Three Things (1/27)

Jan 31, 2025

DeepSeek panic sets in

AI arms race heats up

That was fast … DeepSeek, a Chinese AI startup, is making headlines with the release of its R1 model, raising concerns in the U.S. about the shifting dynamics in artificial intelligence. Founded by hedge fund manager Liang Wenfeng, DeepSeek has developed AI models that rival those from American companies like OpenAI and Anthropic. Notably, DeepSeek’s R1 model matches the performance of OpenAI’s GPT but was developed at just 3% of the cost.

How does DeepSeek stack up with Western AI platforms? For one, R1 employs reinforcement learning, which means it can self-improve without human supervision. This approach contrasts with models like GPT and Claude, which rely on supervised fine-tuning. Further, the open-source nature of DeepSeek’s models creates an advantage as people can collaborate, share ideas, and improve the technology at a faster clip. Meta’s chief AI scientist recently admitted that “open-source models are surpassing proprietary ones.”

Then there’s the cost advantage. The development cost of DeepSeek’s R1 was just $5.6 million, significantly lower than the $100 million to $1 billion range cited by other AI developers. This can be attributed to the self-learning nature of the technology, as well as lower development costs in China (e.g. access to cheap labor and infrastructure).

DeepSeek excels at problem-solving, creative tasks, and research, but as one tester pointed out, there are limitations due to censorship.

DeepSeek’s release largely took Silicon Valley by surprise, and U.S. tech leaders are expressing concern that China’s rapid progress in AI could threaten the nation’s edge in economic and national security—a competition that’s poised to shape the future of global power.

