Three Things (2/14)

Feb 13, 2025

Honda & Nissan end situationship

‘It’s the dawn of a new era’

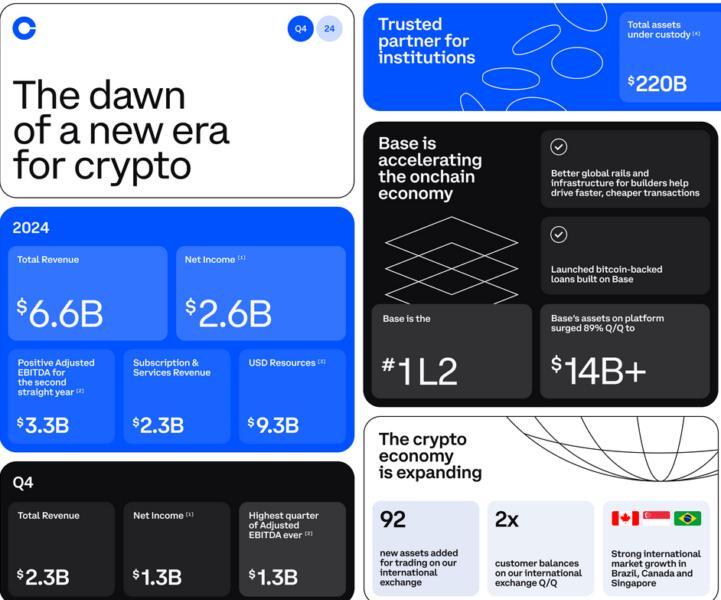

Floodgates open … Coinbase (COIN) reported a strong 2024, with revenue more than doubling to $6.6 billion and net income reaching $2.6 billion. The stock closed the day up 8.44%, though still off its all-time high of $357 in November 2021.

Coinbase says this momentum is already pulling through into 2025, and they reported that $750 million in transaction revenue was already generated through Feb. 11. They attribute some of this to a “sea change” in the regulatory environment, which they say is unlocking new opportunities for the company and the crypto industry overall. “It’s the dawn of a new era.”

Coinbase has three key priorities for 2025: driving revenue, expanding crypto utility, and scaling the foundation. A major focus is making crypto payments easier for consumers and businesses, particularly through stablecoins—that is, digital currencies designed to maintain a stable value by being pegged to assets like the USD.

On the institutional side, trading volume surged 128% quarter-over-quarter to $345 billion, outperforming the U.S. spot market. This aligns with a 2023 Coinbase survey showing 60% of financial institutions planned to increase crypto allocations once regulatory uncertainty cleared.

With headcount at 3,772 full-time employees, Coinbase generated $1.75 million in revenue per employee in 2024. For comparison, Robinhood (HOOD) reported just under $3 billion in revenue in 2024, with a revenue per employee of roughly $1.36 million.

Honda-Nissan merger fails

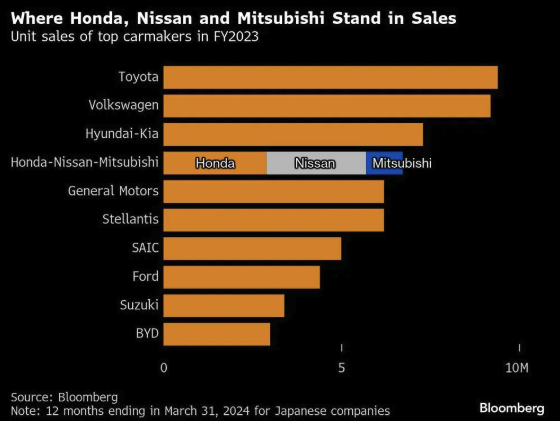

Roadblock reached … What could have been the world’s third-largest automaker is officially off the table. Honda (HMC) and Nissan (NSANY) have abandoned their $60 billion merger, citing major disagreements over structure and control.

The talks, which began in December 2024, initially focused on creating a joint holding company. But as negotiations progressed, Honda proposed a stock swap that would make Nissan its subsidiary—a move Nissan’s CEO Makoto Uchida called “unacceptable.” Instead, Nissan will attempt a financial turnaround without Honda. (Sounds like they are taking time to work on themselves, but will probably still like all of Honda’s Instagram Stories.)

Meanwhile, Honda CEO Toshihiro Mibe expressed disappointment, noting the merger’s potential but acknowledging that “painful” decisions would have been necessary to make things work. The failed deal leaves both companies navigating a rapidly shifting auto industry independently, as EV competition intensifies with Tesla (TSLA) and BYD leading the charge.

For Nissan, the stakes are high. The company reported a massive drop in profits, with an expected $519 million annual loss, leading to 9,000 job cuts. Honda, in stronger financial shape, will continue focusing on electrification, though its strategy for expansion remains unclear.

