Three Things (11/22)

Nov 22, 2024

SEC shakeup, home sales surge

Goodbye, Gensler

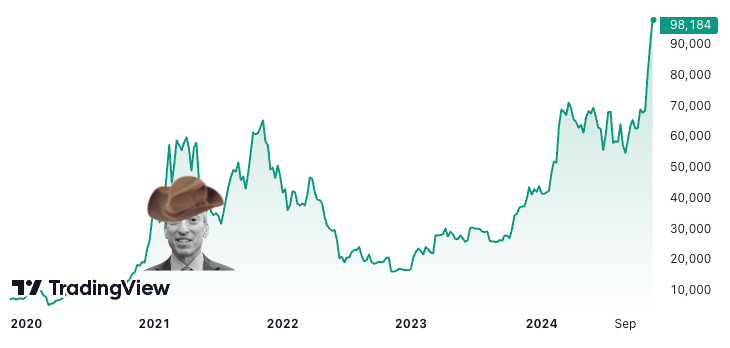

Crypto crossroads … Gary Gensler, chair of the U.S. Securities and Exchange Commission, will step down on January 20, coinciding with the President-elect’s inauguration. The move comes after Trump vowed to remove Gensler on “day one” of his presidency, citing opposition to Gensler’s strict regulatory approach to cryptocurrency.

Rumors suggest Trump may appoint Teresa Goody Guillen, a blockchain lawyer and former SEC insider, to succeed Gensler. Known for her expertise in cryptocurrency and blockchain protocols, Goody Guillen could usher in a more crypto-friendly regulatory era. This speculation aligns with Trump’s campaign promises and the cryptocurrency community’s substantial financial backing of crypto-friendly candidates (reportedly $130 million).

Under Gensler, the SEC took a cautious stance toward digital assets, likening the crypto market to the “Wild West” and emphasizing investor protection. He spearheaded enforcement actions against crypto giants Coinbase and Binance and expressed concerns about fraud and market manipulation.

Despite criticism from crypto advocates who argued his approach stifled innovation, Gensler also oversaw landmark achievements, including launching spot cryptocurrency ETFs, such as BlackRock’s $42.9 billion iShares Bitcoin Trust.

With Bitcoin nearing $100,000 and speculation of Goody Guillen’s appointment, the SEC’s direction could signal a significant shift in the regulatory landscape for cryptocurrencies.

Snowflake heats up

Data has a day … Snowflake (SNOW) just pulled off its best day ever. Shares of the data analytics company soared 30% on Thursday after it bumped up its fiscal 2025 revenue forecast to $3.43 billion, an increase from its previous $3.36 billion estimate. Investors didn’t just like the numbers—they loved them. The stock is now up $12 billion in market value, making this its biggest single-day gain since Snowflake’s 2020 IPO.

So, what’s behind the rally? For starters, Snowflake is all about cloud-based data storage and analytics, helping businesses manage, analyze, and visualize their data. It has over 10,600 customers, including big names like Capital One (COF) and Warner Bros. Discovery (WBD), which rely on Snowflake to make sense of their massive datasets.

