Three Things (1/17)

Jan 17, 2025

Alphabet’s next act, Bezos blasts off, and Shoppers showed up

Alphabet’s next act

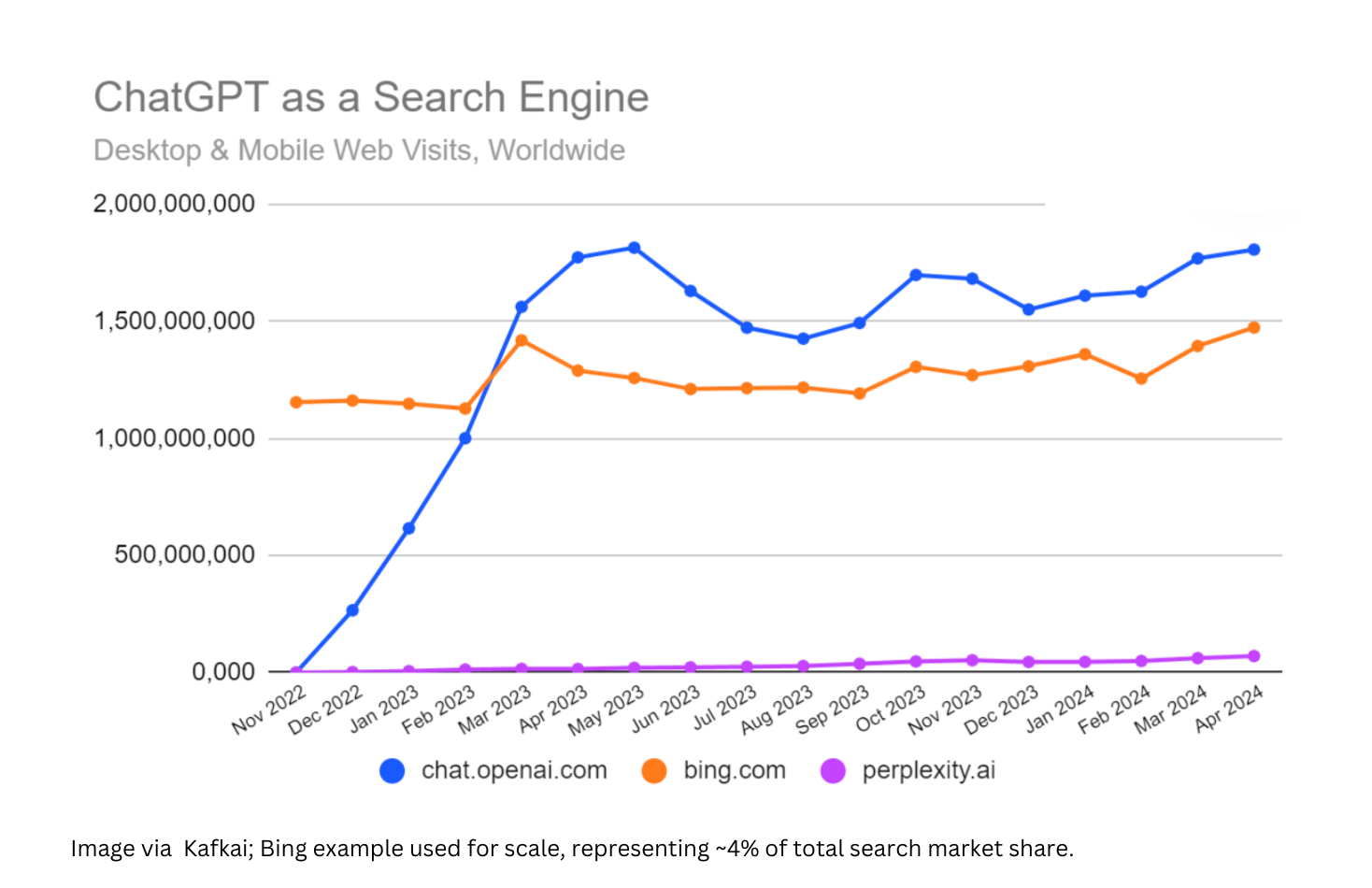

A-minus … For decades, Google has dominated the search market, but its share dipped below 90% in 2024 for the first time since 2015. The real issue; however, is less about users bouncing to other search engines and more about fundamental changes to the way people find stuff online.

In the U.S., more people are turning to AI-powered tools for online searches. A recent Statista report showed a rising trend of adults using generative AI as their go-to method for finding information online. What’s more, younger generations are increasingly turning to alternative platforms like TikTok and Instagram to “search it up” rather than “Google it.” That means less clicking on paid search ads.

Search advertising has long been the bedrock of Alphabet’s revenue, contributing 56% of total income. Over the years, Alphabet has diversified its ad platforms to include YouTube, Google Display Network, and tools like Performance Max, which provide tailored ads across multiple Google services. However, even with this diversification, investors remain wary of the company’s heavy reliance on search.

