Three Things (2/3)

Feb 3, 2025

Not very neighborly

Tariff war escalates

Border battles … The North American trade war is getting ugly. President Trump imposed sweeping tariffs on Canada and Mexico on Friday, triggering swift retaliation from America’s largest trading partners.

Trump’s executive order levies a 25% tariff on most Canadian and Mexican imports and 10% on Canadian oil and all Chinese goods. (You might wonder why China got the better end of the bargain here, and it’s because we have less leverage. Higher tariffs on China could disrupt global supply chains and more significantly raise consumer prices.)

Canada has decided to hit back with 25% tariffs on $20 billion worth of American goods, including beverages, cosmetics, and paper products—with a second wave coming soon. Prime Minister Justin Trudeau called the tariffs harmful to both Canadians and Americans and urged consumers to “choose Canada” in response. Some provinces plan to remove American liquor brands from store shelves, dealing a direct blow to U.S. exports.

Mexico has vowed its own retaliation and we should get more details on that today.

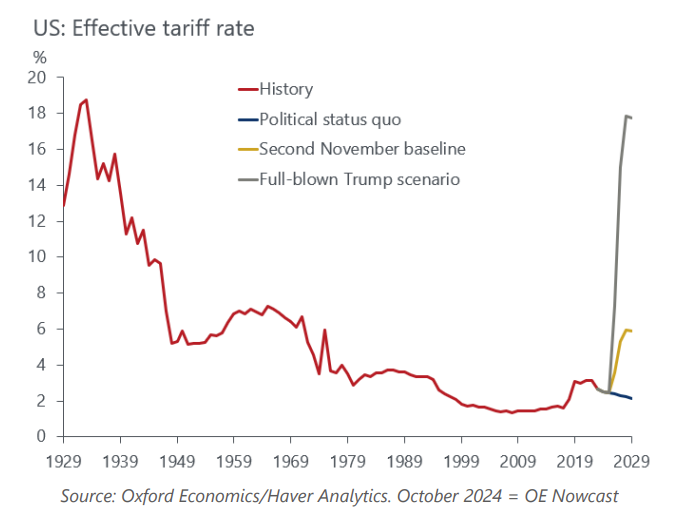

An Oxford Economics analysis released in November demonstrates the historical pivot these tariffs reflect, with economists’ “full-blown Trump scenario” falling below the 25% tariffs placed on our neighbors to the north and south.

So far, Wall Street isn’t taking the news well. Deutsche Bank says the tariffs are the “largest shock” to trade in 50 years—although, NBA fans may disagree. Economists warn of higher consumer prices, lower corporate profits, and market volatility. Some predict a 2.8% drop in S&P 500 earnings and a potential 3-5% market swing this week.

Here’s a roundup of reactions from the business world via Business Insider:

United Steelworkers – Opposes tariffs on Canada, calling it a key ally with an integrated economy.

National Association of Home Builders) – Says tariffs on Canadian lumber and Mexican gypsum will drive up home construction costs.

National Association of Manufacturers – Warns tariffs will disrupt supply chains, increase costs, and threaten U.S. manufacturing jobs.

Shopify (SHOP) CEO Tobi Lütke – Opposes tariffs but also criticizes Canada’s retaliation, saying cooperation is better than escalation.

Billionaire Mark Cuban – Supports Canadian and Mexican retaliation, calling tariffs harmful to businesses and consumers.

