Three Things (1/29)

Jan 31, 2025

Microsoft in the mix

Oh no, Nvidia

AI anxiety … Nvidia (NVDA) stock took a staggering 17% dive on Monday, wiping nearly $600 billion off its market cap—the largest single-day drop for a U.S. company in history. The GPU giant was shaken by market fears surrounding Chinese AI startup DeepSeek. The newcomer unveiled a breakthrough AI model built at significantly lower costs, sparking concerns about diminishing demand for Nvidia’s high-priced chips.

Nvidia, currently trading at a lofty 56x earnings, faced a reality check as investors reassessed its growth potential. This sharp decline sent ripples through markets, dragging the S&P 500 down by 2%—a rare feat for a single company.

Despite the chaos, retail investors rushed to buy the dip, with Monday marking a record-breaking influx of small investor capital into Nvidia shares. Data from Vanda Research showed retail traders scooped up $470 million in stock, banking on a rebound from a company that has historically dominated the GPU space.

Whether Nvidia’s tumble marks a turning point or a temporary blip remains to be seen. The DeepSeek announcement, while disruptive, could also lower AI costs and expand demand, offering Nvidia a potential silver lining. Nvidia rebounded nearly 9% on Tuesday, with the stock currently down 5.25% so far in 2025.

Chevron goes electric

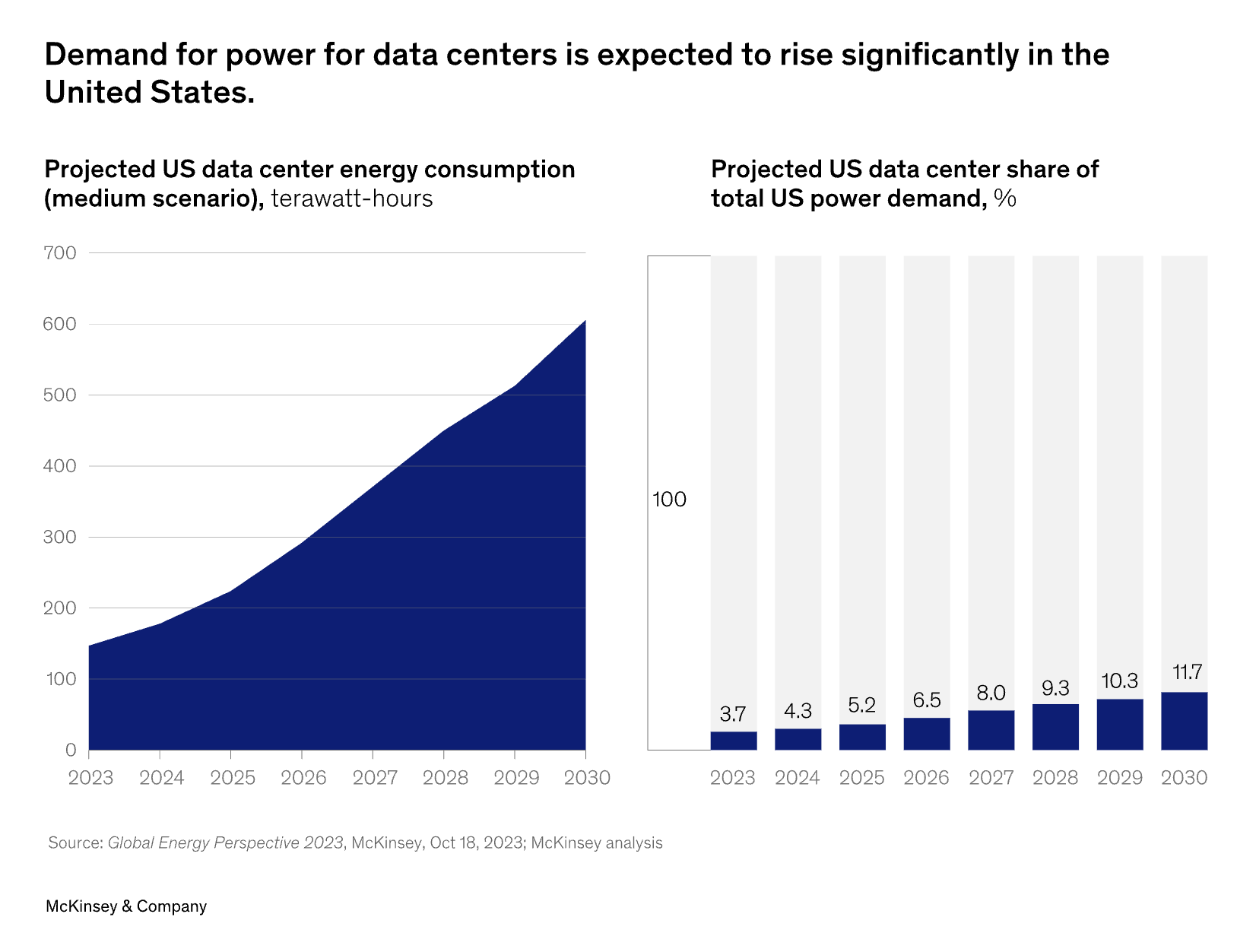

Power play… Chevron (CVX) is stepping into the electricity market, partnering with hedge fund Engine No. 1 and GE Vernova (GEV) to accelerate natural gas power plant projects. This strategic alliance aims to address skyrocketing U.S. energy demand, driven by AI’s rapid expansion and the proliferation of energy-intensive data centers. Electricity consumption is projected to climb 16% by 2030, more than triple previous estimates, according to McKinsey.

