Three Things (2/12)

Feb 11, 2025

Powell stays patient

Powell stays patient

No rush … Federal Reserve Chair Jerome Powell told the Senate Banking Committee on Tuesday that the central bank isn’t in a hurry to cut interest rates, citing a strong economy and persistent inflation. Here are the key takeaways from his testimony:

— Interest Rates: Powell stressed that lowering rates too soon could backfire. “Reducing policy restraint too fast or too much could hinder progress on inflation,” he warned.

— Inflation: While inflation has cooled from its peak, it remains above the Fed’s 2% target. “We will do everything we can to achieve maximum employment and stable prices,” Powell said.

— Tariffs & Trade: Powell dodged direct criticism of Trump’s new tariffs but reaffirmed that “free trade still makes sense” and the Fed’s job is to react to, not set, trade policy.

— Stablecoins: Powell voiced support for regulating stablecoins, or digital assets pegged to traditional currencies or commodities to maintain a stable value. He noted they “may have a big future,” but need clear oversight.

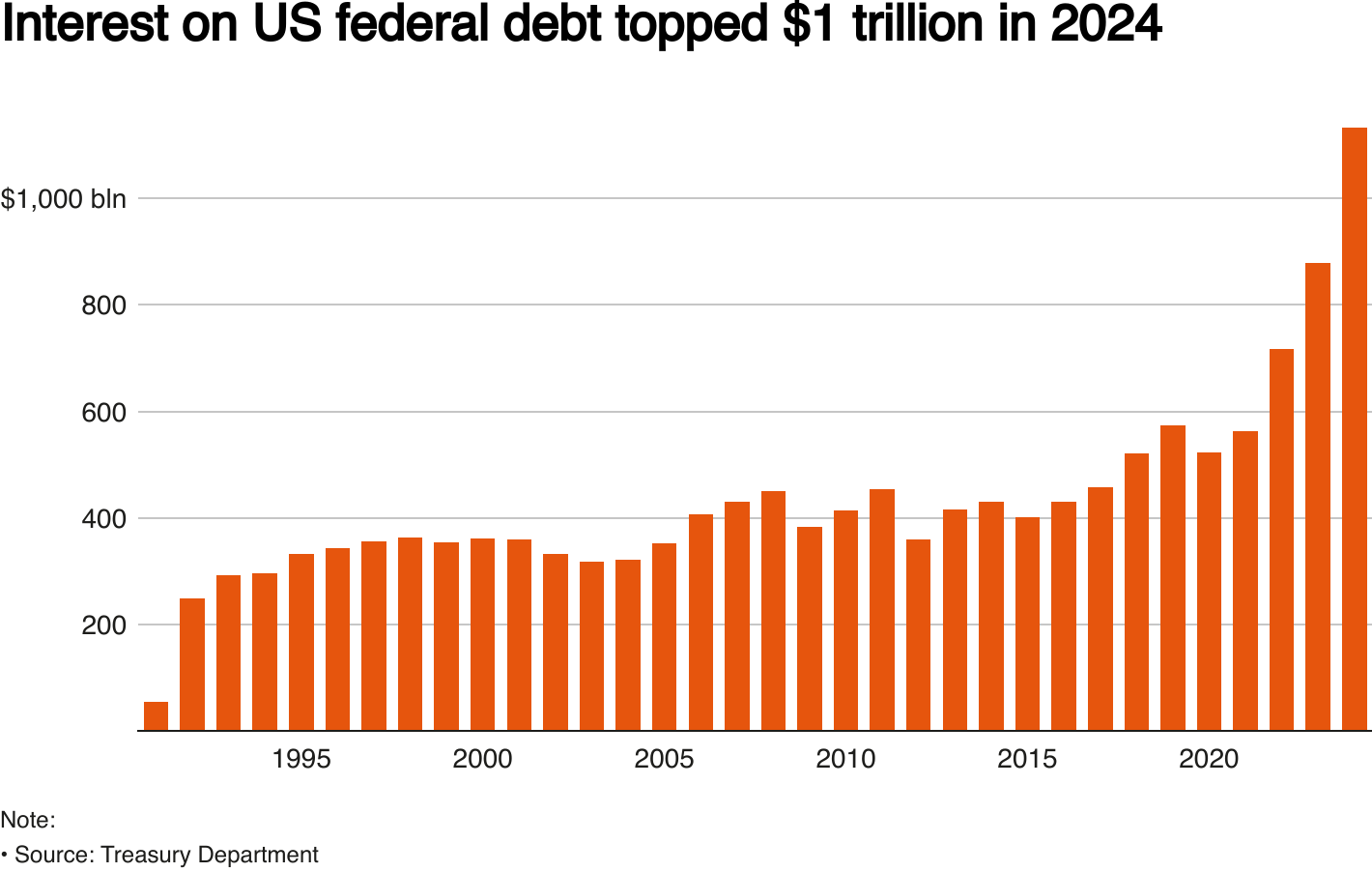

— Federal Deficit: Powell warned that the nation’s current deficit path is unsustainable and will need to be addressed.

