Three Things (1/15)

Jan 15, 2025

Diamonds aren’t forever

Diamonds, disrupted

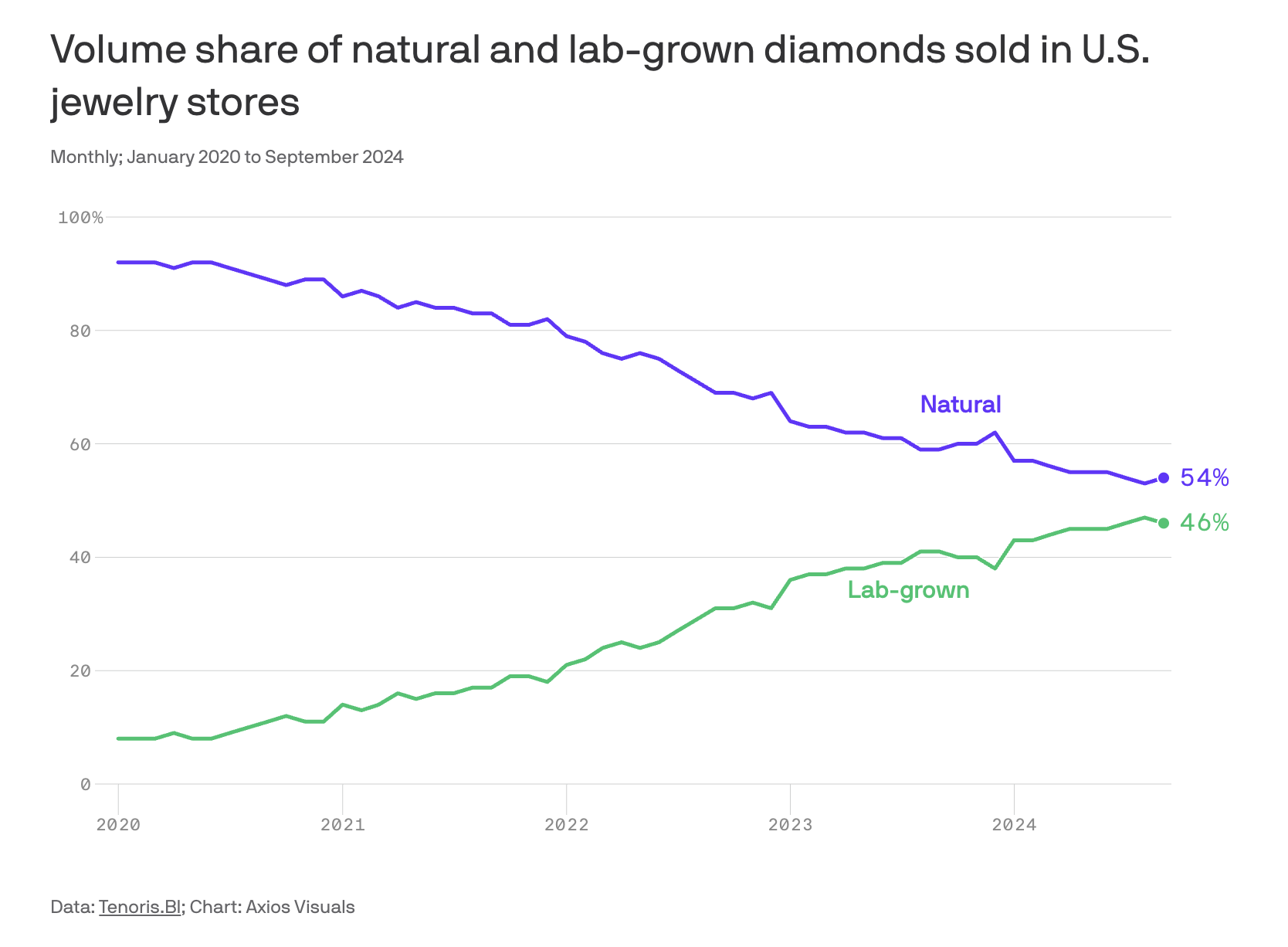

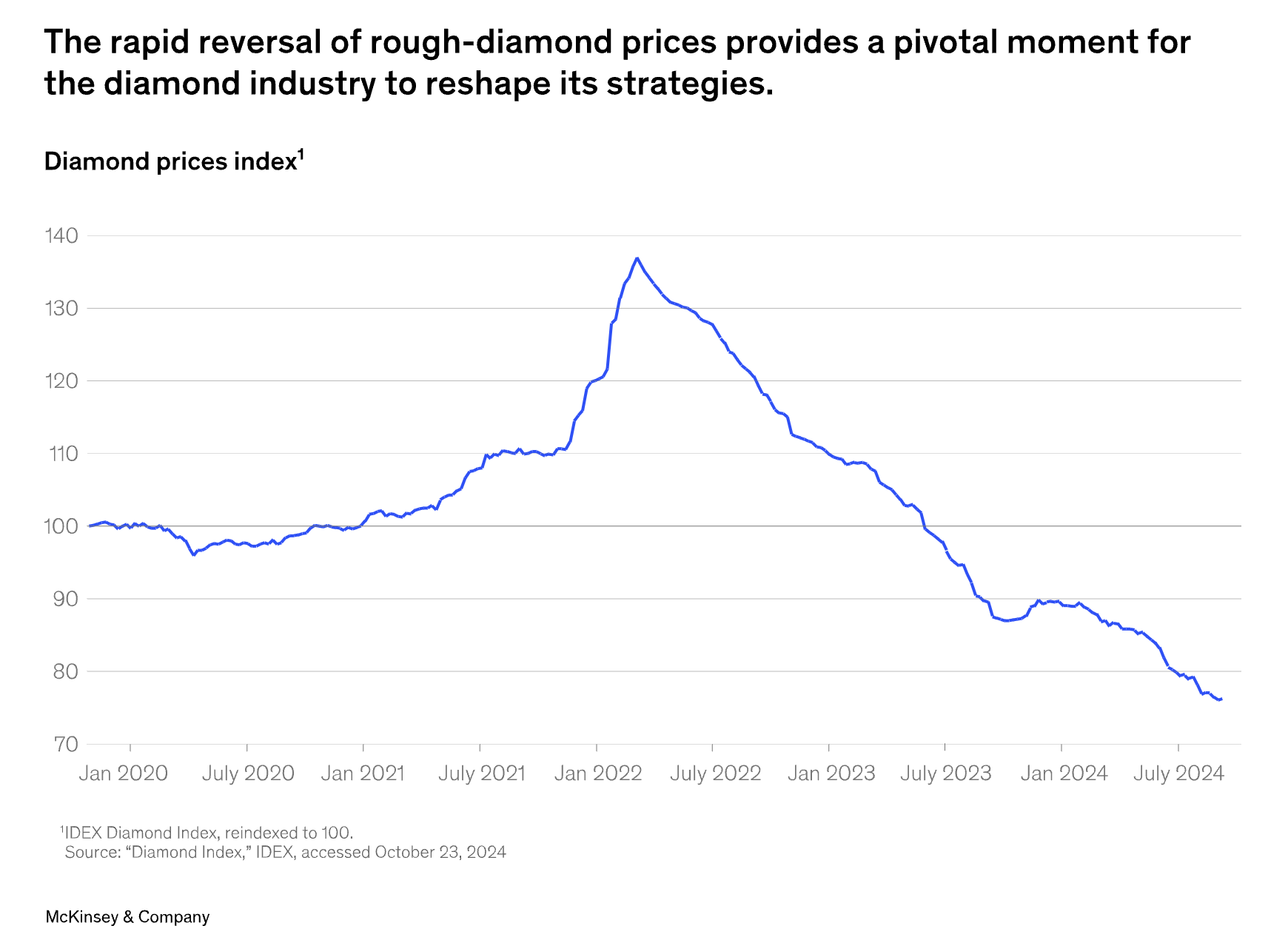

Imitation ice … Lab-grown diamonds are transforming the luxury jewelry market, capturing consumer interest with their affordability and eco-conscious appeal. Sales of lab-grown diamonds have soared by 63% from 2020 to 2023, while natural diamond sales have declined by 15% during the same period. Lab-grown diamonds now account for 14% of the diamond market by revenue—a figure expected to reach more than 21% by 2025.

The draw? Cost. Lab-grown stones are about 30-40% cheaper than their mined counterparts. A 1-carat lab diamond averages $2,500, while a similar natural diamond costs $4,000 or more. Additionally, growing environmental and ethical concerns around mining have nudged younger, sustainability-conscious buyers toward lab-grown options.

