Three Things (2/5)

Feb 5, 2025

Trucks caught in trade war crossfire

Winners and losers

Earnings roundup … Here are this week’s key results (so far).

↓ Alphabet (GOOG) is down bad (and potentially crying at the gym). The company reported a 12% revenue increase to $96.47 billion in the fourth quarter, slightly missing expectations, with cloud growth slowing and increased competition in digital advertising. The stock futures fell 8% following the report.

↓ Chipotle (CMG)’s Q4 earnings met Wall Street expectations, but conservative guidance and concerns over higher menu prices (yes, guac is going to be extra) affecting customer demand led to a drop in share price.

↓ Advanced Microdevices (AMD) beat Q4 earnings estimates with $7.66 billion in revenue and issued strong Q1 guidance, but the stock fell after missing data center revenue expectations.

→ PepsiCo (PEP) faced a slight revenue dip as consumers cut back on salty snacks, but the company remains optimistic about bouncing back with affordable and healthier options.

→ Pfizer (PFE) beat fourth-quarter expectations, driven by its COVID-19 treatments, but investors are concerned about the sustainability of this growth. Meanwhile, RFK Jr. advanced another step toward confirmation as HHS secretary.

↓ PayPal (PYPL) reported better-than-expected earnings, but its stock fell 13% due to worries over its payments and processing unit (Braintree), which could hurt revenue growth.

↑ Palantir (PLTR) skyrocketed over 29% since Monday after reporting impressive earnings, thanks to strong demand for its AI products. It was the best-performing stock in 2024 and, so far, is the top performer in 2025.

China hits back

Trade tussle … In response to the United States’ 10% tariff on Chinese imports, China has declared its own set of tariffs targeting U.S. goods. Beginning Monday, Beijing will impose a 15% tariff on American coal and liquefied natural gas, and a 10% tariff on crude oil, agricultural machinery, and certain vehicles.

China’s focus on energy commodities is strategic. These sectors are significant exports for the U.S., and the tariffs aim to put pressure on key industries. Additionally, by targeting agricultural machinery, China is signaling its intent to impact American agriculture, a sector that has been central in previous trade disputes. (Beijing also included pickup trucks on its list, because why not hit America where it really hurts?)

Tariffs typically strengthen the U.S. dollar since they increase the cost of imported goods, leading to reduced demand for foreign products. While a stronger dollar benefits travelers and importers, it negatively impacts U.S. exporters by making their products less competitive abroad. Crude oil prices have also been volatile amid concerns that the new tariffs could dampen demand and disrupt global supply chains.

In a related move, China has initiated an antitrust investigation into Google, alleging potential violations of Chinese antimonopoly laws (which are a bit paradoxical). This action is viewed as part of China’s broader strategy to counter U.S. trade measures and to assert its regulatory authority over foreign tech giants operating within its borders.