Outside of ads, Alphabet is betting big on growth areas like Google Cloud, which accounted for 12% of its revenue in 2024, generating over $4 billion in operating income. Subscription services, including YouTube Premium, have also gained traction, contributing $15 billion annually. Alphabet executives are also doubling down on AI innovation, which they hope will sustain growth and defend its position in search.

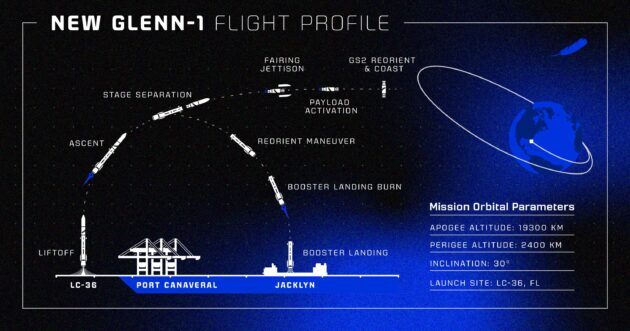

Bezos blasts off

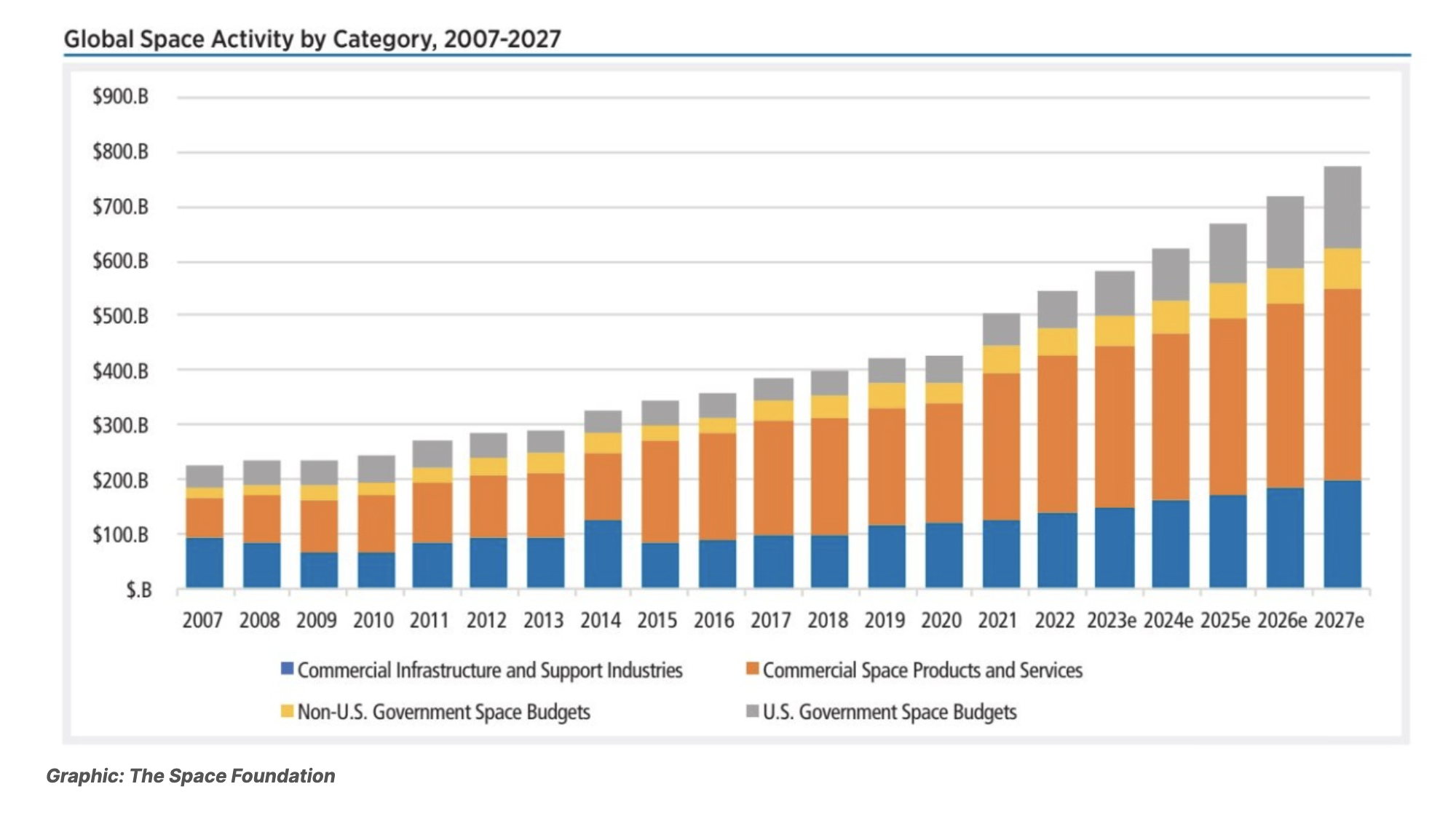

Space race … Jeff Bezos-backed Blue Origin successfully launched its New Glenn rocket from Cape Canaveral, marking a critical milestone in the space race. The mission carried the Blue Ring Pathfinder satellite into orbit, proving the company’s heavy-lift capabilities. This debut puts Blue Origin closer to competing with SpaceX in the commercial space industry, expanding its footprint in satellite launches and future deep-space missions.

The broader implications of this launch are significant. The global space economy, valued at over $600 billion, is expected to exceed $1 trillion by 2040. This growth isn’t limited to rocket launches. Investors are funneling capital into satellite networks, space tourism, manufacturing, and data analytics. For example, ARKX, an ETF focused on the space economy, includes companies like Rocket Lab (RKLB), Amazon (AMZN), and John Deere (DE), which reflect the diversity of investing angles in the sector.

Private and public interest in space continues to skyrocket. Alumni Ventures points to infrastructure and logistics as key investment areas, with commercial applications ranging from Earth observation to asteroid mining. (Asteroid mining involves extracting valuable resources like metals, water, and minerals from asteroids for use in space and on Earth.)

