Three Things (1/8)

Jan 8, 2025

Pentagon blacklist grows

U.S. sanctions hit Tencent

Trade tensions … The U.S. Department of Defense has added Tencent (TCEHY) to its list of “Chinese military companies,” accusing the tech giant of ties to China’s military-industrial complex. This designation bars Americans from investing in the company and underscores deepening friction between the world’s two largest economies. Tencent, traded in Hong Kong and known for its global dominance in gaming and social media, saw its shares tumble following the announcement.

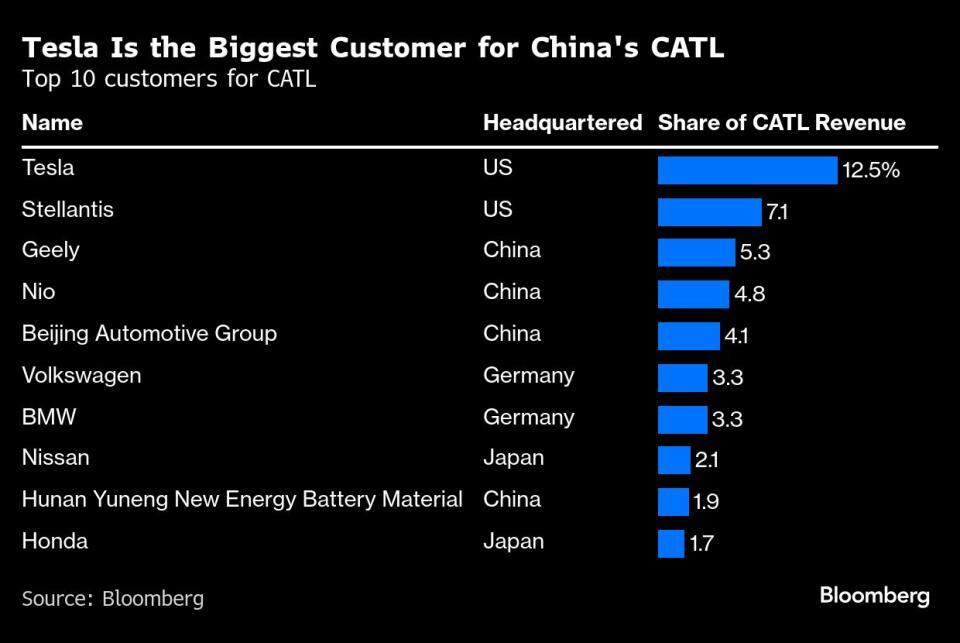

The Pentagon’s list, authorized under the Defense Authorization Act, targets companies believed to support China’s military through technology or funding. Alongside Tencent, EV battery-maker CATL and AI leader SenseTime were also blacklisted, further broadening the U.S.’s crackdown on Chinese firms.

Tencent’s inclusion is particularly notable. Best known for its flagship app WeChat and ownership stakes in global gaming brands, the company plays a pivotal role in China’s tech ecosystem. Its market influence stretches far beyond China’s borders, making this move a significant blow.

Critics of the blacklist argue that such decisions are often opaque, relying on classified intelligence to justify sweeping actions. Meanwhile, Beijing has condemned the U.S.’s efforts, framing them as economic suppression rather than legitimate national security measures.