Ackman ditches Delaware

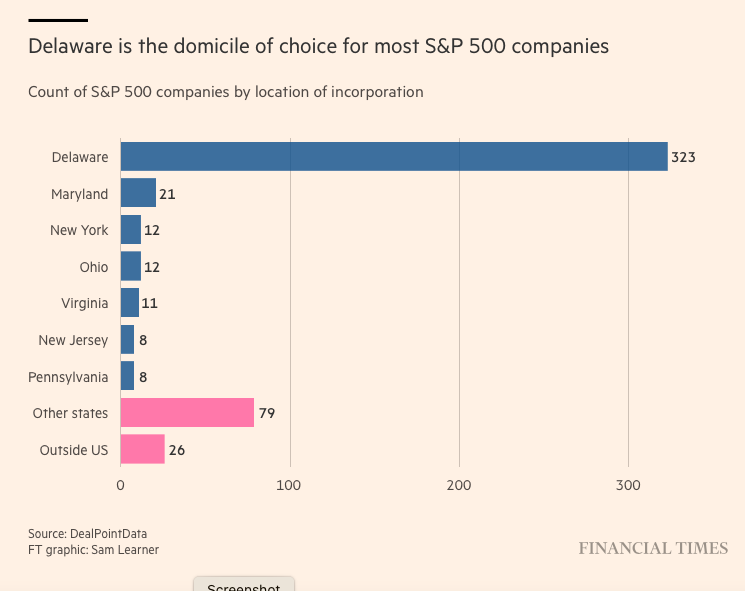

Incorporation exodus … Billionaire investor Bill Ackman is moving his management company, Pershing Square Capital, from Delaware to Nevada, marking another high-profile exit from the First State. Ackman announced the decision on social media, stating that “top law firms are recommending Nevada and Texas over Delaware.”

His move follows reports that Meta (META) is considering a similar shift to Texas. While Meta won’t move its headquarters from California, the company has already relocated key teams to Texas, with CEO Mark Zuckerberg citing free speech concerns as a factor. Meanwhile, Elon Musk has already reincorporated Tesla and SpaceX in Texas after a Delaware court ruled against his $56 billion compensation package.

For decades, Delaware has been the go-to state for incorporation, thanks to its business-friendly laws, a specialized corporate court, and legal predictability. Currently, more than two-thirds of Fortune 500 companies are incorporated there. However, rising costs, increased litigation, and regulatory shifts have companies looking elsewhere. States like Nevada and Texas offer lower taxes, stronger privacy protections, and legal frameworks that favor management.

The implications are significant. If more corporations leave Delaware, the state risks losing its dominance in corporate law—and a major source of tax revenue. Meanwhile, Nevada and Texas are positioning themselves as the next big corporate havens.

This week on Wall Street

Jam-packed … Here’s your outlook for the week ahead.

Today: Palantir (PLTR), Tyson Foods (TSN), and Clorox (CLX) release earnings. ISI Manufacturing PMI released at 10 a.m. EST.

Tuesday, Feb. 4: Alphabet (GOOG), Advanced Micro Devices (AMD), Amgen (AMGN), Pfizer (PFE), Merck (MRK), PayPal (PYPL), Chipotle (CMG), KKR (KKR), Simon Property Group (SPG), Mondelez (MDLZ), Marathon Petroleum (MARA) and PepsiCo (PEP) report earnings. JOLTs Job Openings released at 10 a.m. EST

Wednesday, Feb. 5: Disney (DIS), Qualcomm (QCOM), Uber (UBER), Ford (F), Prudential Financial (PRU), Allstate (ALL), Aflac (AFL), and Microstrategy (MSTR) report earnings. ISM Services PMI released at 10 a.m. EST

Thursday, Feb. 6: Amazon (AMZN), Eli Lilly (LLY), Yum Brands (YUM), Hilton Worldwide (HLT), MetLife (MET), Roblox (RBLX), Bristol-Myers Squibb (BMY), and Kenvue (KVUE)—formerly the consumer health division of Johnson & Johnson—report earnings. Bank of England Interest Rate Decision released at 7 a.m. EST.

Friday, Feb. 7: Non-Farm Payrolls, Unemployment Rate, and Michigan Consumer Sentiment Panel released at 8:30 a.m. EST, 10 a.m. EST, and 10 a.m. EST, respectively.

One more thing: The FDA has approved Vertex Pharmaceutical’s (VRTX) Journavx, the first new non-opioid pain medication in over two decades, offering a safer alternative for managing moderate-to-severe acute pain. Meanwhile, the Sackler family and Purdue Pharma have agreed to a $7.4 billion settlement with 15 states over their role in the opioid crisis, relinquishing control of the company and funding addiction treatment and prevention programs. To date, none of the Sacklers have served jail time.