Three Things (1/31)

Jan 31, 2025

Is TSLA outgrowing EV?

Microsoft stumbles

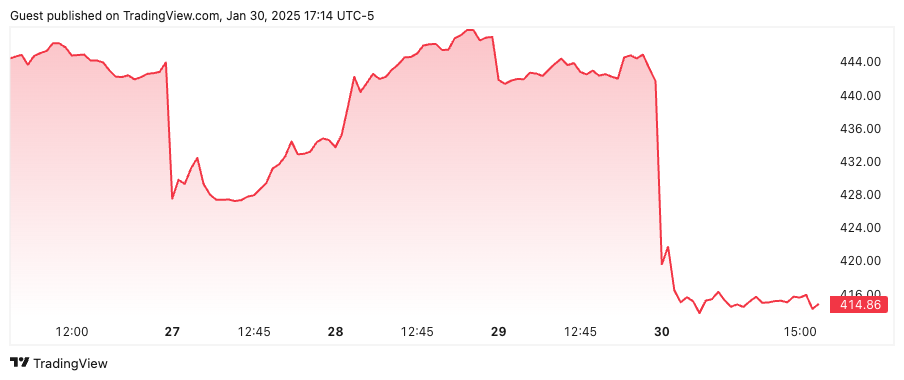

Rapid reaction … Microsoft (MSFT) stock fell 6.2% after issuing weaker-than-expected revenue guidance, despite beating Wall Street’s second-quarter estimates. The company reported earnings of $3.23 per share on $69.63 billion in revenue, surpassing analyst expectations, but CFO Amy Hood’s forecast of $67.7 billion to $68.7 billion for the current quarter fell short, leading to the worst single-day drop for Microsoft since 2022.

