Trade Update: Adding exposure in Flagship

Jul 21, 2023

We’ve made trades in Flagship

On Friday, we made trades on behalf of clients in our Flagship strategy with the goal of capitalizing on opportunities found within individual stocks while increasing our exposure to the market (deploying more of our strategic cash).

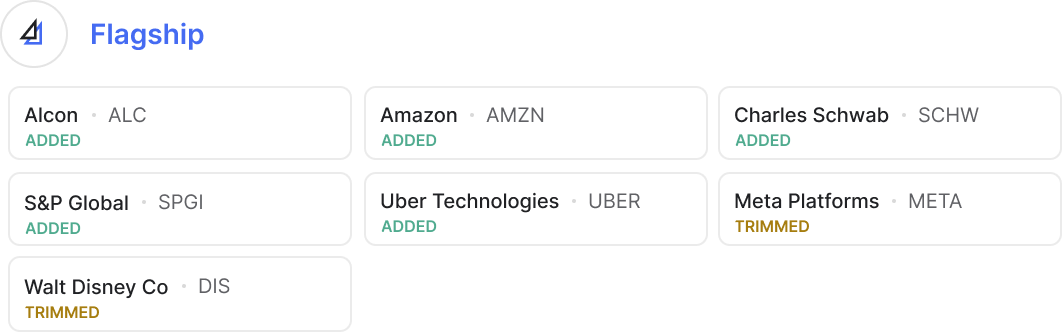

We elected to add to our positioning in Alcon (ALC), Amazon (AMZN), Charles Schwab (SCHW), S&P Global (SPGI), and Uber Technologies (UBER). We also trimmed our positioning in Walt Disney (DIS) and Meta Platforms (META).

Let’s dive in.

Adding exposure

Alcon (ALC) is one of Flagship’s two healthcare companies in the portfolio, with the stock having performed remarkably well year-to-date despite the broader sector being flat on the year. Trading at an attractive valuation, adding to our positioning here seems prudent given the ongoing consumer resilience, margin expansion, and exceptional execution.

Even as same-store sales decelerate for US retailers, our research indicates that Amazon’s (AMZN) retail arm remains strong. We believe this will lead to sequential growth in revenues and, when combined with cost-efficiency measures, should bolster retail margins near-term. This, in combination with a reacceleration from AWS, gives us confidence to add to our positioning in the e-commerce giant here.

Charles Schwab (SCHW) experienced intense volatility in the wake of the regional banking crisis but, following a strong earnings report, showed that the cash-sorting headwinds that once worried investors may be firmly in the rearview. As long term investors, we took advantage of the unwarranted selloff last quarter by adding to our position and we continue to remain constructive of the company's ability to benefit from this higher for longer interest rate environment.

S&P Global Inc. (SPGI) has been a beneficiary of increased capital markets activity and we expect this trend to continue through the second half of the year. After divesting non-core assets, we believe the company is well-positioned to capitalize on the improved outlook. We decided to add to our position here as a result.

The scale and range of Uber Technologies (UBER) leads to higher frequency and superior unit economics vs. peers and we expect these benefits will drive gross bookings growth over the medium-term. The stock has been one of our biggest winners year to date and we continue to believe there may be catalysts for near term growth – earnings beats, share buybacks, and inclusion in the S&P 500. We’re excited to add to the ride sharing company here even after its impressive start to the year.

Controlling risk

Walt Disney (DIS) has been a detractor over the last six months and although we remain confident in the company’s direct-to-consumer and cost reduction story, we elected to trim our positioning in advance of some potential near term headwinds. Despite CEO Bob Iger’s commentary around the challenges ahead (i.e. decisions around ABC, FX, Freeform), we remain optimistic in the long-term story for the company which is why we maintain a toehold position in the stock for now.

Meta Platforms (META) has been Flagship’s top performer year to date, thanks to Zuckerberg’s “Year of Efficiency” initiative, which has led to more cost-effective and efficient operations (driving profit margins and free cash flow higher than many investors expected). Despite encouraging progress on AI endeavors and improving Reels engagement, we decided to trim our position to take some profits after the stock has more than doubled year to date.

These trades increase our net exposure to ~85% and we plan to be opportunistic in making changes to the strategy as Q2 earnings season kicks into full swing.

As always, let us know if you have any questions about the recent trades; we’re happy to assist.

–Your Titan Team

Disclosures:

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Contact Titan at support@titan.com.

Trade communications are meant for informational purposes only. Statements made in these communications represent opinions and conjecture, and should not be construed as a guarantee of future results. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. There is always the potential of losing money. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. The rate of return on investments can vary widely over time, especially for long term investments. Past performance is no guarantee of future results.

There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Please visit www.titan.com/legal for important disclosures.