Why meme coins are multiplying

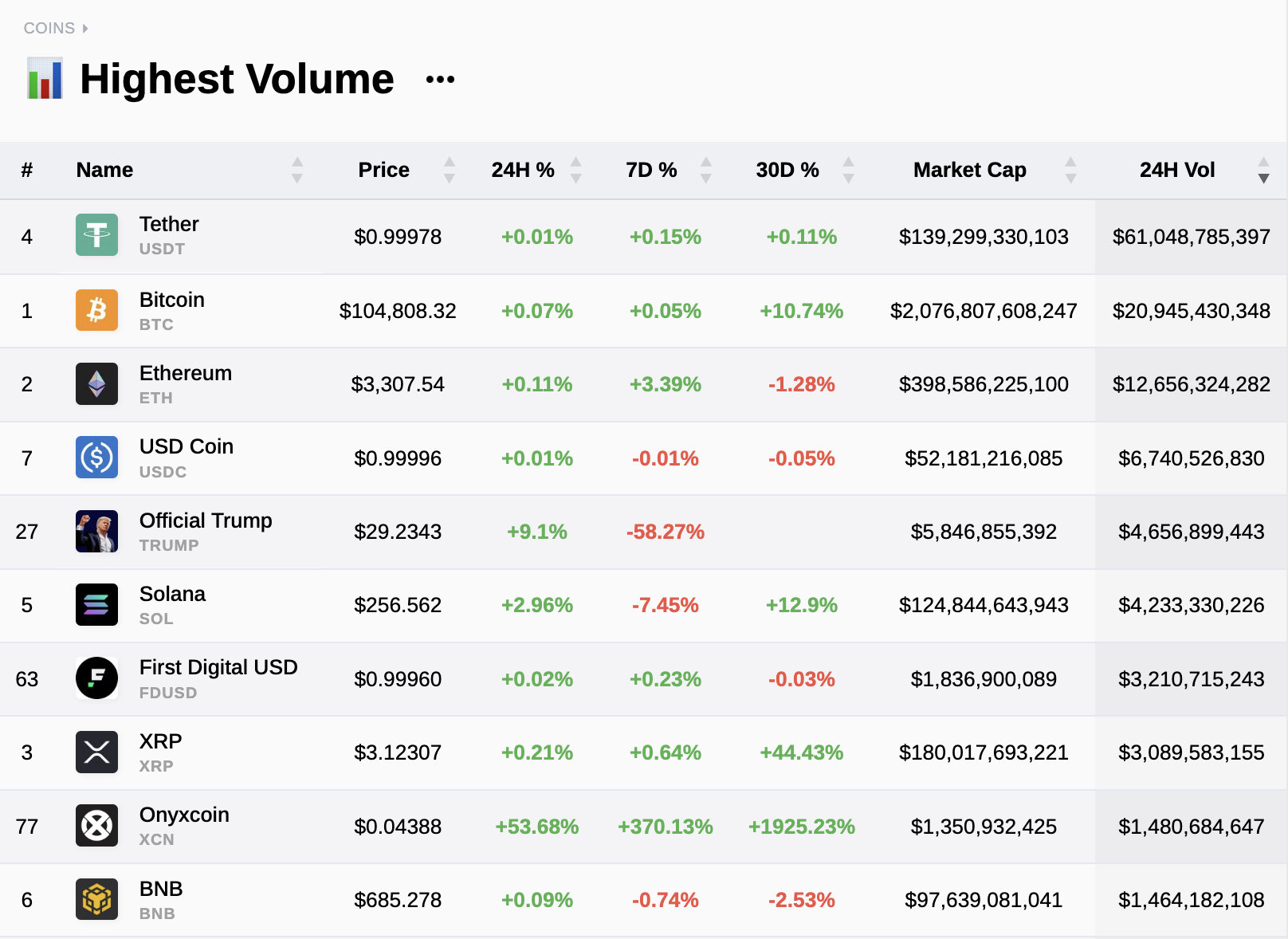

Always be minting… In 2025, the creation of meme coins has surged dramatically. Reports indicate that up to 100,000 new meme coins are minted daily, with numbers spiking during viral events. Tokens like $TRUMP and $FARTCOIN (yes, that’s a real thing) aren’t about utility or “digital gold” status like Bitcoin. Instead, they thrive on trends, hype, and whatever’s making headlines that week.

Platforms like Moonshot and Pump.Fun make it easy to mint and trade meme coins almost instantly. Solana (SOL) has become the blockchain of choice for these tokens because it’s fast, cheap, and built to handle the kind of high-volume action meme coins attract.

Take $TRUMP, for example—it shot up to $70 per coin and a $14 billion market cap before taking a nosedive when $MELANIA launched. The dynamics here are noteworthy. The launch of $MELANIA created the perception that new coins could be introduced indefinitely within the Trump-themed crypto ecosystem, undermining confidence in $TRUMP’s scarcity. Even though $TRUMP’s supply ceiling remained fixed, investors feared its value would be diluted, leading to a selloff.

