Join us for our first Summit Series live event, February 11th NYC

The energy dislocation continues

Aug 26, 2022

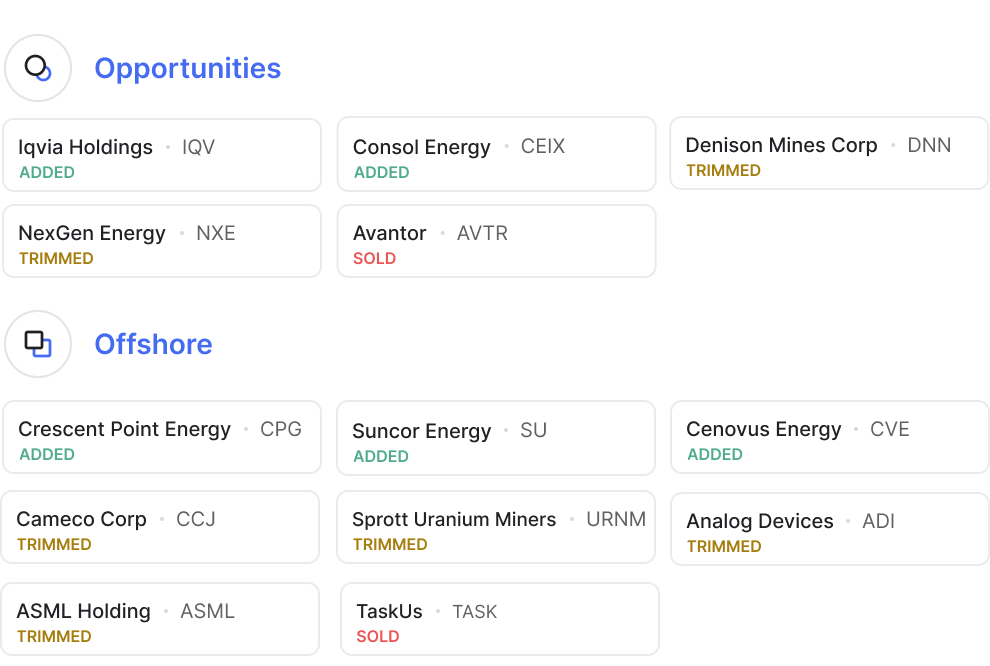

We’ve made trades in Opportunities and Offshore

We made several trades across our Opportunities and Offshore strategies in an effort to further diversify our energy exposure and manage risk after the recent run-up. Let’s dive in.

Energy crisis persists

The impacts of the ongoing energy crisis have been far-reaching as countries around the globe yearn for alternative sources of energy to combat current constraints.

Japan announced plans to reinstate investment in nuclear power plants on Wednesday following the European Union’s historic policy shift with respect to green nuclear energy. The secret is out: nuclear power is not only safe but essential.

Our uranium positions have benefited from these tailwinds, and we took the opportunity to trim Cameco Corp (CCJ), Sprott Uranium Miners (URNM), Denison Mines Corp (DNN), and NexGen Energy (NXE) following recent reports.

In that same light, global actors have been forced to turn to alternative energy sources in order to combat inelastic demand coinciding with limited supply.

At the end of July, we initiated starter positions in Cenovus Energy (CVE), Crescent Point Energy (CPG), Consol Energy (CEIX), and Suncor Energy (SU) in both Offshore and Opportunities. Our thesis is playing out better than expected thus far, and we’ve made the decision to add weight behind these four holdings on the back of stronger conviction post-earnings.

With these moves, we believe we have further diversified our energy exposure while remaining well positioned to benefit from a once-in-a-generation energy dislocation.

Touching up the edges

Current market movements have given us the opportunity to shore up the edges of our strategies in the face of what we believe will be a volatile fall.

Analog Devices (ADI): Semiconductors have not fared well in this market downturn, but ADI has held up nicely amidst broader dislocation. A small trim here is a short term tactical move as we believe we may add back to this core holding after macro headwinds subside.

ASML Holding (ASML): We trimmed positioning in ASML as we pare down our exposure to semiconductors. Chatter around China’s potential invasion of Taiwan seems to have faded into the background, but we believe this is a meaningful risk that may be overlooked by many investors. As a reminder, Taiwan is the world’s leading semiconductor manufacturer.

Avantor (AVTR): Despite our thesis tracking moderately well since initiation last year, we believe subpar management execution in recent quarters has placed Avantor in the “show me story” penalty box. Unfortunately, after extensive review of these developments, we believe these growing pains could take longer than expected to be resolved. Considering the high opportunity costs, we believe the incrementally higher threshold needed for investors to enter the stock coupled with the lack of liquidity from high PE ownership create an unattractive risk/reward set up for our clients, and thus have decided to exit our position.

Iqvia Holdings (IQV): A business that has historically done well in recessionary environments, Iqvia’s sales backlog and defensive nature have allowed us to add the position in an effort to increase our healthcare allocation. Our thesis is tracking well here, and we continue to be happy shareholders of Iqvia.

TaskUs (TASK): TaskUs has been collateral damage of the current macro downturn as companies reduce vendor spend and are potentially delaying signing larger deals. Although we believe the underlying value proposition for TASK still holds true, we felt it was prudent to exit our position to control our risk moving forward.

Recent market velocity has been fast and furious, allowing us to manage risk in the face of an uptrend. As always, let us know if you have any questions about these moves, and thank you for the opportunity to manage your capital.

Best,

Titan Investment Team