Three Things (1/13)

Jan 13, 2025

Sneak(er) attack

Skechers hits its stride

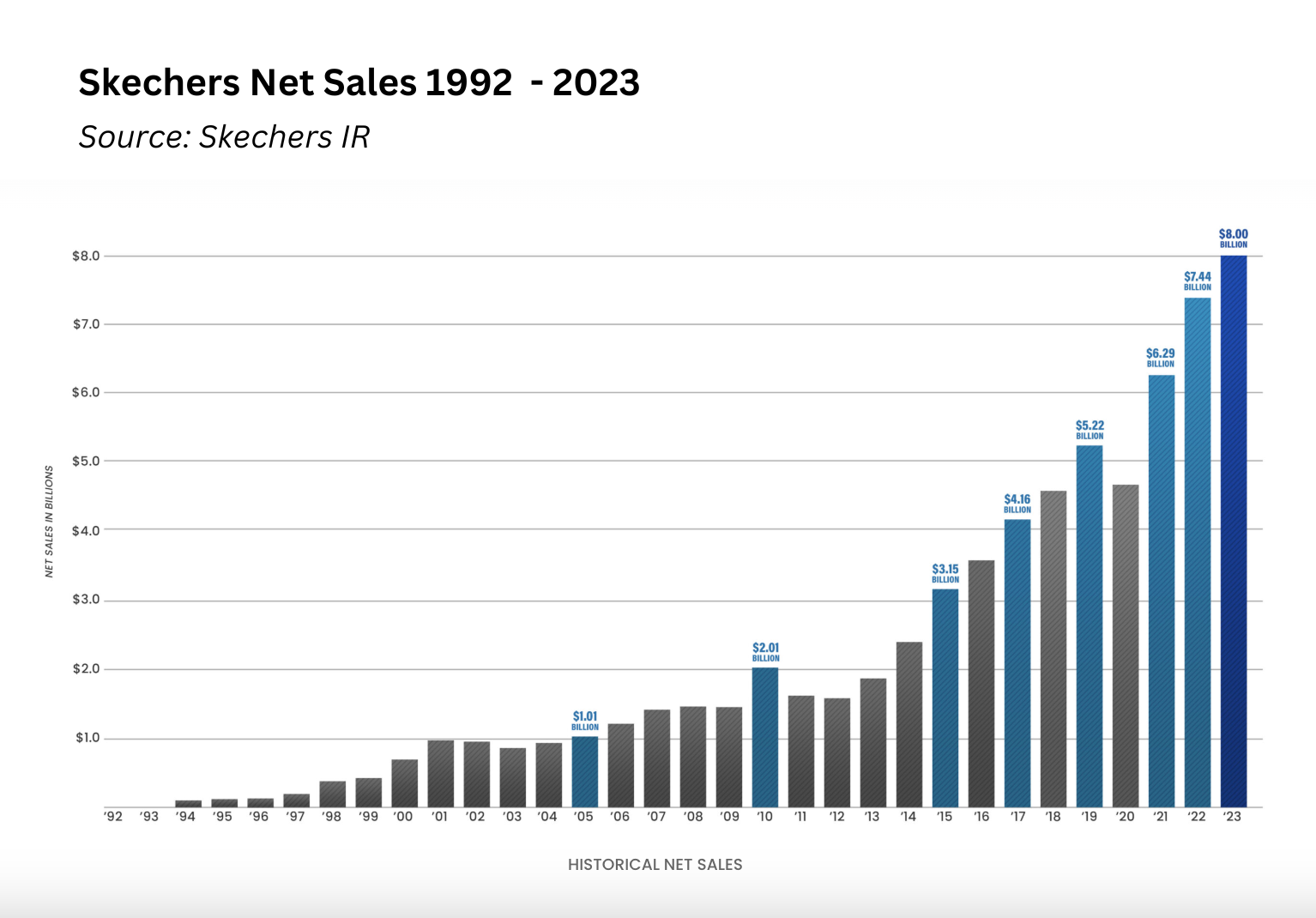

What are those? … Skechers (SKX) is no longer seen as a vestigial sneaker brand of the 90s—it’s a serious contender in the global footwear market. A new Wall Street Journal report outlines how the company’s strategy of focusing on practical, everyday shoes for overlooked consumers has transformed it from an industry afterthought into a booming success story.