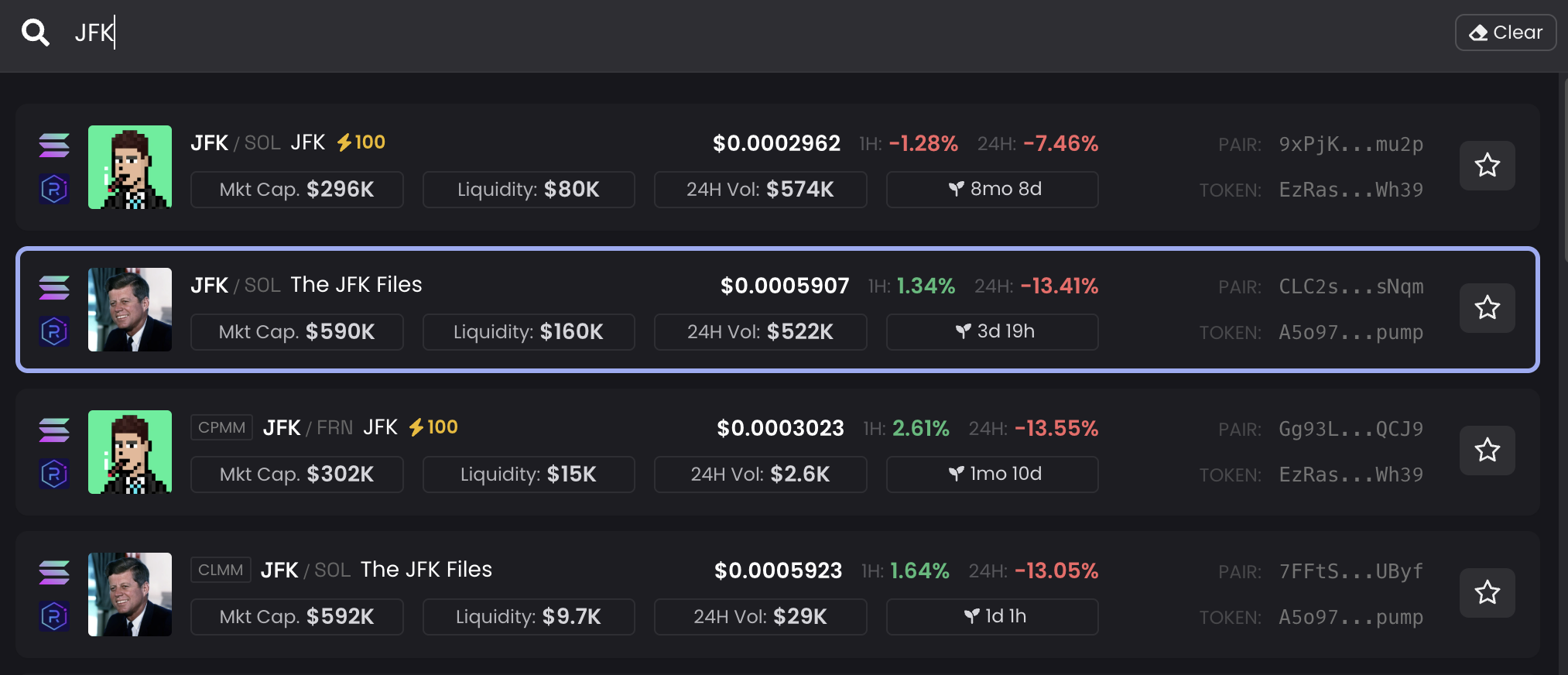

And in this day in age, everything is fair game. After it was announced that the JFK assassination details would be made public, enterprising coin-strikers minuted tokens like “The JFK Files,” seeking to capitalize on the virality of the moment.

Coinbase (COIN) CEO Brian Armstrong has called out outdated regulations, saying they make it impossible for exchanges to list tokens fast enough to keep up with the hype. Solana’s low fees and quick launches are great for meme coins, but “evaluating each one by one is no longer feasible … and regulators need to understand that applying for approval for each one is totally infeasible.” Instead, he advocates for moving from an allow list to a block list, and leveraging community comments and notes to help customers make decisions.

This week on Wall Street

It’s all happening … Here’s a look at major earnings and economic events on deck this week, which include highly quarterly updates from Apple and Meta, as well as a new interest rate decision from the Fed.

Today: AT&T (T) and SoFi Technologies (SOFI) report earnings. New Home Sales (Census) will be released at 10 AM EST.

Tuesday, 1/28: Boeing (BA), Lockheed Martin (LMT), Starbucks (SBUX), General Motors (GM), and JetBlue (JBLU) report earnings. Consumer Confidence data drops at 10 AM EST.

Wednesday, 1/29: Meta (META), Tesla (TSLA), T-Mobile (T), ServiceNow (NOW), UBS (UBS), Levi Strauss (LEVI), and Waste Management (WM) report earnings. We’ll also get an FOMC interest rate decision and press conference from Jerome Powell, who plans to serve until the end of his term in June 2026.

Thursday, 1/30: Apple (AAPL), Mastercard (MA), UPS (UPS), Caterpillar (CAT), Blackstone (BX), Atlassian (TEAM), Comcast (CMCSA), Intel (INTC), Deckers Outdoors (DECK), Southwest Airlines (LUV) and Sirius XM (SIRI) report earnings. The latest GDP numbers (Q4) will be released at 8:30 AM EST.

Friday, 1/31: AbbVie (ABBV) and Exxon Mobil (XOM) report earnings. Core PCE Price Index and Chicago PMI (manufacturing) data released.

One more thing: Home sales in 2024 hit their lowest level since 1995, with high interest rates and soaring prices making homes unaffordable for many buyers. Sales showed some improvement late in the year when rates dipped, but a rebound was limited as mortgage rates climbed back to around 7%. Without a significant drop in rates, experts say the housing market will remain sluggish despite small signs of normalization.

Disclosures

As of writing, META and MA are holdings in Titan's Flagship strategy.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.