This shift has shaken the metals and mining industry, with miners experiencing reduced demand. Natural diamond producers are exploring ways to bolster their appeal, including enhancing transparency in their sourcing processes.

Meanwhile, jewelers are adapting. DeBeers has a lab-grown sub-brand called Lightbox, Pandora saw a nearly 90% increase in lab-grown sales YoY, and Effy just announced a new collection made entirely of lab-grown products. This strategy has enabled retailers to meet diverse customer preferences without alienating traditional buyers.

Gen Z sobers up

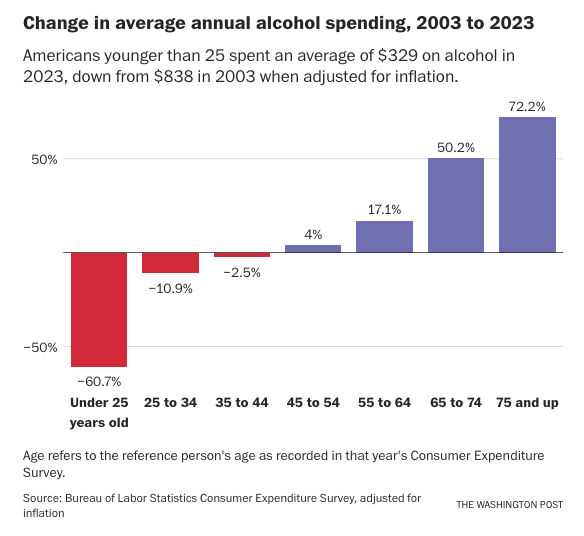

Drying demand … Americans are partying less—and the data shows it’s more than a passing trend. The Atlantic highlights a significant cultural shift: fewer late nights out, less bar hopping, and a growing preference for sober socializing. This lifestyle pivot comes as the U.S. Surgeon General warns of alcohol's health risks, including its links to cancer and addiction.