Skechers skeptics might not realize how much ground the brand has gained. According to a 2023 Harris Poll, Skechers ranked in the top five most popular footwear brands among U.S. adults, with strong marks for comfort, value, and quality.

Skechers’ approach is paying off with consistent stock growth and record-breaking financial performance. In Q3 2024, the company reported $2.7 billion in revenue, a 13.5% year-over-year increase, while net earnings surged 77.6%. A key factor in this growth has been its international expansion, particularly in China, which has become a critical driver of revenue gains.

Adding to its appeal, Skechers has built a surprisingly relatable roster of brand ambassadors, including Chiefs head coach Andy Reid, who promotes the brand’s easy-to-wear slip-ons, and celebrities like Snoop Dogg and Martha Stewart. These endorsements have helped Skechers connect with a broader audience, reinforcing the brand’s reputation for blending comfort, functionality, and style.

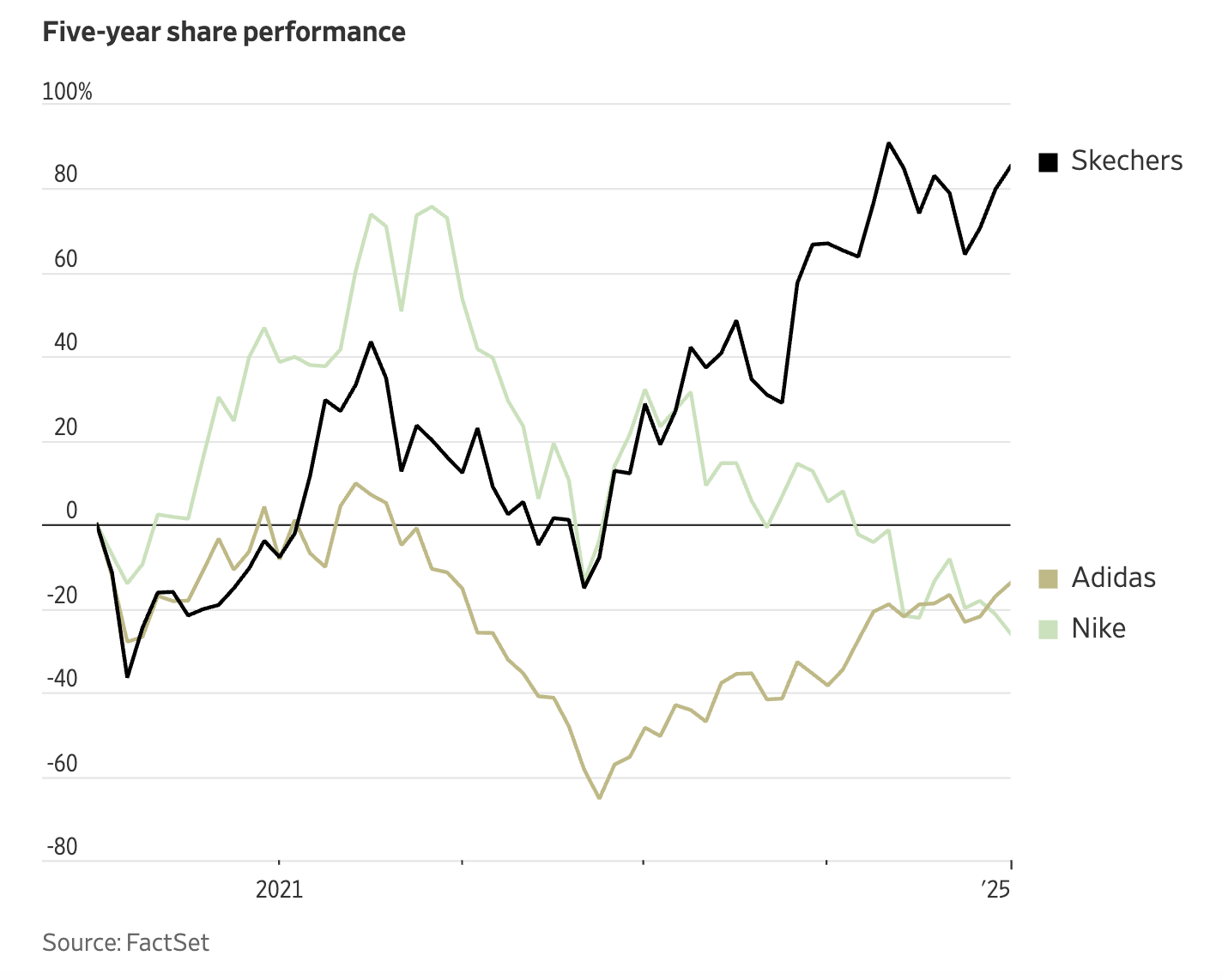

With its next earnings call scheduled for Feb. 8, all eyes are on whether Skechers can sustain this momentum. Nike stock is down 30% over the past 5 years, while Skechers is up 65%.

