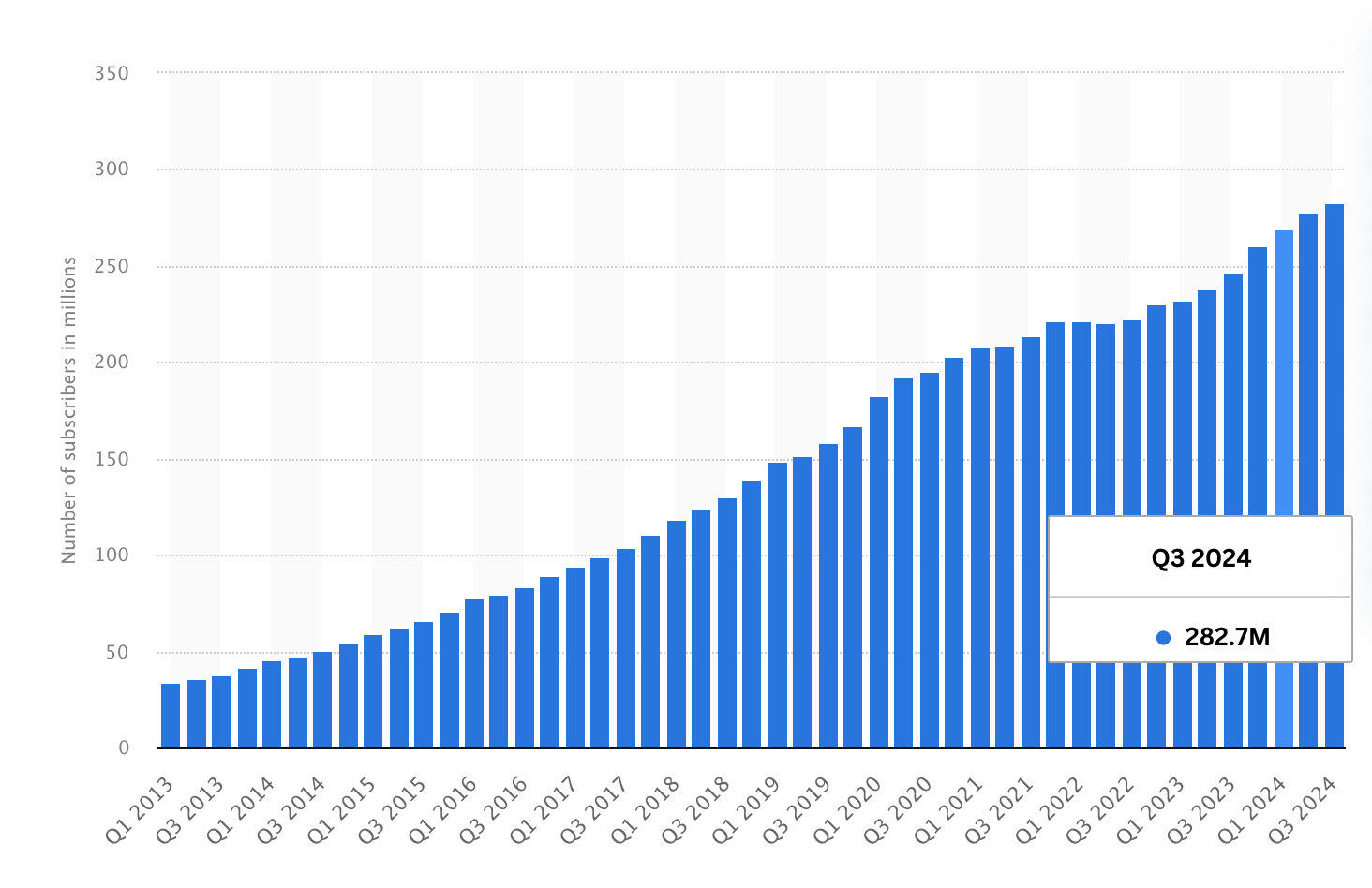

Number of Netflix paid subscribers worldwide (in millions)

The fight itself, held at the AT&T Stadium in Texas, was a sluggish spectacle. Paul defeated the legendary Tyson on points, landing 78 hits to Tyson’s 18. Alongside live streams, Netflix partnered with Joe Hand Promotions to distribute the event to 6,000 bars and restaurants, setting a commercial record.