Meta eases fact-checks

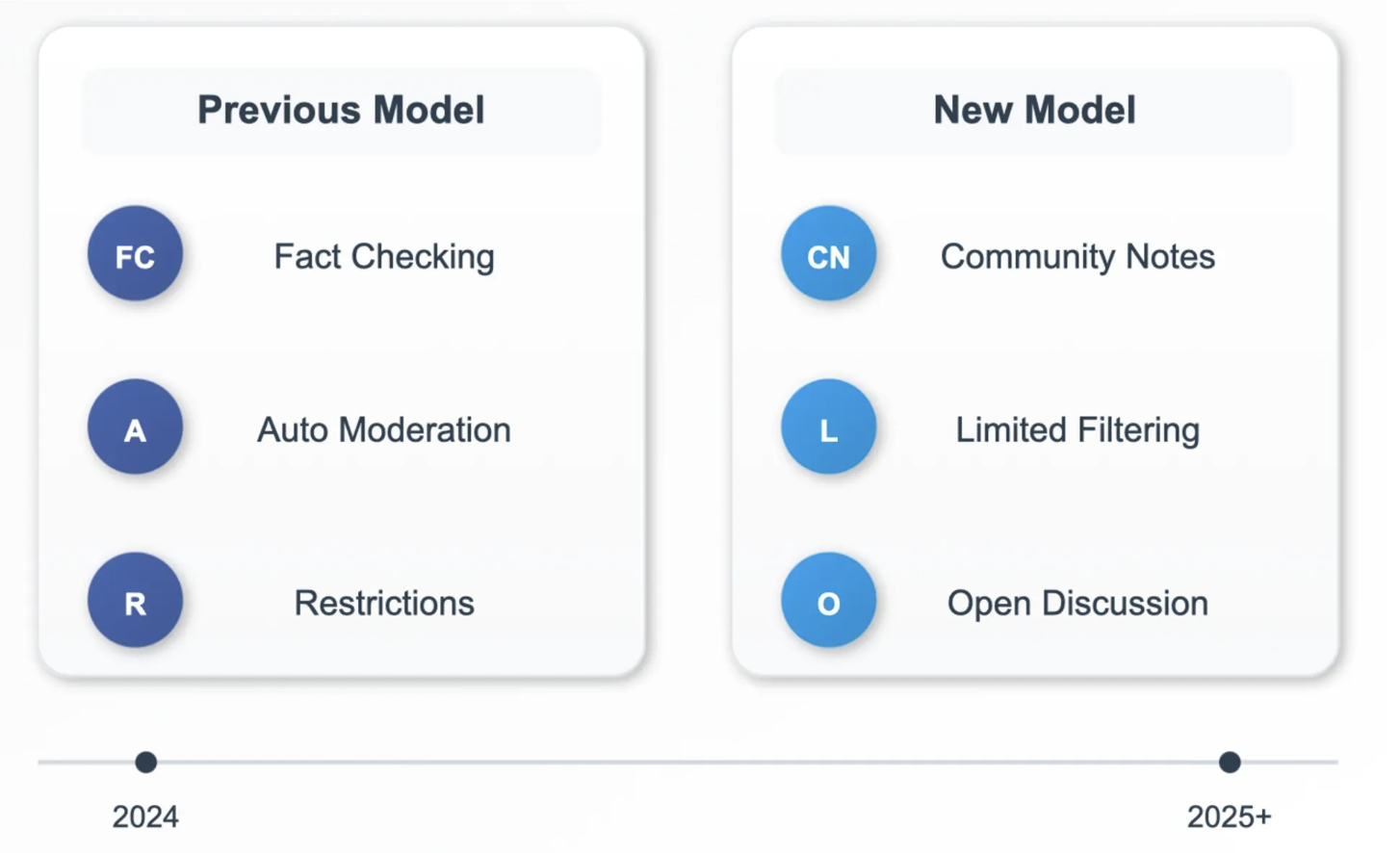

Policy pivot … Meta (META) announced a significant shift in its free speech policy on Tuesday, signaling a move toward fewer restrictions on political content and less reliance on moderation. The policy update, detailed in a blog post titled “More Speech, Fewer Mistakes”, reflects CEO Mark Zuckerberg’s belief in the importance of open dialogue, even at the expense of potential inaccuracies.

Key changes include a reduction in content moderation, especially on political posts, and an end to fact-checking claims made by public figures. The new stance aligns with Zuckerberg’s long-standing view that social media platforms should not act as the “arbiter of truth.” Critics warn this could lead to a surge in misinformation during critical events like elections.

The move comes as Americans continue to struggle with identifying misinformation online. One study found that while only 17% of people admitted to falling for misinformation weekly, 35% thought their friends or family did, showing we tend to overestimate our own media smarts. Other studies show that media literacy remains low nationwide, with fewer than 1 in 5 adults receiving formal training.

In other Meta news, the company has added three new board members: UFC President Dana White, auto tycoon John Elkann, and tech investor Charlie Songhurst, while former members Peggy Alford and Tony Xu exit amid Zuckerberg’s closer ties with the president-elect.