Jobs and jitters

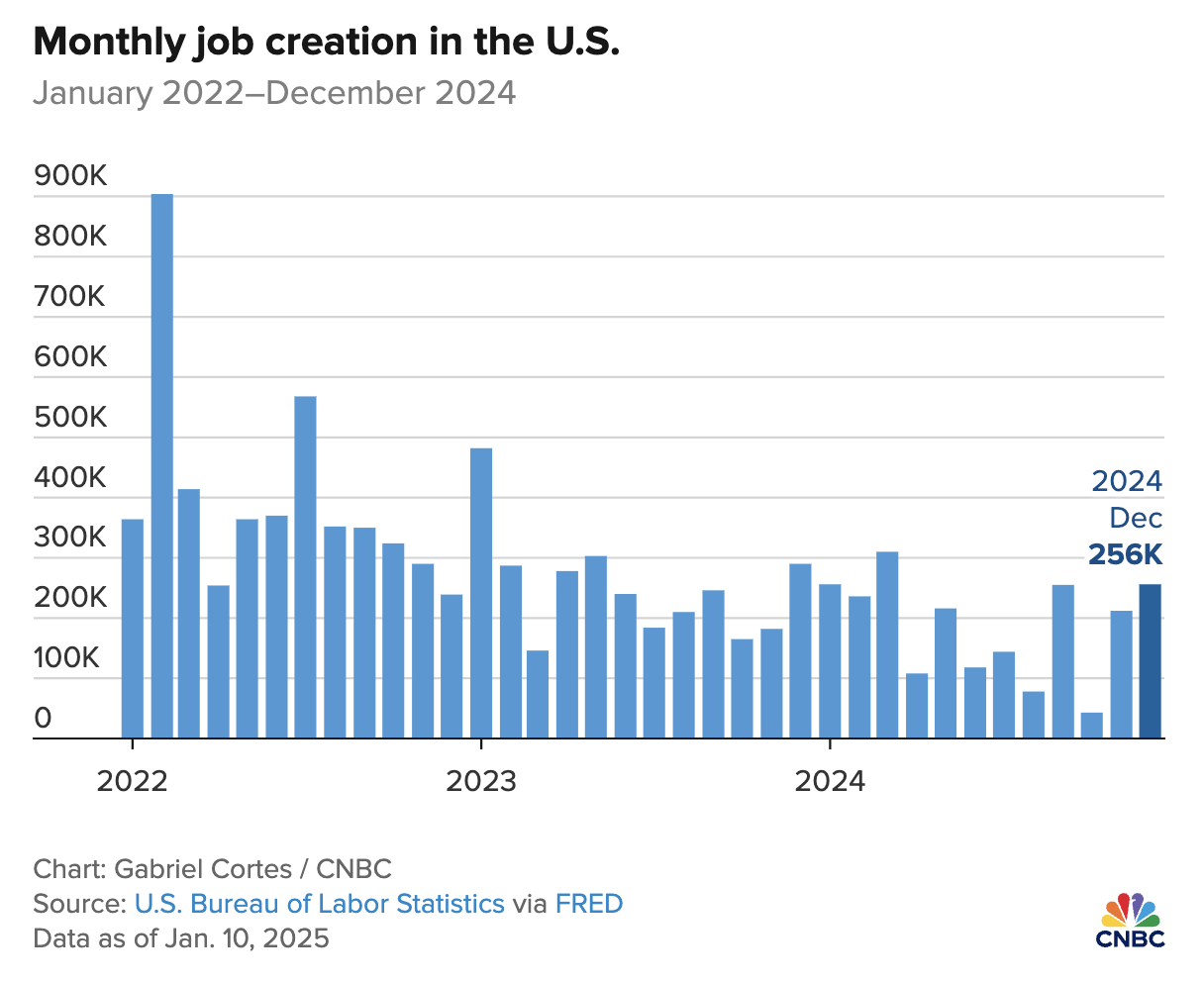

Stocks drop … The Jan. 10 U.S. jobs report showed surprising strength, with 350,000 jobs added in December, far surpassing economists’ expectations of 200,000. The unemployment rate held steady at 3.5%, its lowest in decades. However, this robust labor market has left investors nervous.

Wall Street reacted sharply to the latest numbers. The S&P 500 dropped 1.2% on Friday as traders recalibrated expectations for interest rate hikes. A strong labor market could pressure the Federal Reserve to continue its aggressive stance to tame inflation, a move that historically dampens stock performance. Bond yields also climbed, reflecting concerns over higher borrowing costs ahead.

The jobs report wasn’t all good news. Despite headline growth, wage increases slowed to 3.9% year-over-year, down from 4.3% in November. This hints at cooling inflation but raises questions about whether wage stagnation will impact consumer spending. Meanwhile, layoffs in tech and finance are mounting, signaling potential turbulence for white-collar workers despite broader gains. Among the companies already trimming down in 2025 are BlackRock (BLK) and Microsoft (MSFT).

Analysts say the stock market’s start to 2024 feels reminiscent of 2016—a year marked by early volatility. However, this time, the economy’s resilience amid high interest rates adds a new layer of complexity.