The Fed’s next rate decision comes in March, but for now, Powell’s message is clear: the economy is strong, inflation is stubborn, and patience is the game plan.

Carbonated comeback

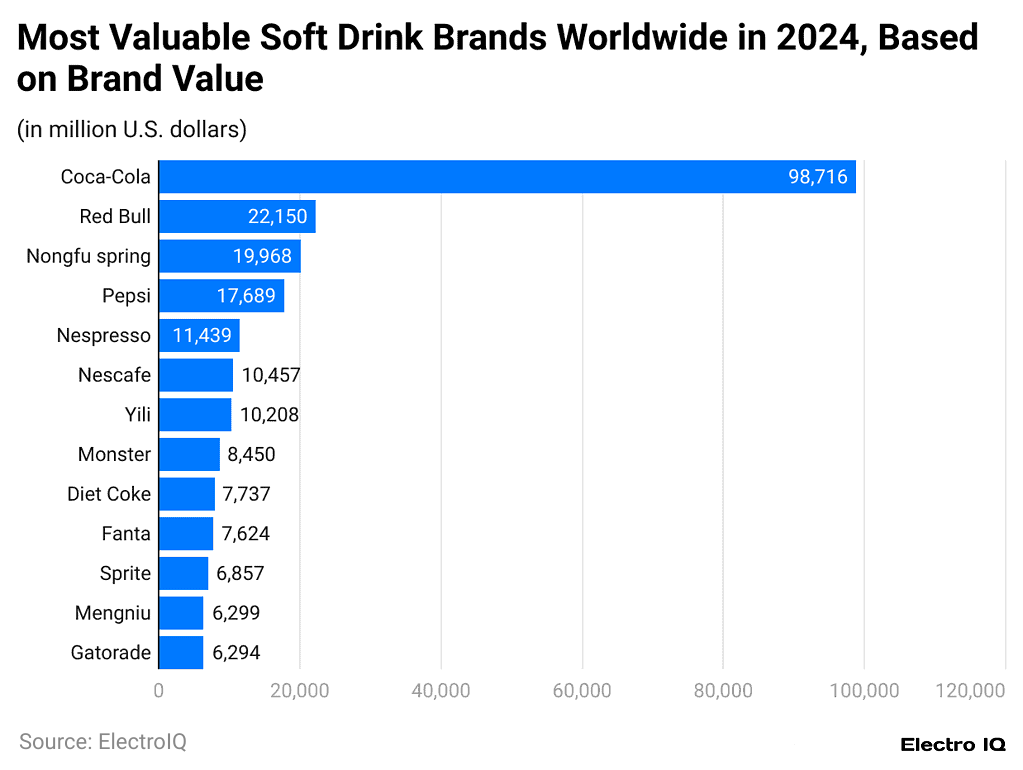

Knockout earnings … Coca-Cola (KO) wrapped up 2024 with a strong fourth quarter, beating Wall Street estimates and reversing a recent sales dip. The soda giant reported a 6% revenue increase to $11.54 billion, with earnings per share at 55 cents, surpassing expectations of 52 cents. Growth came from both higher pricing (up 9%) and increased demand in key markets like China, Brazil, and the U.S.

Coke’s Zero Sugar line led the way, posting 13% volume growth, while its core sparkling soft drinks rose 2%. Its water and tea categories also saw gains, but juice and plant-based beverages declined by 1%. Meanwhile, new limited-time flavors like Oreo Coke and Fanta Beetlejuice also helped lift sales.

Despite a strong quarter, Coke faces potential challenges ahead, including a 25% tariff on aluminum imposed by the Trump administration. However, CEO James Quincey downplayed the impact, stating that the beverage giant could shift to plastic bottles and other cost-saving strategies.

Elsewhere in the world of trendy soda startups, a social media feud is bubbling over. Poppi, known for its prebiotic sodas, sparked backlash after gifting luxury vending machines to influencers instead of everyday fans. Rival Olipop seized the moment, fueling the controversy online and throwing shade at Poppi’s so-called misstep. We can’t help but wonder what La Croix (FIZZ) would have to say about all this.

Back to the future

Titan talks … Titan’s first-ever Summit, held Tuesday in New York and streamed live on YouTube, tackled a big question: How do historical patterns shape the future of investing?