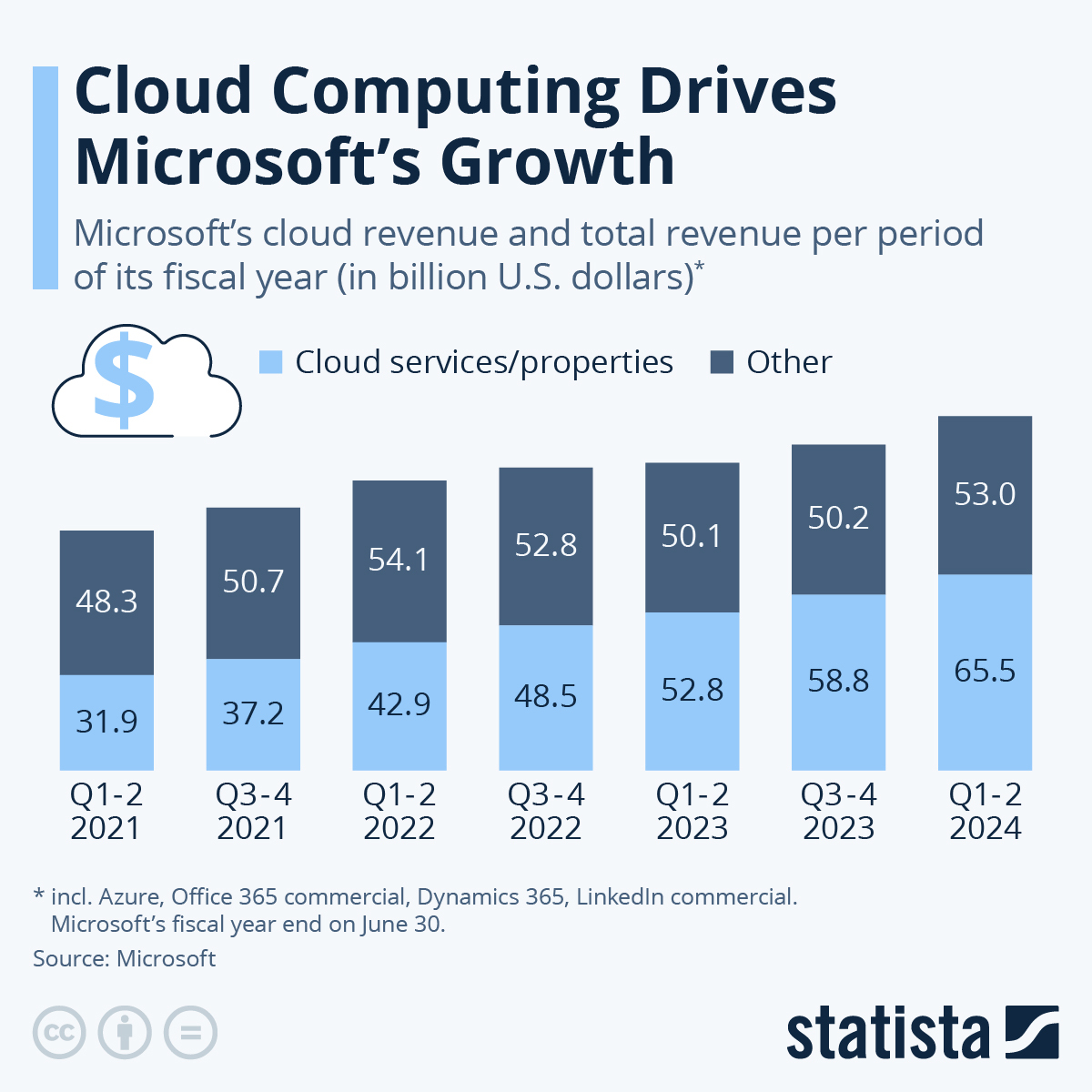

One major concern was the slowdown in Microsoft’s cloud business. Azure revenue grew 31%—a strong number but down from 33% in the previous quarter.

Analysts, however, remain optimistic. Goldman Sachs (GS) has called Microsoft one of the most attractive AI investment opportunities and maintained a buy rating with a $500 target. The company’s AI revenue run rate hit $13 billion for the quarter, well above earlier forecasts, and CEO Satya Nadella assured investors that AI would continue to drive growth.

Apple (AAPL) also reported earnings with mixed results. While overall revenue rose 4%, iPhone sales missed expectations during the critical holiday period, and China revenue dropped 11.1%, marking Apple’s biggest sales decline in the region in a year. Apple stock remained flat despite the news.