Trend-tracking: Agentic AI

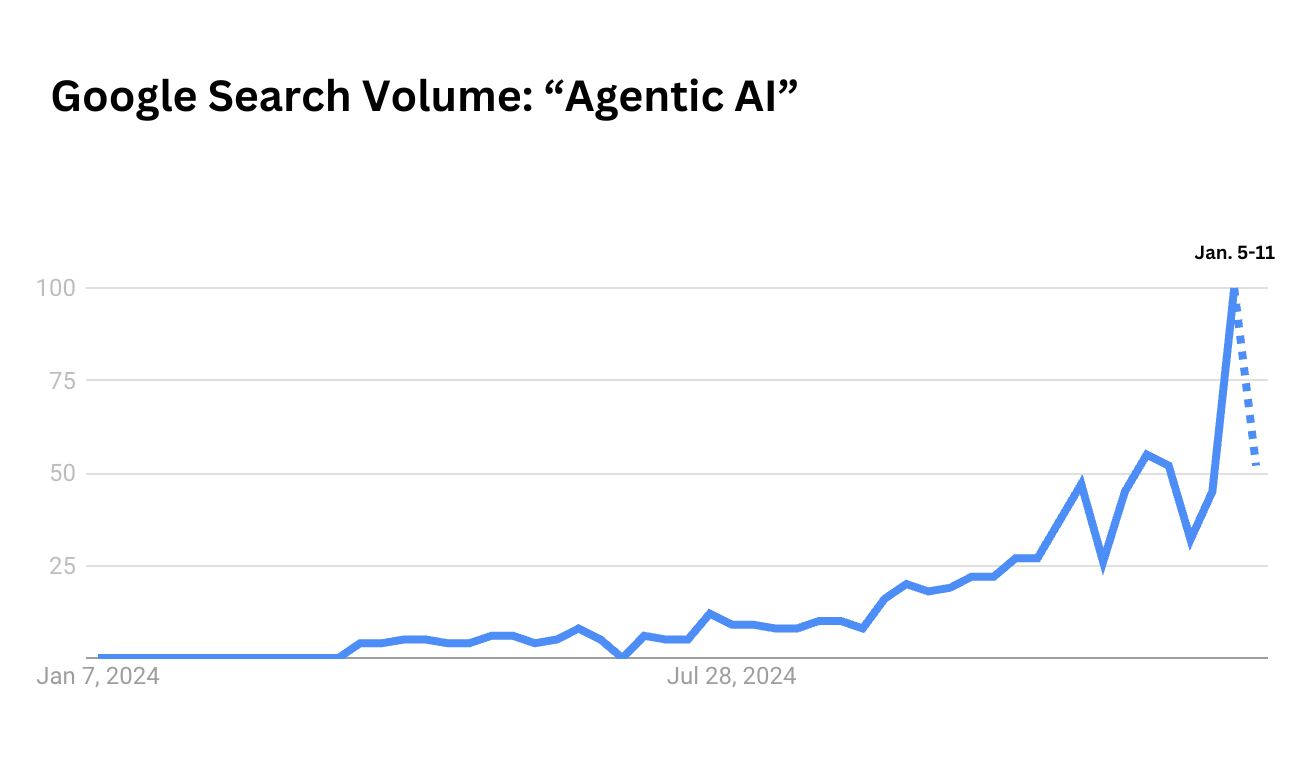

Behind the buzz … The term “agentic AI” is already everywhere in 2025, reshaping industries and redefining the future of work. But what does it mean, and why does it matter for investors?

This next generation of artificial intelligence operates autonomously, making decisions and executing tasks without human intervention. Unlike traditional AI, which relies on programmed instructions, agentic AI combines machine learning, natural language processing, and advanced algorithms to analyze data, evaluate options, and act independently. It’s like giving software a mission and letting it figure out the best way to achieve it—whether that’s optimizing supply chains, executing financial trades, or managing customer service issues in real-time.

This technology is already reshaping industries. Businesses are using agentic AI to cut costs and improve efficiency in logistics, finance, and healthcare. While it boosts productivity, the shift comes with challenges, especially in the job market. McKinsey estimates AI could automate tasks representing up to 30% of global work hours by 2030, displacing roles like data entry and customer service. However, new opportunities—such as AI oversight roles—are emerging.

Some companies making moves in agentic AI include:

Salesforce (CRM): Agentforce 2.0 will debut in February 2025, streamlining AI deployment across departments.

Nvidia (NVDA): Announced Cosmos for autonomous machines and task automation at last week’s CES event.

Microsoft (MSFT): In November, announced autonomous agents to manage tasks like supply chain invoicing. (Source: AP News)

Looking at impacts across the AI supply chain, agentic AI systems need constant access to live data and real-time processing to work effectively. This creates a higher demand for advanced computing power, secure data systems, and scalable cloud platforms to support their complex decision-making and operations.

Looking to learn more? See UC Berkeley’s comprehensive long-read on the topic.

One more thing: It’s game over for Venu Sports, the would-be streaming service backed by Disney (DIS), Fox (FOXA), and Warner Bros. Discovery (WBD). The companies involved forfeited plans after facing scrutiny over potential antitrust concerns. This move highlights increasing regulatory pressures on media consolidation and signals a shift in how major players navigate the competitive sports streaming landscape.