Streaming platforms like Netflix have revolutionized TV consumption, making “appointment TV”—where viewers watch shows concurrently—largely obsolete. However, in a full-circle twist, these platforms are attempting to revive the collective viewing experience through live events. The Tyson-Paul fight drew roughly 48% of U.S. TV households. For perspective, 58% of Americans with TVs watched Elvis Presley’s comeback TV special in 1968.

Retail sales rise

Spending snapshot … Retail sales gained 0.4% in October, a sign that consumers are still spending despite lingering economic pressures. The monthly increase was driven by a 1.6% jump in auto purchases and a 2.3% surge in electronics and appliance sales. Dining out also saw growth, with spending at bars and restaurants climbing 0.7%.

Some sectors, however, saw declines. Furniture stores, drugstores, and clothing outlets reported slower sales, a trend partly linked to hurricanes disrupting activity. Grocery sales remained almost flat, reflecting the continued challenge of elevated food prices.

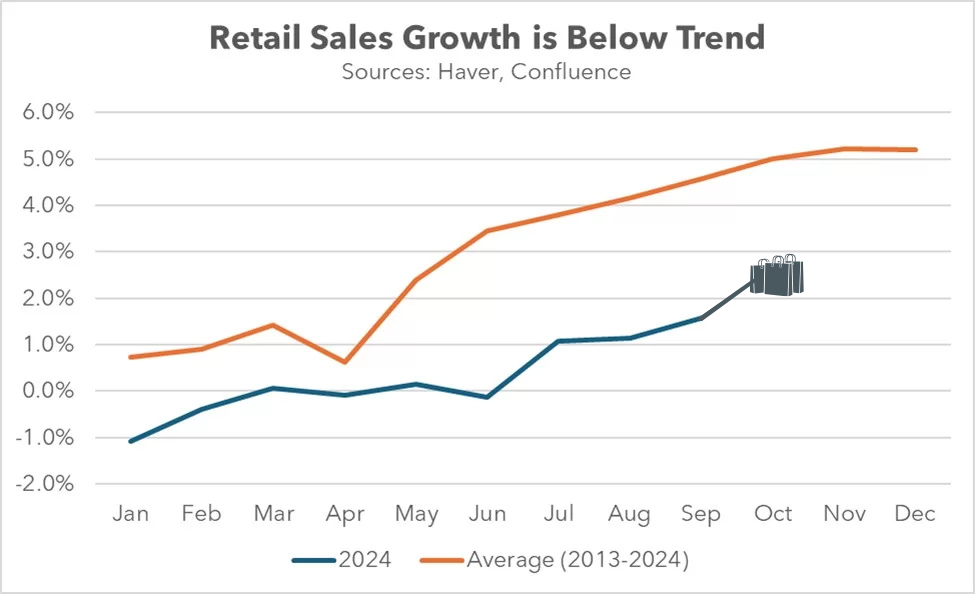

Still, year-over-year sales growth continues to lag behind historical pace.

Despite these mixed results, analysts are optimistic about the upcoming holiday season. The National Retail Federation forecasts a 2.5% to 3.5% increase in holiday spending over last year. Still, this projection lags behind the 3.9% growth seen in 2023, as shoppers grapple with higher prices.

Related: Despite auto sales seeing a lift, new data from Kelley Blue Book finds that the average price of a new car is nearly $50,000, a 30% increase over five years.

This week on Wall Street

Big dog … The newly anointed world’s largest public company (by market cap), Nvidia, is on deck to share Q3 2024 earnings on Wednesday, which will signal to investors where the AI trade is trending. This week, investors will also get key retail reports from Walmart, Target, and Lowe’s.

Tues. 11/19: Walmart (WMT), Lowe’s Companies (LOW), Futu Holdings (FUTU), Valvoline (VVV)

Weds. 11/20: NVIDIA Corp (NVDA), Target (TGT), TJX Companies Inc (TJX), Palo Alto Networks Inc (PANW), Snowflake (SNOW), Wix.com (WIX)

Thurs. 11/21: Intuit (INTU), Deere and Co (DE), Baidu Inc (BIDU), Warner Music Group (WMG), BJ's Wholesale Club Holdings Inc (BJ), Gap Inc (GAP)

IPOs scheduled this week: Self-driving robotaxi company Pony AI (PONY) and mineral development company Brazil Potash Corp (GRO)

One more thing: Palantir’s stock surged 11% to a record high after the company announced it will change its listing from the NYSE to Nasdaq, effective November 26. News of the move boosted the stock as investors anticipated inclusion in the Nasdaq 100, driving buying by index-tracking funds.

Disclosures:

As or writing, NVDA is a holding in Titan's Flagship strategy.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.