Join us for our first Summit Series live event, February 11th NYC

Trade Update: An active start to the fourth quarter

Oct 4, 2022

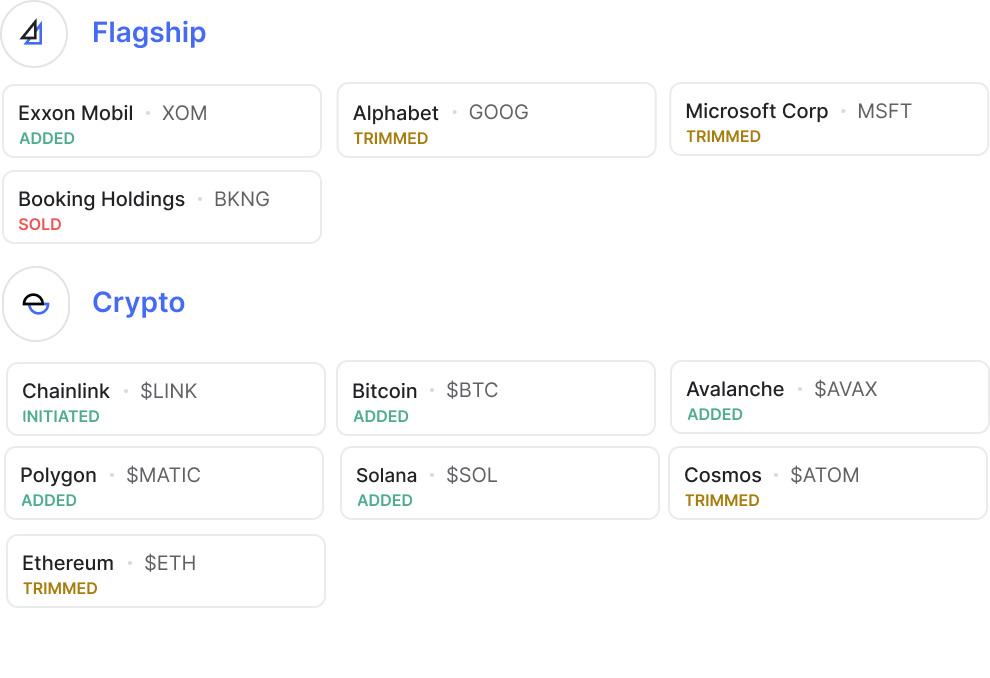

We've made trades in the Flagship and Crypto strategies

We made several trades in our Flagship and Crypto strategies in an effort to capitalize on a generational dislocation in the energy markets and to manage risk amidst a period of continued market fragility. Let’s dive in.

The energy crisis persists

The global energy crisis in Europe continues with no signs of structural changes on the horizon. Russia’s invasion of Ukraine has had far-reaching impacts on the global energy system, disrupting supply and demand patterns and fracturing long-standing trading relationships.

As a result, the United States has been forced to refocus efforts on domestic production and Exxon (XOM) has been a beneficiary of this trend.

When we initiated the position in July, we asserted that Exxon’s diversified approach to energy markets, strong balance sheet, low break-even costs (company target of $35/barrel), and 4%+ dividend yield made it an attractive conduit to gain energy exposure.

Our thesis continues to track and the recent pull back in markets has provided us with an attractive opportunity to increase our position in Exxon. We continue to see very few outcomes where many Exxon doesn’t continue to generate outsized cash flows over the coming quarters.

Exiting the re-opening

Booking Holdings (BKNG) has been a big beneficiary of the global reopening trend that has seen increased demand for travel in a post-Covid world.

As the global consumer continues to weaken as a result of macro uncertainty, we believe that there are near term risks associated with owning the world’s largest Online Travel Agency. Although it is difficult to predict how travel will perform in 2023 (even for travel CEOs), we believe it is more likely that gross bookings may weaken causing industry wide growth prospects to falter.

An exit here allows us to manage our risk in advance of what we believe will be an uncertain several months for consumer discretionary spending.

Trimming two generals

With uncertainty abound in the market, it feels prudent to maintain our cash reserves in each strategy – for now. As a reminder, the strategic cash reserve is intended to reduce market exposure during times of extreme volatility, like we’ve seen since Q3 of last year, and its added positive attribution year-to-date.

To maintain this cash reserve, our team needed to fund the increase in Exxon using proceeds from a few other holdings. Coupled with the fact that we were already overweight Alphabet and Microsoft compared to the benchmark and that both holdings had evolved into some of the largest in Flagship, we decreased our position in both names slightly to fund the additional investment in Exxon.

Backing Bitcoin

Leaning into recent price weakness, we took the opportunity to increase our net exposure in our crypto strategy. This is not a full “risk-on” trade by any means, but we believe the near-to-medium term prospects are attractive.

Bitcoin ($BTC): We’ve added to our Bitcoin positioning in an effort to capitalize on the current advantageous trading environment around BTC dominance. We believe that its performance over the last 3-month, 6-month and 12-month periods in combination with institutional inflows create favorable upside skew relative to other coins.

Ethereum ($ETH): Following the highly anticipated Merge, ETH has experienced weakening fundamentals relative to Bitcoin. As data continues to prove that institutional capital is rotating out of ETH in favor of BTC, we believe it is prudent to control our ETH sizing at this time.

Avalanche ($AVAX): A ~0.70% addition to AVAX brings our weight to ~1.50% of allocated capital within Titan Crypto. Our thesis continues to track and we’re happy to add a small amount of capital to this position.

Chainlink ($LINK): We’ve added a starter position to Chainlink as technicals for the cryptocurrency look attractive and their recent additions of staking and cross-chain initiatives function as catalysts for the token.

Cosmos ($ATOM): Following the release of the long awaited ATOM 2.0 white paper, we are taking this opportunity to control risk over the short term and trim our position in Cosmos. As the upgrade begins, we should expect the inflation rate to have a material impact on price action as ATOM bootstraps initial funding for a new Cosmos Hub Treasury.

Polygon ($MATIC): We trimmed our position in Polygon as we have seen declining on-chain total value locked (TVL) as inflows have transitioned to Layer 2’s. As we have noted in the past, should Polygon launch a Layer 2, this could be a big opportunity for the cryptocurrency.

Solana ($SOL): Solana remains one of the most used blockchains with user activity level greater than many of other Layer 1’s. The team continues to develop and improve upon the blockchain with their "iterate-as-we-go" approach, and the blockchain has only suffered 1 network downtime since June (a significant improvement). Adding here provides meaningful risk/reward for long-term investors.

We’ll be out with our quarterly recap later in the week, but it's important to remember, bear markets don’t last forever. We believe we’re far closer to the end than the beginning of this historic correction, and we’re optimistic that our current positioning may prove advantageous as the dreary days run their course.

As always, let us know if you have any questions about these moves.

Best,

Titan Investment Team

The content contained in this material is intended for general informational purposes only and is not meant to constitute legal, tax, accounting, solicitation of an offer, or investment advice.

Disclosure