Reddit’s market influence

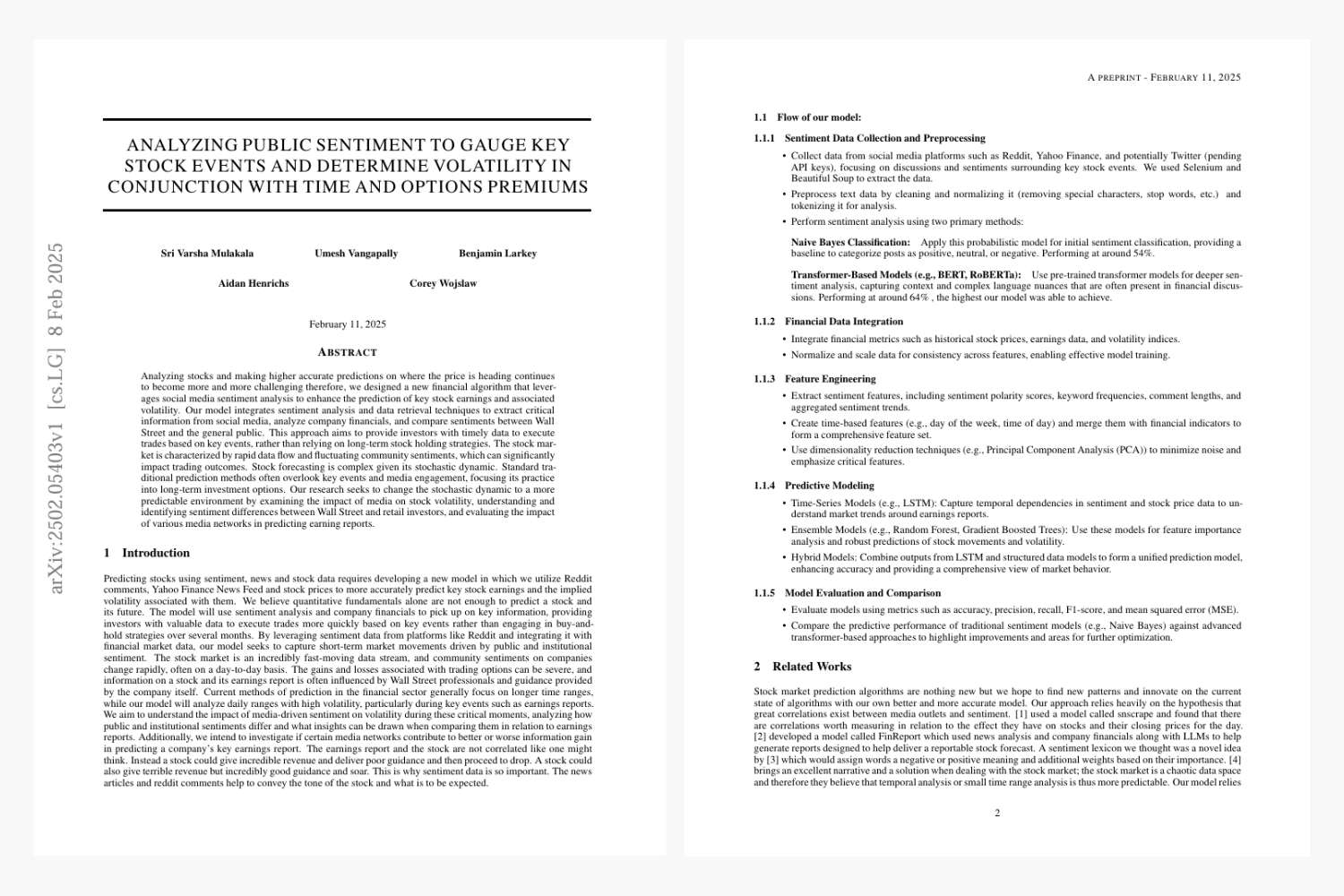

Social science … A new study from Cornell University explores how social media sentiment paired with financial data can predict stock movements. The researchers built an AI-driven model able to scrape discussions from Reddit (r/stocks, r/wallstreetbets, r/investing) and Yahoo! Finance to gauge investor mood and compare it against stock performance.

Using sentiment analysis, the study classified posts as positive, negative, or neutral. This data was then fed into machine learning models to predict stock price movements.

The big finding? Retail investor sentiment often diverges from Wall Street expectations, creating opportunities for options traders. Stocks with negative sentiment before earnings reports but strong post-report performance were frequently undervalued. The study suggests traders could leverage sentiment trends to identify mispriced options and short-term trading opportunities. (Although, this is, of course, research and not investment advice.)

The methodology isn’t perfect though. Researchers noted that data scraping limitations, API restrictions, and sentiment bias (Reddit leans speculative) hinder accuracy. You can read the full study here.

One more thing: They’re calling it Y’all Street. NYSE Chicago is moving to Texas and rebranding as NYSE Texas, giving companies another listing option in the business-friendly state. Meanwhile, TXSE Group is pushing ahead with its own Texas Stock Exchange, aiming to launch in 2026 with $161 million raised. With big names like Tesla already making Texas their legal home, the Lone Star State is shaping up to be Wall Street’s next big rival.

Disclosures

As of writing, TSLA is a 0.70% position in the ARK Venture Fund.

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC-registered investment adviser. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not necessarily reflect the views of Titan, or any of its affiliates. They are meant for educational and informational purposes only and are not intended to serve as investment advice or a recommendation to trade any security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan. All hyperlinks to third-party sites are provided ‘AS IS’ for informational purposes only. Titan does not necessarily agree with, endorse, edit, or sponsor the content on these external websites. Titan is not responsible for the accuracy, completeness, or reliability of the information on third-party sites. All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results or returns. Investors should consider their investment objectives and risks carefully before investing.

Titan newsletters are curated digests of business news stories delivered frequently. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the information and our perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Certain investments may not be suitable for all investors based on their investment objectives and risk tolerance. Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter. For more information, visit titan.com/legal.