Tesla in transition

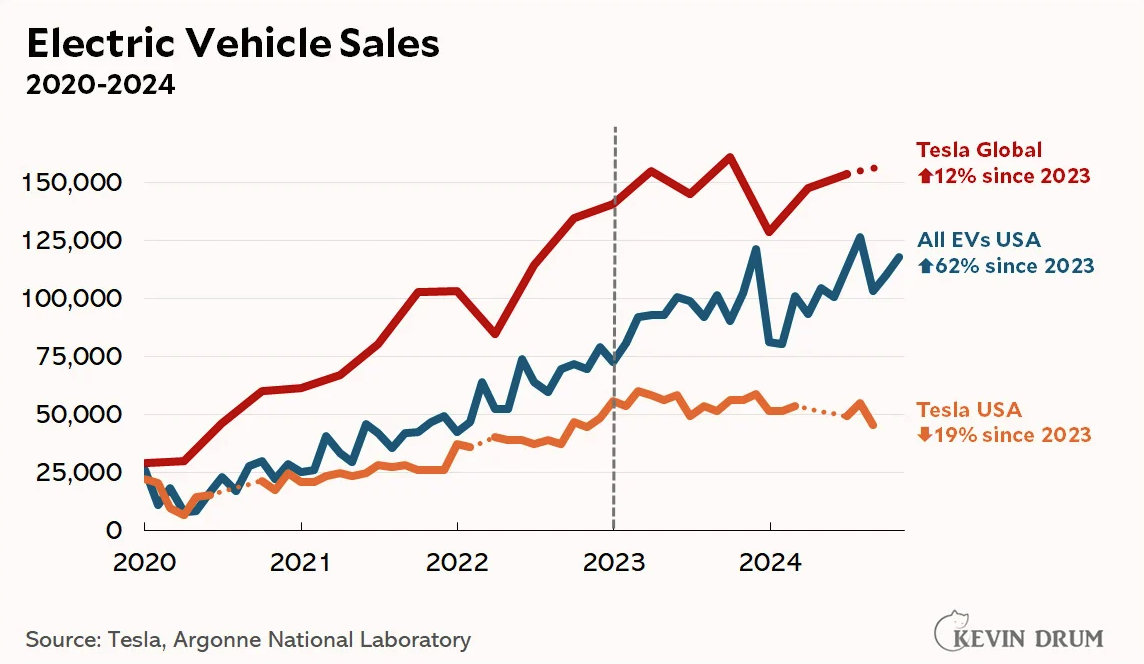

Analysts divided … Tesla (TSLA) released fourth-quarter earnings with mixed reception from the Street, as the OG EV automaker continues to broaden its remit into robotics, AI, and beyond. In Q4, the company saw a decline in automotive sales, delivering 495,930 vehicles globally, missing expectations of 510,400. This marks Tesla’s first annual delivery decline, with 1.78 million vehicles delivered in 2024, slightly below 1.8 million in 2023.

Nevertheless, Tesla still rose 4% after the earnings call. CEO Elon Musk pivoted attention away from auto sales, instead emphasizing Tesla’s future in AI and robotics. He detailed plans for a driverless ride-hailing service in Austin by mid-2025 and introduced the Optimus humanoid robot, expected in 2026.

Analysts remain divided on Tesla’s trajectory. Some see weakening auto sales as a red flag, while others argue Tesla’s growing AI and robotics focus could drive long-term value. Musk, for his part, insists Tesla will become “the world’s most valuable company” due to its AI dominance.

Price targets reflect this uncertainty. Evercore ISI has a target of $350, Goldman Sachs is at $400, and Morgan Stanley is at $450. Current sentiment within the trading community Stocktwits is “extremely bearish” with a score of 16 out of 100. Tesla closed at $400.28 on Thursday.

GDP growth slows

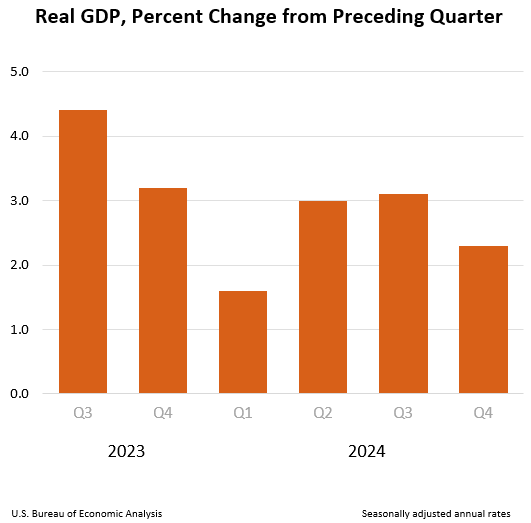

Economic snapshot … The U.S. economy expanded at an annual rate of 2.3% in Q4 2024, slightly below analysts’ expectations of 2.4% and down from 3.1% in the previous quarter. The Bureau of Economic Analysis releases GDP data quarterly, tracking the total value of goods and services produced.

A bright spot: consumer spending remained robust, increasing by 4.2%, with notable expenditures on healthcare services and recreational goods. The housing sector also saw a 5.3% rise in residential investment. However, business investment declined, partly due to a significant strike at Boeing (BA).

Exports decreased by 0.8%, indicating reduced international demand for U.S. products. Declines like this can indicate trade imbalances, where the country imports more than it exports, potentially affecting domestic industries and employment.

In the labor market, initial jobless claims fell by 16,000 to a seasonally adjusted 207,000 for the week ending January 25, suggesting low layoffs. Economists had predicted 220,000 claims. While layoffs are low, job opportunities remain scarce for the unemployed.

Meanwhile, the Fed is maintaining its benchmark interest rate between 4.25% and 4.50%, opting to pause rate hikes as it monitors inflation trends. Across the Atlantic, the European Central Bank cut its key interest rate by 0.25 percentage points to 2.75% to support the stagnant Eurozone economy.

One more thing: Can you hear me now? Vodafone (VOD) just made history with the first-ever satellite video call using a regular smartphone, no special equipment needed. The call, made from a remote area with no service, proves that soon anyone can stay connected anywhere. Vodafone plans to roll this out across Europe starting later in 2025.

Disclosures

As of writing, MSFT is a holding in Titan's Flagship strategy. TSLA is a 0.61% position in the ARK Venture Fund.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.