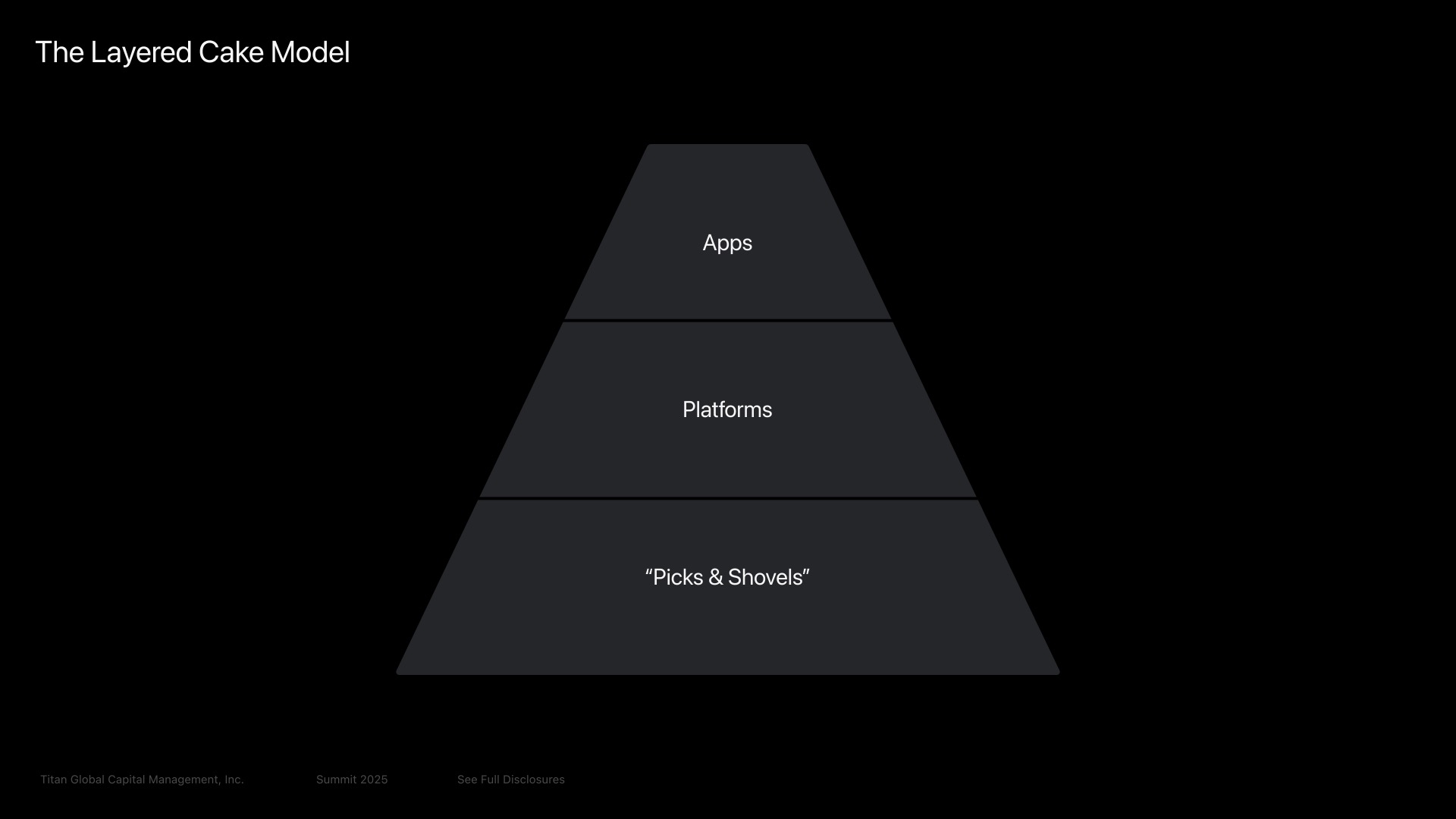

Co-founders and co-CEOs Joe Percoco and Clay Gardner, alongside venture investor David Tisch, laid out a framework for understanding technological revolutions. Percoco described it as a “layered cake,” where foundational infrastructure (picks and shovels) comes first, followed by platforms, and finally applications. “In a gold rush, sell shovels,” Percoco said. “Right now, we’re in the picks and shovels phase of AI.”

The AI boom has fueled massive market gains, but is it a bubble? Gardner pointed to the volatility in AI stocks, noting that infrastructure investments—such as NVIDIA’s (NVDA) dominance in AI chips—tend to be more resilient. Meanwhile, Tisch emphasized that despite AI’s rapid advancements, human intuition remains critical. “Winning is tactics. Picking is taste,” he said.

Looking ahead, Titan sees major opportunities in “test-time compute,” where AI models don’t just generate outputs but actively reason and make decisions, driving exponential demand for more advanced computing power. They also highlight hyperscaler efficiency, emphasizing that while tech giants are investing heavily in AI, the real metric to watch is return on capital—how effectively these companies monetize their AI infrastructure. Additionally, Titan predicts that nuclear energy will become a crucial solution for AI’s growing energy demands, with hyperscalers increasingly turning to uranium as a long-term power source to sustain AI-driven workloads.

One more thing: Trump wants to kill the penny, but can he? He’s directed the Treasury to stop minting new pennies, arguing they cost more to make than they're worth, but Congress has the final say—just like when past lawmakers, including Obama and McCain, pushed for the same change. While some fear price rounding could hurt consumers, other countries, including Canada, have successfully phased out low-value coins, proving it can be done.

Disclosures

As of writing, NVIDIA is a holding in Titan's Flagship strategy.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.