Gen Z is leading this shift. This generation drinks 20% less than Millennials did at their age. The reasons vary: health consciousness, financial prudence, and a quest for authenticity. Millennials, though, remain the largest drivers of alcohol purchases today, balancing a penchant for cocktails with a rising interest in non-alcoholic options.

Alcohol sales overall have slowed, with beer suffering the most. Yet the non-alcoholic sector is thriving. Part of this is due to the normalization of sober lifestyles: a new Ipsos survey finds that 80% of NA drinkers say that their choices are more socially acceptable than they were 5 years ago. NA beer brand Athletic Brewing recently hit an $800 million valuation after raising $50 million in July 2024. Its revenue growth heading into 2025 is the strongest in its category, fueled by creative campaigns and a loyal consumer base.

Even celebrities are in on the action. Katy Perry’s De Soi—a line of NA cocktails—targets luxury sober drinkers (an 8 oz. serving retails at ~$5). Traditional brands are adapting too: Guinness Zero (DEO) and Heineken Zero (HEINY) have joined the race for alcohol-free innovation.

Keep scrolling, Elon

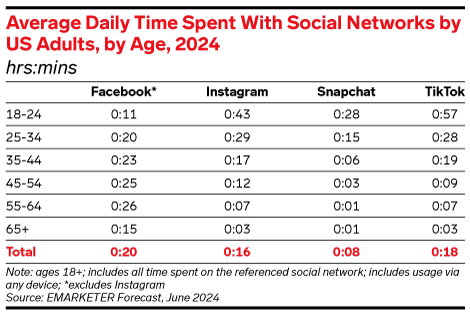

Rumors denied … ByteDance has dismissed speculation that it’s negotiating with Elon Musk to sell TikTok amid growing pressure in the U.S. to ban the app. The company called the reports “completely false,” following claims that Chinese officials might be weighing such an option.

This denial comes as TikTok faces mounting scrutiny from U.S. lawmakers over national security concerns. Critics fear the app could share user data with the Chinese government, a claim TikTok has repeatedly denied. The U.S. Supreme Court is expected to rule on Jan. 19 regarding a proposed ban that could force the app off millions of devices.

TikTok users, especially its younger demographic, have responded with everything from petitions to tongue-in-cheek videos lamenting a potential ban. Others are flocking to alternative Chinese-owned platforms, like RedNote, which hit No. 1 in the App Store.

As for the likelihood of a ban? Analysts believe it’s a real possibility, but the timing remains unclear. Even if approved this weekend, implementing a nationwide ban could take months due to logistical and legal hurdles. ByteDance plans to appeal if the ban is upheld.

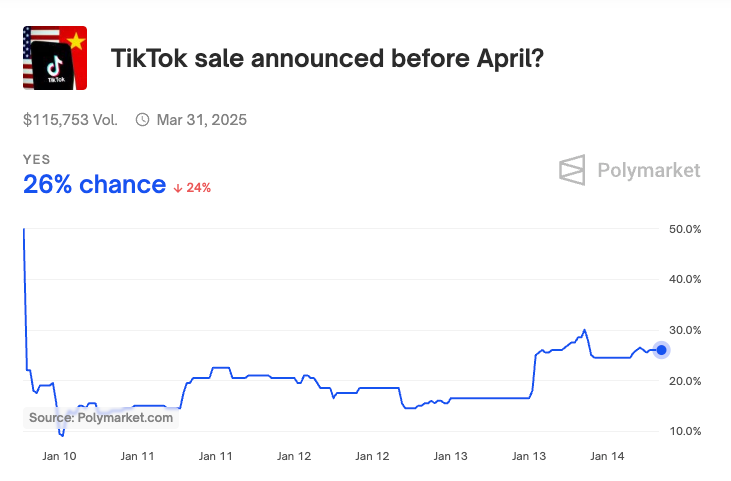

Unsurprisingly, Polymarket bettors are weighing in.

If TikTok exits the U.S., platforms like Instagram (META) and Snapchat (SNAP) may see a surge in users. Meta and Snap could capitalize on TikTok’s absence, potentially gaining a larger share of the short-video content market. Or, perhaps an old favorite, Vine, will be resurrected. Elon Musk polled X users in April, and 70% said they wanted him to bring back the app.

One more thing: Moderna (MRNA) just cut its 2025 sales forecast, mainly because demand for its COVID-19 vaccine is dropping faster than expected. They’re also facing delays in launching new products, which is adding to their financial challenges.