Three Things (2/21)

Feb 21, 2025

Permanent shift or temporary upset?

Permanent shift or temporary upset?

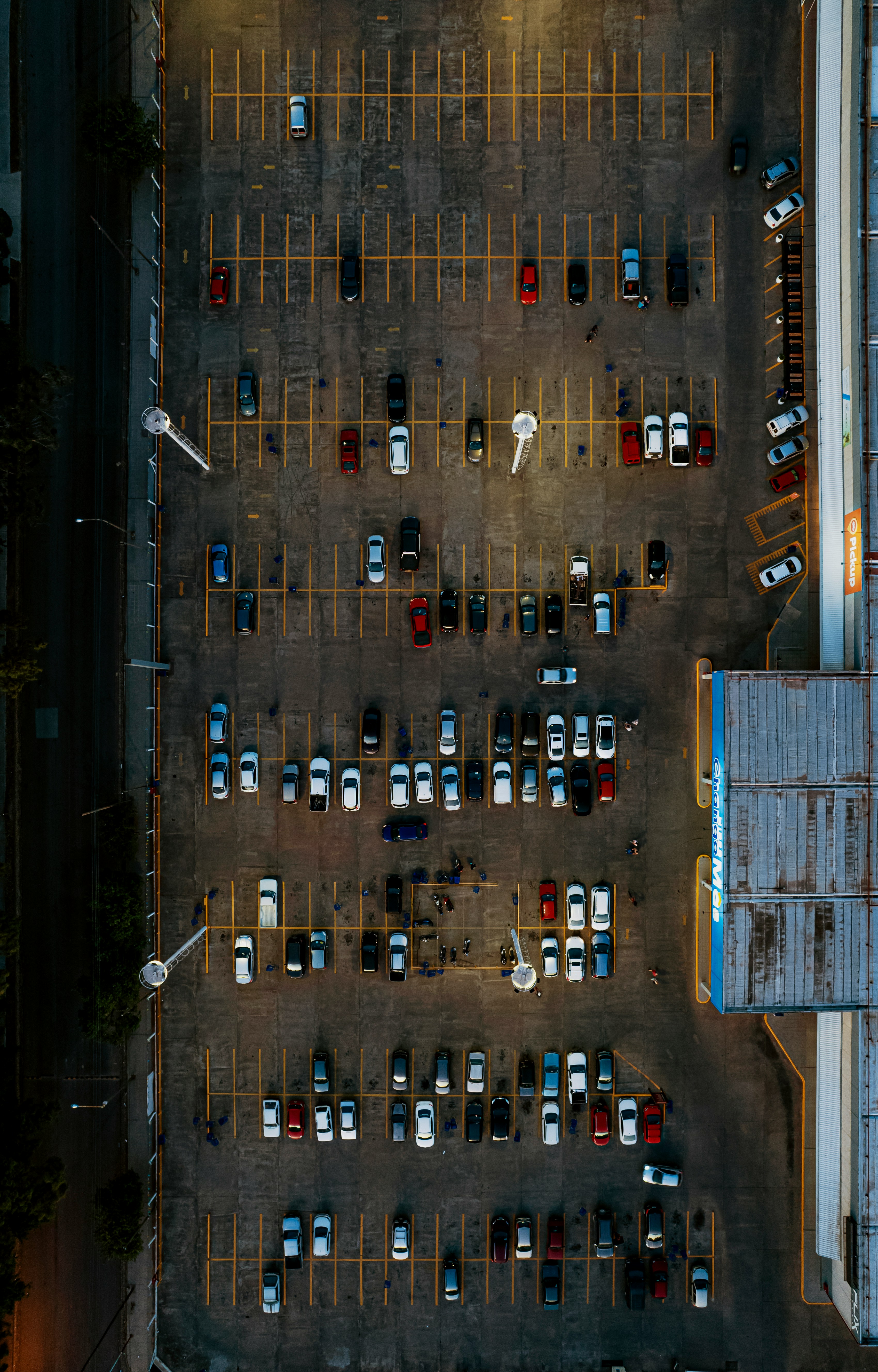

Amazon leapfrogged Walmart in quarterly sales for the first time ever, reporting $187.8 billion versus Walmart’s $180.5 billion. Walmart still leads the way in annual sales, though Amazon is gaining ground. Walmart is projected to reel in $708.7 billion in the fiscal year ahead while Amazon’s full-year revenue for 2025 is expected to reach $700.8 billion. Although Amazon’s revenue can be supplemented by their impressive cloud business, Amazon surpassing Walmart doesn’t just reorder the top two – it redefines the competitive landscape for all retailers. We’d argue that brick and mortar isn’t necessarily dead, though, it’s simply evolving. E-commerce and digital prowess now define retail leadership but it doesn’t come at the expense of established footprints and local distribution.

While Amazon’s surge reflects structural changes, it’s not an uncontested victory. Walmart still posted record annual revenues and is growing online sales at ~20% in the U.S. suggesting it’s adapting rather than ceding the field. But Amazon’s ~38% share of U.S. e-commerce (versus Walmart’s ~6%) underscores how dominant it has become in online retail. Consumer preferences are changing and how these giants continue to invest will determine the true winners and losers over the long run.

Quantum leap

Microsoft researchers on Wednesday unveiled an approach to quantum computing that the company claimed involved the creation of a new state of matter. The announcement follows Google’s public release in December, adding momentum to a potentially transformative new industry. Why does it matter? In essence, a viable quantum computer at scale would be a general-purpose “innovation engine”. It could let us design things right the first time – whether drugs, materials, or complex engineering systems – by computing exact outcomes rather than relying on experiments and prototyping. Think: complex simulations of the physical world that can lead to more efficient batteries, more efficient chemical production, new drugs, or even break the most traditional encryption frameworks of today.

The importance lies in error correction and scalability. Topological qubits, if they work as hoped, store information in a way that is naturally protected from noise. This could drastically reduce the error rates that plague other quantum computers and offers a clear path to scaling up to a million qubits on a chip that fits in your hand. The macroeconomic impact of this is hard to overstate: it could boost productivity in R&D-intensive industries, potentially ushering in a new wave of technological breakthroughs.

A shrinking appetite

Minutes from January’s Fed meeting were released on Thursday and it appears that Fed officials were broadly comfortable with their decision to hold interest rates steady. The report offered nothing to suggest any immediate change to their wait-and-see stance on interest-rate cuts. Notably, the Fed removed language that inflation had “made progress” toward 2%, instead stating price growth “remains high", signalling that policymakers are not yet finished in their efforts to tame inflation.

The biggest takeaway for us is that the minutes reflect the continued concern that inflation is still too high and stubborn. The Fed’s stance of “no near-term cuts” is a bet that they can manage a soft landing without causing any financial missteps. A contrarian would say that’s optimistic – the full impact of rate hikes comes with a lag, and 2024–2025 is when those lags hit. If signs of a credit crunch mount (e.g. banks significantly curtail lending, or bond markets signal distress), the Fed may have to pivot earlier than it wants, inflation be damned. For now, though, the message is clear: the Fed would rather risk slight overtightening and deal with those consequences than risk cutting too early and reigniting inflation.

As of writing, AMZN, MSFT, and GOOG are holdings in Titan's Flagship strategy.