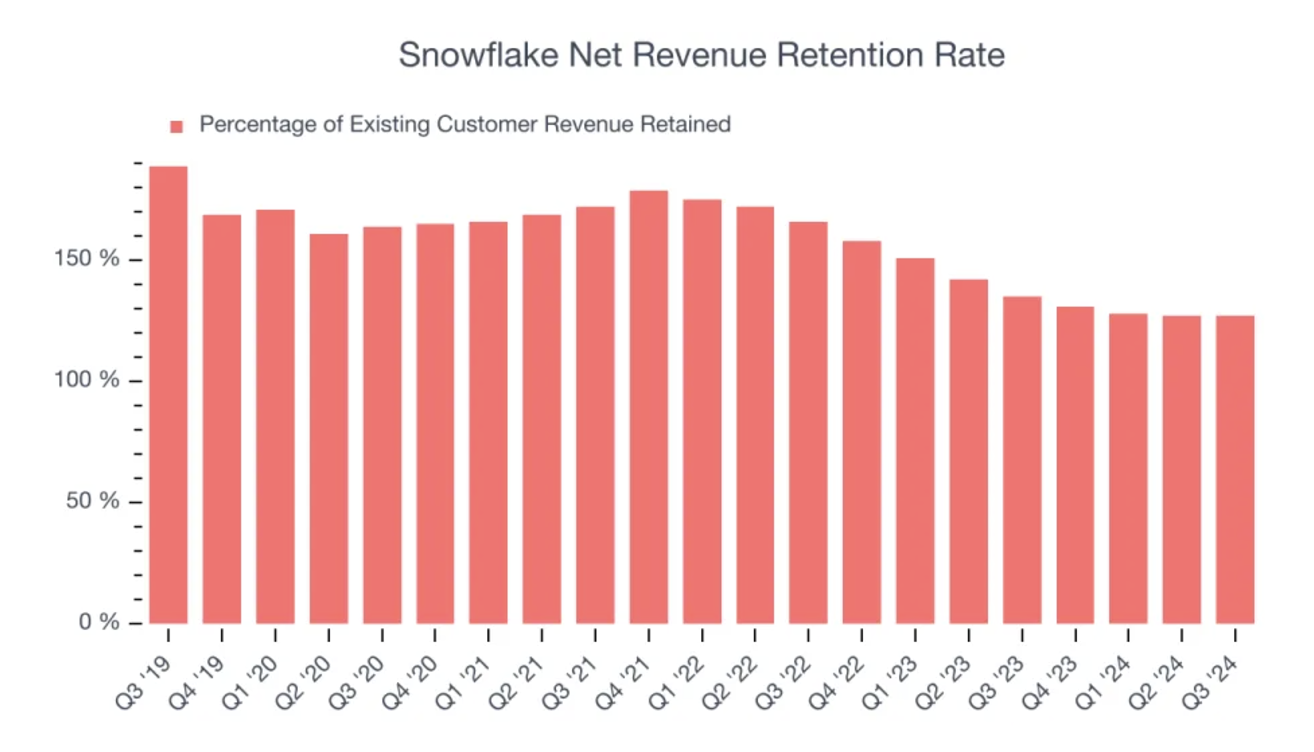

Snowflake’s net revenue retention rate, which signals customer loyalty, was 128% for the quarter. Even if it didn’t add any new logos, Snowflake still would have grown 28%.

The real headline, though, is its new partnership with Anthropic, a major player in artificial intelligence. Snowflake is integrating Anthropic’s AI tools into its platform, giving its customers some serious new capabilities—like automating data insights and generating sleek visualizations. For Snowflake, this partnership isn’t just about staying competitive; it’s a step toward becoming a key player in the AI space, a top priority for CEO Sridhar Ramaswamy.

Snowflake’s momentum spilled over into the broader tech market, lifting data-focused peers like MongoDB (MDB) and Elastic (ESTC) by 15% and 5%, respectively.

Home sales up, jobless claims down

Macro for a minute … The U.S. economy offered mixed but promising signals this week, with a resurgence in home sales and steady declines in unemployment claims.

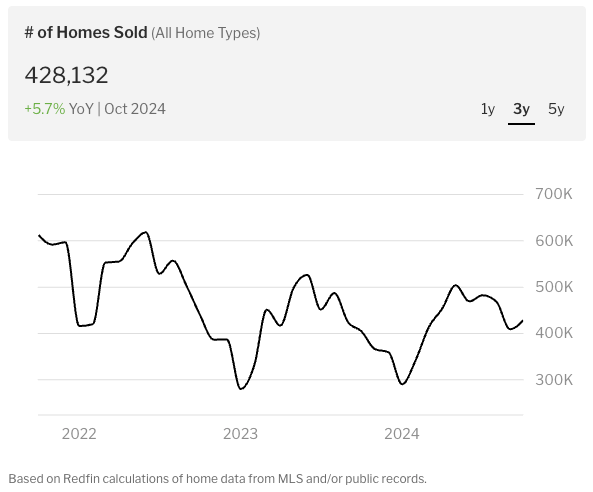

Sales of previously owned homes rose 3.4% in October compared to September, reaching an annualized rate of 3.96 million units. This marks the first year-over-year increase in over three years, with sales climbing 2.9% from October 2023. A temporary drop in mortgage rates during August and September likely fueled this surge. However, rates have since rebounded, sitting at 7.05% for a 30-year fixed mortgage.

Despite improved inventory—up 19.1% from a year ago—the market remains tight, keeping prices high. The median sale price climbed 4% year-over-year to $407,200, driven by limited supply and stronger activity in higher-end properties. First-time buyers remain a small share of the market, constrained by rising costs and steep mortgage rates.

Meanwhile, unemployment claims continued their downward trajectory. Weekly applications for benefits dropped by 6,000 to 213,000, nearing seven-month lows. Continuing claims, however, edged up by 36,000 to 1.91 million, their highest level since 2021. This suggests some workers are struggling to find new jobs, even as layoffs remain low.

Both indicators reflect a U.S. economy navigating challenges but maintaining resilience.

Disclosures:

As of writing, AAPL and SQ are holdings in Titan's Flagship strategy, ESTC is a holding in Titan's Opportunities strategy, and IBIT is a holding in Titan's Crypto strategy. As of 10/31/2024, Anthropic is a 4.22% holding in the ARK Venture Fund.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.