Labor demand dips

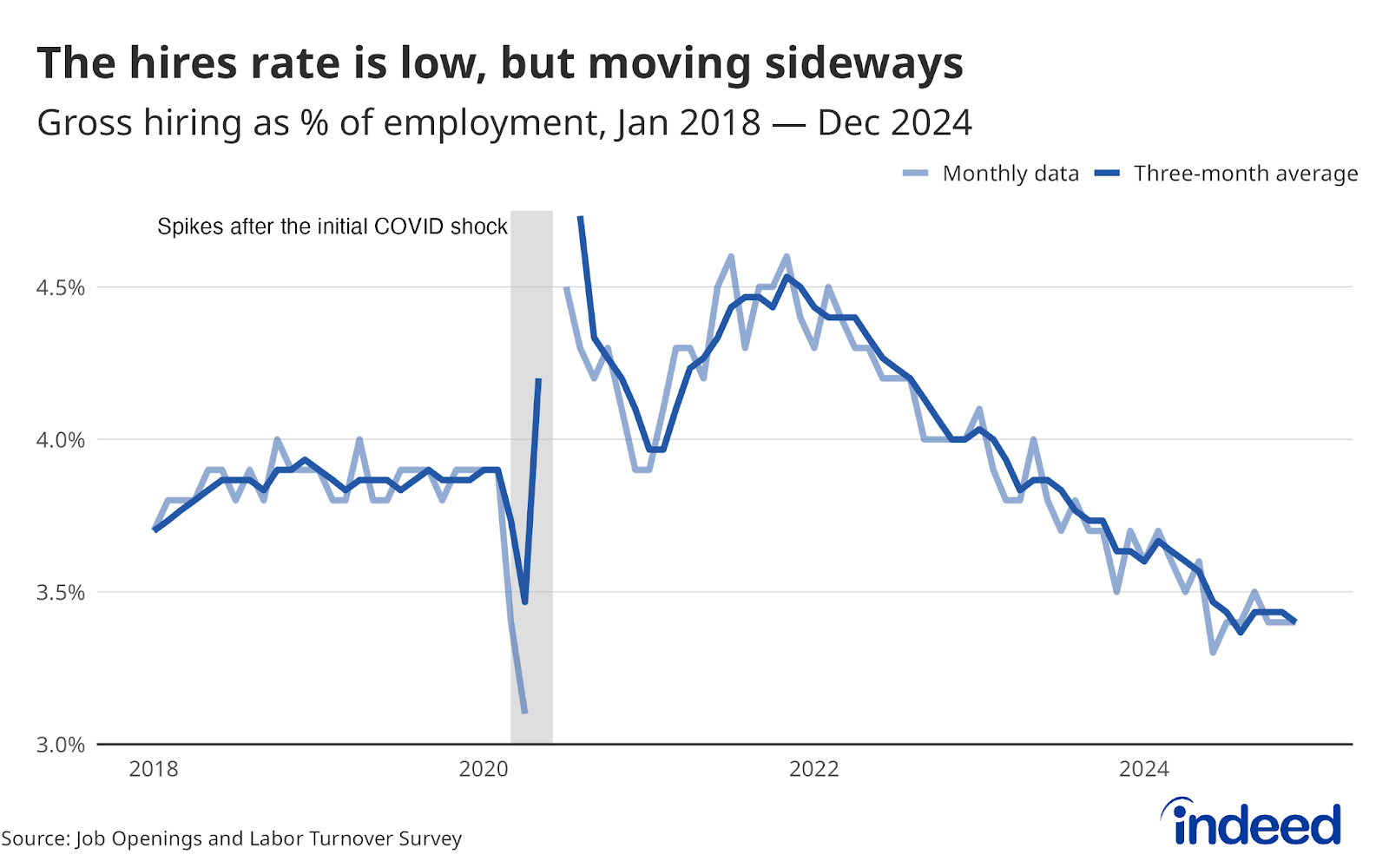

Still stable … U.S. job openings fell sharply in December, dropping by 556,000 to 7.6 million—the biggest decline in 14 months. This sharp drop was well below forecasts, although hiring and layoffs remained steady. The ratio of job openings to unemployed individuals dipped to 1.1, signaling a shift closer to pre-pandemic norms.

White-collar jobs—professional and business services to be exact—saw the steepest decline with 225,000 fewer openings, followed by private education and health services losing 194,000, and financial activities down 166,000. However, arts, entertainment, and recreation bucked the trend with an increase of 65,000 job openings.

While job postings fell, layoffs remained low at 1.77 million, dipping slightly by 29,000. Hiring actually rose modestly to 5.46 million, hinting at continued resilience despite economic headwinds.

The Fed watches the JOLTS report closely because it lags behind other employment data, offering clues about the labor market’s underlying strength. With markets responding to both labor data and geopolitical tensions—including tariff uncertainties—the U.S. dollar dipped as expectations for future Fed rate cuts grew.

One more thing: Sens. Bernie Sanders and Josh Hawley—two lawmakers who disagree about quite literally everything—are backing a bill to cap credit card interest rates at 10% for the next five years. The American Banking Association’s president said the legislation would limit consumer choice.

As of writing, GOOG and AMD are holdings in Titan's Flagship strategy.