Chevron and GE Vernova, the energy division of the recently reorganized General Electric, will leverage Engine No. 1’s expertise in capital allocation to fast-track the deployment of natural gas power plants. The facilities will serve as a critical stopgap in ensuring reliable electricity during the country’s ongoing “re-industrialization,” as described by Engine No. 1 founder Chris James. Per James, the partnership is all about “allocating capital in an economy that is undergoing a re-industrialization and needs dramatically more power.”

This move marks a major shift for Chevron, traditionally a fossil fuel giant, as it begins competing in the electricity sector. It also reflects an evolution for Engine No. 1, whose 2021 campaign against ExxonMobil emphasized ESG priorities and cleaner energy transitions. Now, the hedge fund is collaborating with industry heavyweights to address immediate energy needs with lower-emission solutions.

GE Vernova’s involvement is also significant, following GE’s split into three standalone businesses—healthcare (GEHC), aerospace (GE), and energy (GEV). By focusing on energy infrastructure, Vernova is poised to play a central role in the push for more sustainable and scalable power solutions.

Tech giants pursue TikTok

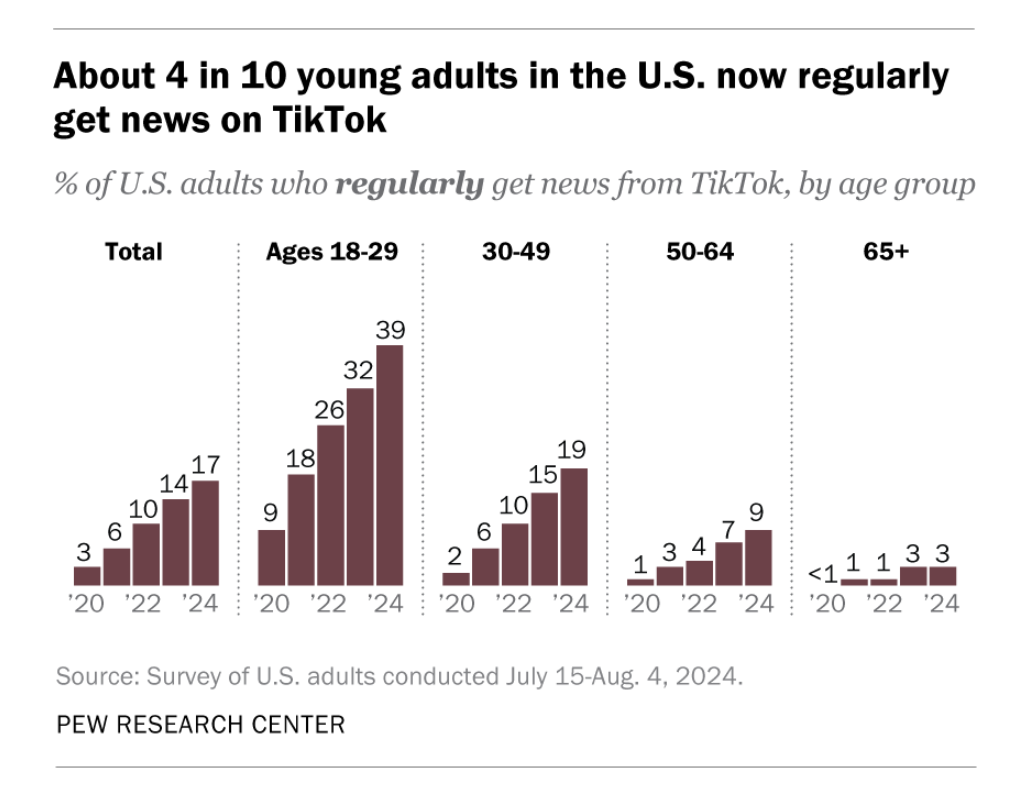

Many suitors …President Trump revealed Tuesday that Microsoft (MSFT) is exploring a deal to acquire TikTok’s U.S. operations, alongside Oracle (ORCL) and other interested parties. Rumors also swirl around Elon Musk’s potential involvement via X, though details remain speculative. The move comes as TikTok works to comply with a U.S. law requiring its separation from China-based parent company ByteDance by March 2025.

Trump extended the compliance deadline by 75 days earlier this month, temporarily restoring TikTok’s service in the U.S. The ban saga began in August 2020, when Trump himself issued an executive order mandating ByteDance divest TikTok’s U.S. assets, citing national security concerns. While President Biden revoked the ban in 2021, he signed subsequent legislation restricting TikTok on government devices and eventually passed a law requiring ByteDance to sell U.S. operations by January 2025. A Supreme Court ruling upheld the law, leading to TikTok’s temporary shutdown (and ensuing user meltdown) on Jan. 18.

Now, TikTok’s survival depends on a U.S.-based buyer meeting regulatory and security demands. In addition to Microsoft and Oracle, privately-held Perplexity is also in the mix, per reports, with each of these seeing value in TikTok’s massive (and highly engaged) user base and corresponding ad revenue. With Musk’s name also in the mix, rumors about the app’s future stateside continue to swirl.

One more thing: Actually, a few things: Today, we’ll get earnings results from Meta (META), Microsoft (MSFT), and Tesla (TSLA). Fed Chair Jerome Powell will also provide remarks following this month’s FOMC meeting, with analysts anticipating a pause on rate cuts.

Disclosures

As of writing, NVDA, MSFT, and META are holdings in Titan's Flagship strategy. ORCL is a holding in Titan's Offshore strategy. GE is a holding in Titan's Opportunities strategy. TLSA is a 0.61% position in the ARK Venture Fund.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.