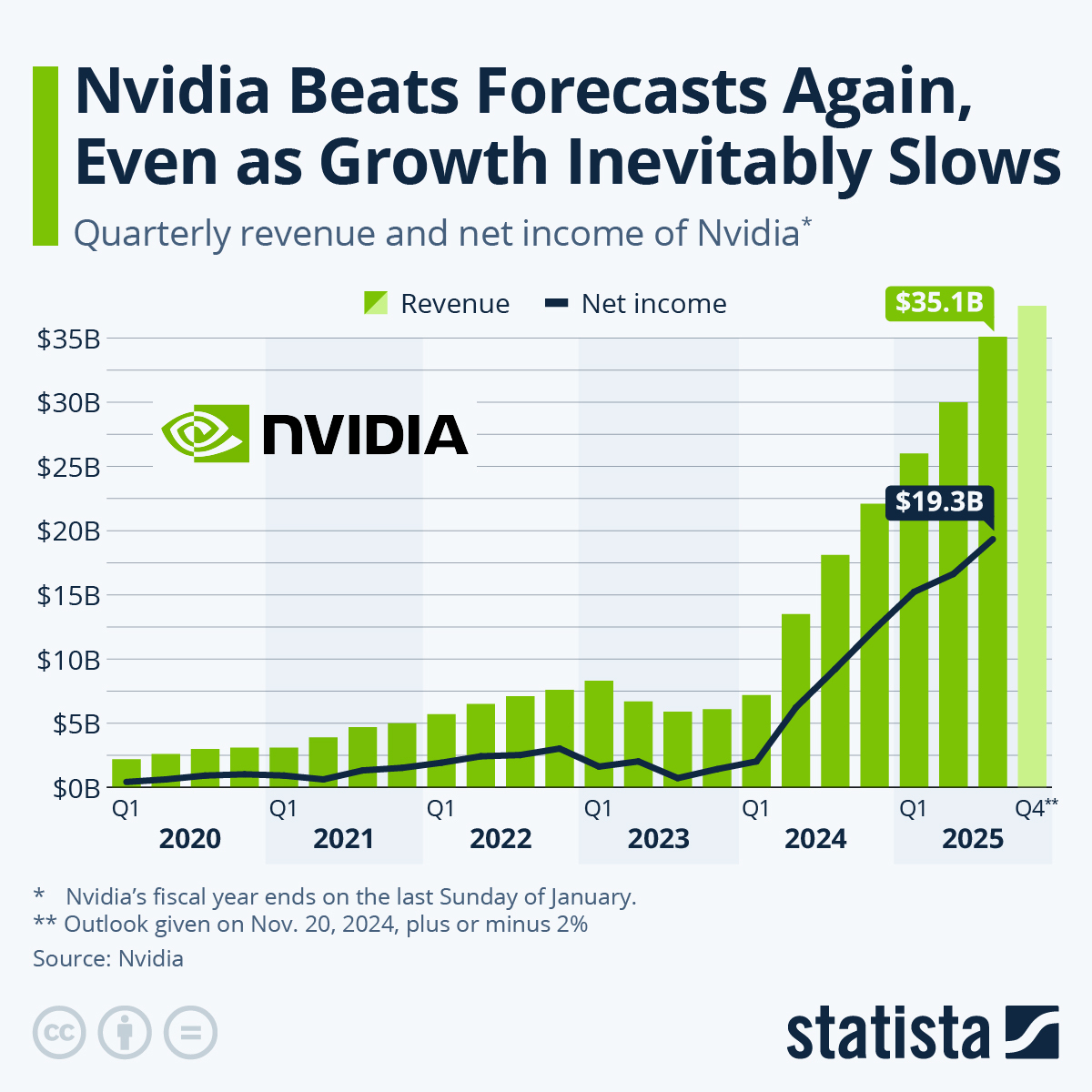

NVIDIA rises, then falls at CES

From Vegas … At this year’s Consumer Electronics Show, NVIDIA (NVDA) CEO Jensen Huang delivered a keynote that highlighted the company’s vision for AI, gaming, and sustainability. CES, known for debuting transformative technologies, served as the stage for several key updates from the semiconductor giant.

Among the announcements was NVIDIA’s new Cosmos AI platform, designed to enhance the capabilities of robotics and autonomous systems. This platform enables robots and self-driving cars to navigate and adapt more effectively to real-world environments, bringing advanced AI closer to practical applications.

On the gaming front, NVIDIA unveiled its Blackwell RTX 50 Series GPUs, which deliver significant performance improvements for PC gamers. These next-generation chips double processing power while offering enhanced ray-tracing for lifelike visuals, promising a leap forward for gaming enthusiasts.

Huang also emphasized the company’s commitment to sustainability, sharing plans to achieve a fully carbon-neutral supply chain by 2030.

Initially, the announcements appeared to excite investors, with the stock hitting a record high during the event. However, in the aftermath, shares declined by 2.5%. Analysts attributed this to concerns over valuation and a lack of immediate revenue-driving products, highlighting the challenges of maintaining momentum after such high expectations.

One more thing: Major U.S. stock exchanges, including the NYSE and Nasdaq, will close on Thursday, Jan. 9 for a National Day of Mourning honoring former President Jimmy Carter, while bond markets will close early at 2:00 PM ET. The closures coincide with President Biden’s official proclamation marking the state funeral for Carter, who passed away on Dec. 29.