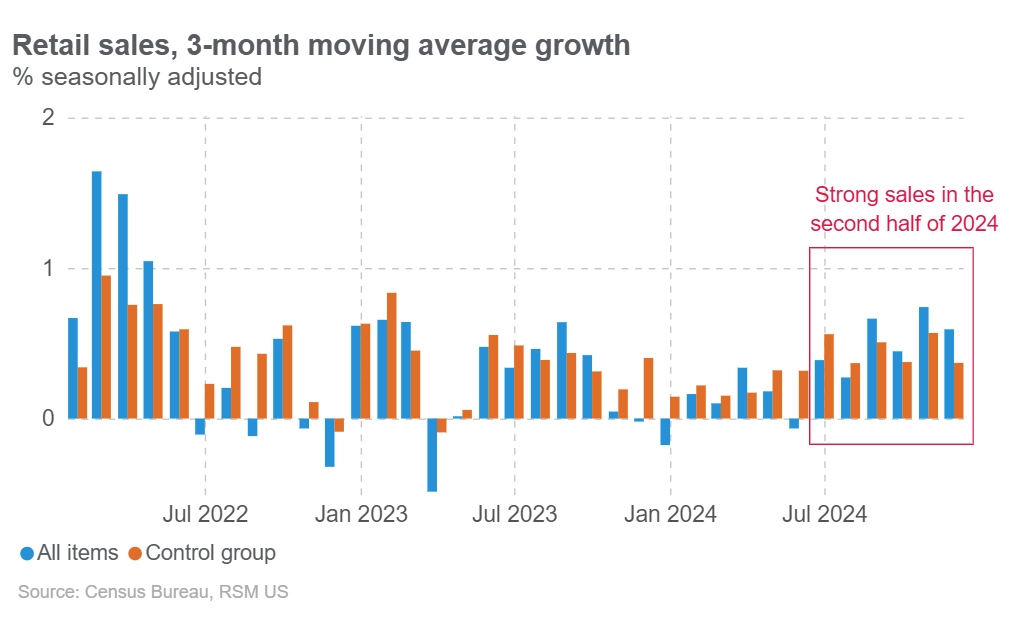

Shoppers showed up

Retail rush … U.S. retail sales surged in December, wrapping up the holiday season with a 0.9% increase from November and a 3.1% year-over-year jump, according to Commerce Department data. The gains came as consumers took advantage of early discounts and last-minute deals.

Notably, spending at general merchandise stores and online retailers was robust. However, sales at electronics stores declined, reflecting ongoing challenges in the sector. Analysts say the strong retail performance suggests a resilient economy, buoyed by low unemployment and moderating inflation.

Target (TGT) released its own holiday sales figures this week, revealing a 5.7% increase in revenue for the quarter compared to the prior year. The company attributed this growth to strong demand for toys, home goods, and essentials during the holiday season. Despite higher revenues, profits fell 13%, driven by markdowns, rising labor costs, and a one-time charge related to restructuring. Despite increased revenue guidance, TGT faltered on the news, with its share price down roughly 5% following the report.

One more thing: Hindenburg Research, the firm famous for uncovering major corporate frauds like the Adani Group scandal, is shutting down as founder Nate Anderson steps away for personal reasons. Before closing, Anderson plans to make Hindenburg’s investigative methods public, marking the end of a firm that reshaped how investors think about corporate accountability.